In the past 24 hours, crypto markets have seen nearly $385 million USD in perpetual contracts liquidated. This is more than double May’s worse single-day liquidations of $140 million.

The recent spike in liquidations is a direct reflection of volatile market conditions. The DeFi ecosystem has been especially affected by the spate of liquidations.

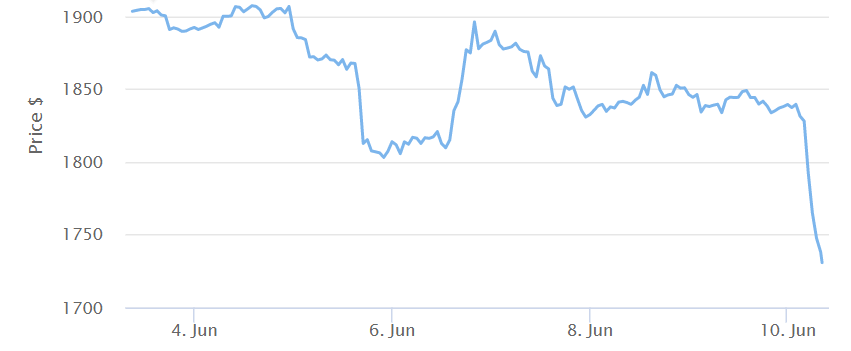

Fall in ETH Price Leads to Spike in Long Liquidations

Liquidations are when a crypto exchange closes out a trader’s long or short position when their initial margin falls below a certain threshold.

In futures contracts, the total liquidated volume signifies the contracts that are forcefully closed due to traders’ inability to fulfill margin requirements.

When engaging in long positions for Ethereum futures contracts, traders are betting on the price of ETH increasing. But if ETH falls below a certain price, traders’ accounts may lack sufficient funds to cover the losses, resulting in liquidation.

Coinglass data reveals that in the past 24 hours, exchanges have skewed heavily toward long liquidations.

Declining ETH Price Hits DeFi Traders

Considering the centrality of Ethereum to the DeFi ecosystem, recent liquidations from decentralized exchanges are largely the result of declining ETH value.

On Saturday morning, the price of ETH dipped below $1,750 for the first time since March. Accordingly, many traders betting on the rising price have had their positions forcefully closed.

More Liquidations on the Horizon?

According to DeFiLlama data, when ETH falls to $1,753, there will be $83.5 million in stETH collateral facing liquidation. When it falls to $1,681, more than $26 million in ETH will be at risk.

And it isn’t just traders going long on Ether that may find themselves in hot water. The same data suggests that if BTC falls to $23,194, more than $24 million in WBTC collateral could be liquidated.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.