Over the past couple of weeks, the events that played out have led people to consider decentralized wallets and exchanges over their centralized counterparts.

The coins behind decentralized wallets and exchanges are rallying this week. Trust Wallet (TWT) is up by 129%, GMX by 55%, and DYDX by 70% from the candle opening of Nov. 10, according to data from TradingView.

The tweets from Changpeng Zhao, the CEO of Binance, about Trust Wallet acted as a catalyst for the rally of TWT.

The collapse of centralized exchanges.

The events related to FTX unfurled one after the other, eventually resulting in the FTX group declaring bankruptcy. Just when the crypto community believed it could not get worse, the FTX exchange suffered a $400 million hack. The community speculates that it was an inside job.

After the collapse of FTX, centralized exchanges were releasing their Proof of Reserves to promote transparency. During such releases, it was found that Crypto.com has Shiba Inu as 20% of its reserves. Before publishing their Proof of Reserves, the exchange withdrew 210 million USDT from Binance and 50 million USDC from Circle. Apart from that, various other discoveries led to a 50% tank in the price of CRO, the native token of Crypto.com.

Crypto.com is also one of the sponsors for the upcoming FIFA World Cup 2022, just like FTX, who spent millions of dollars sponsoring sports events.

Transition from centralization to decentralized services

During bull markets, users preferred centralized exchanges over decentralized ones because of the easy User Interface (UI) and convenience. They found DEX unusable due to various complexity present.

The collapse of various centralized exchanges over 2022 has now led users to transition to their decentralized counterparts. There is a realization of the importance of self-custody, and the popular crypto phrase, “Not your keys, not your crypto,” says it all. Notable crypto influencers are urging to get the cryptos off the exchanges.

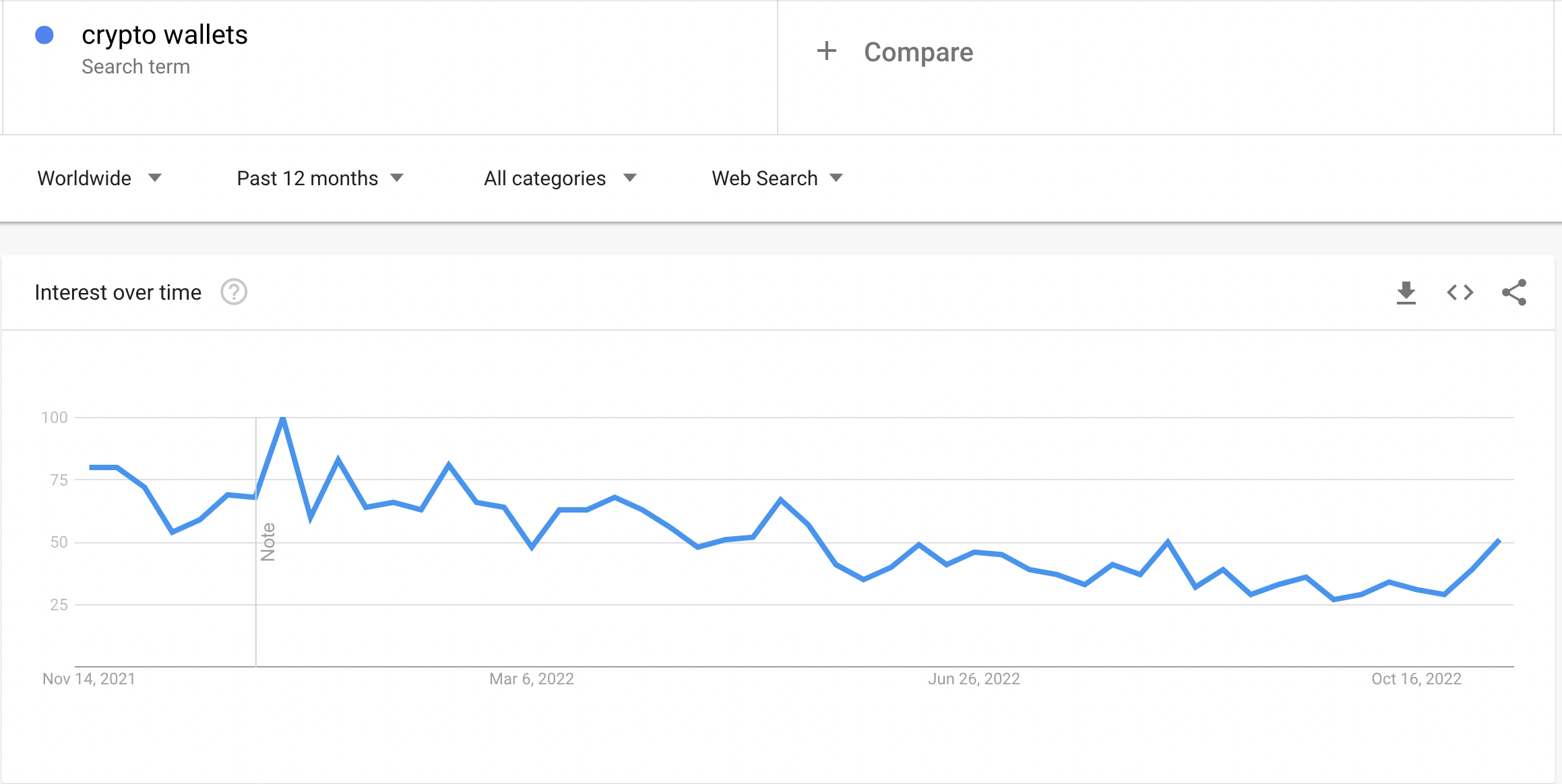

There is also a recent spike in the search term ‘crypto wallets’ according to data from Google Trends.

TWT price-action

TWT formed a clear cup and handle pattern in the weekly timeframe before the breakout. The coin that has been pumping from Nov 10, when Binance announced not to pursue the FTX breakdown, finally breached the neckline at $1.2327 on Nov 12. It is trading at an all-time high now.

TWT will face immediate resistance at $2.6427, which is 2 Fibonacci retracement levels drawn from March 2022 highs to May 2022 lows. The next resistance will be between $2.9396 to $3 because the area has 2.272 Fibonacci retracements and a psychological resistance of $3.

DYDX price prediction

DYDX seems to form a solid double-bottom base. With the support of volume, a close above the neckline at $2.578 can send the price over the $5 level. However, the same neckline is a strong resistance as of now.

Got something to say about decentralized wallets and exchanges or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.