Unique Users

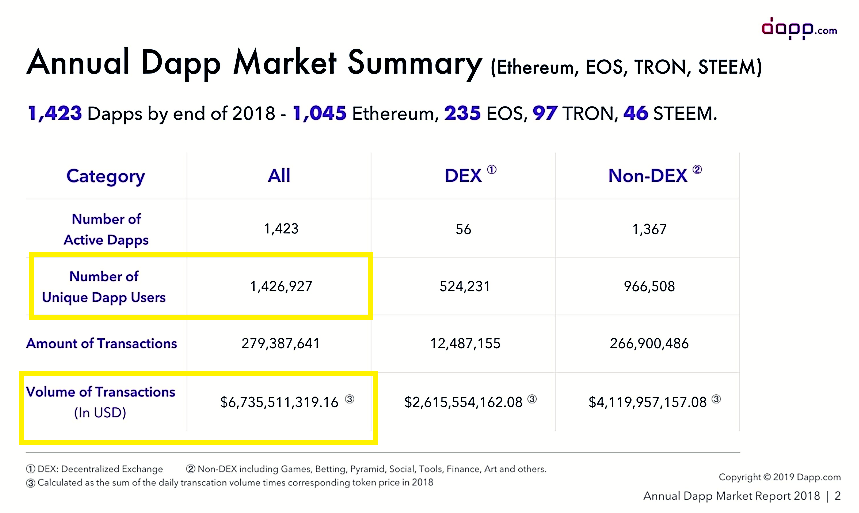

It is reported that the most used dApp across all the platforms are decentralized exchanges. According to dApp.com, there were 1,423 dApps developed in total across the Ethereum, EOS, TRON, and STEEM platforms by the end of 2018. Only 56, or less than 4 percent, were decentralized exchanged (DEXs); however, dapp.com reported that they account for over one-third of dApp users. There are problems with this data in the categories highlighted above (Number of Unique Dapp Users and Volume of Transactions in USD).

Number of Unique dApp Users

First, the total number of unique visitors is calculated at 1,426,927. When you add up the unique users of DEXs and non-DEXs, however, there are a total 1,490,739 unique visitors.

Perhaps the total number of unique visitors is not being derived from the sum of unique visitors to DEXs and non-DEXs. This explanation does not necessarily make sense because the total in the other three categories in the table equals the sum of the DEX and non-DEX variables.

Furthermore, if the total number of unique dApp users is being calculated differently than the other three categories, the writers of the report do not specify this to be the case — neither do they specify how the total of unique dApp users is calculated.

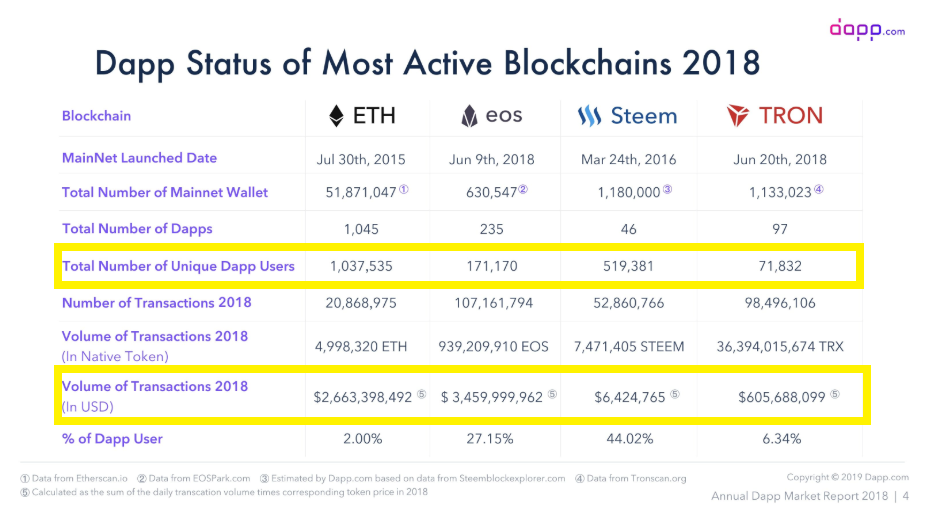

Further, the total number of unique dApp users reported for each of the four platforms on the next page add up to a total of 1,799,918. Thus, there are three different totals of unique dApp users given within these two tables. Perhaps there is a reason for this discrepancy, but dApp.com does not offer one. If the variable ‘unique dApp users’ is being used differently in each of these situations, it should be described as such.

There are problems with this data in the categories highlighted above (Number of Unique Dapp Users and Volume of Transactions in USD).

Number of Unique dApp Users

First, the total number of unique visitors is calculated at 1,426,927. When you add up the unique users of DEXs and non-DEXs, however, there are a total 1,490,739 unique visitors.

Perhaps the total number of unique visitors is not being derived from the sum of unique visitors to DEXs and non-DEXs. This explanation does not necessarily make sense because the total in the other three categories in the table equals the sum of the DEX and non-DEX variables.

Furthermore, if the total number of unique dApp users is being calculated differently than the other three categories, the writers of the report do not specify this to be the case — neither do they specify how the total of unique dApp users is calculated.

Further, the total number of unique dApp users reported for each of the four platforms on the next page add up to a total of 1,799,918. Thus, there are three different totals of unique dApp users given within these two tables. Perhaps there is a reason for this discrepancy, but dApp.com does not offer one. If the variable ‘unique dApp users’ is being used differently in each of these situations, it should be described as such.

Transaction Volume (in USD)

Another discrepancy between these two tables is that the total transaction amount in USD is not the same. The first table reports a total transaction amount of $6,735,511,319.16. However, the sum for the four platforms in the second table is $1.16 less. This amounts to a difference of less than 0.00000001 percent. Such a difference is relatively insignificant.

The bigger issue at hand is not the dollar or percentile difference between these two numbers, however. What really matters is that the reason for these discrepancies is never explained. Speculations can be made, but they cannot determine with certainty why the two tables report different amounts for the same statistic.

If a methodology were provided to explain how statistics like these were derived, we might be able to receive an explanation from the report. The lack of a methodology also causes problems elsewhere in the report.

Transaction Volume (in USD)

Another discrepancy between these two tables is that the total transaction amount in USD is not the same. The first table reports a total transaction amount of $6,735,511,319.16. However, the sum for the four platforms in the second table is $1.16 less. This amounts to a difference of less than 0.00000001 percent. Such a difference is relatively insignificant.

The bigger issue at hand is not the dollar or percentile difference between these two numbers, however. What really matters is that the reason for these discrepancies is never explained. Speculations can be made, but they cannot determine with certainty why the two tables report different amounts for the same statistic.

If a methodology were provided to explain how statistics like these were derived, we might be able to receive an explanation from the report. The lack of a methodology also causes problems elsewhere in the report.

Other Table Problems

In the ‘dApp Status of Most Active Blockchains 2018’ table, there is included a final category reading ‘% of dApp Users.’ Dividing the number of unique dApp users by the number of MainNet wallets generates this figure. Problematic, however, is that the report does not explain this. It simply offers the % of dApp Users without telling the reader how these figures were derived. Once again, this problem could have been prevented had a methodology been provided to explain how figures such as this percentage of users and total transaction volume were calculated. Furthermore, there are a minimal number of citations and an insignificant amount of source material. In the ‘Dapp Status of Most Active Blockchains 2018’ table, only the volume of transactions in USD is cited. The other three statistics reported are presented without citation. Similarly, in the ‘Dapp Status of Most Active Blockchains 2018,’ the source material for only two of the eight data points is cited.

Problems Beyond the Tables

There are other problems within the report itself. Most notably, the same variables are not reported for each of the four cryptoassets. While total user distribution is reported for Ethereum, the supposed number of active users is reported for the other three platforms. Furthermore, the requirements for an active user are not discussed in the report. Lastly, in the ‘Bonus Reading,’ only two types of dApps are analyzed — betting applications and decentralized exchanges. Despite the fact that social applications are reported as the most used on STEEM and Pyramid dApps are reported as the most used on TRON, neither these nor any other type of dApp receive special attention. For a yearly report, there seems to be a plethora of information missing.Conclusion

There are a variety of discrepancies, dissimilarities, lack of citations, and under-reporting present in dApp.com’s ‘dApp Market Report 2018.’ The need for accurate, verifiable information is a necessity if mass adoption is to take place successfully. As long as the people reporting on the crypto industry are creating reports as problematic as this, the actual rates of adoption cannot be known. Worse, people may use these reports to discuss adoption at rates that are higher or lower than normal. Perhaps worst of all, those who have not adopted cryptocurrency into their lives may become more reluctant to do so if they cannot determine trustworthy sources of information. In short, problematic reports like this only harm rather than help mass adoption.What sort of methodologies do you think should be implemented in reports such as these? Let us know your thoughts in the comments below!The highly-anticipated “Annual Dapp Market Report 2018” is finally here. Check out to learn insights on dapp market, a summary of decentralized applications that are built on #Ethereum, #EOS, #Tron and #Steem, major events, and much more: https://t.co/BBLiblDQ6N pic.twitter.com/jDULCbGHqB

— Dapp.com (@dapp_com) January 16, 2019

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.