Despite their decentralized nature, cryptocurrencies can be susceptible to significant influence from a small number of investors holding large amounts of tokens. These whales can exert considerable power over the market and decision-making processes.

In a conversation with BeInCrypto, Lynn Chen, Marketing Manager at SONEX, discussed the inherent risks of whale activity and how decentralized autonomous organizations (DAOs) can take steps to curb their influence.

Whale Impacts on Market Performance

Cryptocurrency whales can have an enormous impact on market behavior, sometimes for the better and other times for the worse. In certain aspects, these large players can positively influence market trends, sometimes stabilizing or increasing cryptocurrency prices through their trading activity.

Whale activity can signal to the community that the platform is worth investing in, consequently attracting more users and developers. By onboarding more users, this can potentially lead to a more decentralized distribution of influence.

However, the market volatility caused by whales can be problematic. A large sell order from a single whale can trigger panic and a sharp price decline, potentially undermining trust in decentralized systems.

Another key concern is the ramifications on governance.

Excessive Control by Venture Capitalists

If a small number of large holders control a significant portion of the cryptocurrency, it can create power imbalances that contradict the decentralized principles of blockchains.

This concentration of power can influence governance decisions, such as protocol updates and community fund distribution, disproportionately benefiting the large holders at the expense of the wider community.

Over the years, several examples of centralization risks have risen across different protocols.

One prominent example occurred in February 2023 when a Bubblemaps investigation revealed Andreessen Horowitz’s control of over 4% of Uniswap’s UNI token supply. Since 4% of votes is required to pass any Uniswap proposal, a16z’s wallets could collectively determine the outcome of any governance vote, raising questions about Uniswap’s decentralized governance.

The firm exercised this control that month, leveraging a 15 million UNI token voting block to oppose a proposal to use the Wormhole bridge for Uniswap V3 deployment on the BNB Chain, reportedly favoring LayerZero, a competing bridge platform in which a16z has a significant investment.

This wasn’t the first time a16z raised eyebrows among the community. In 2017, the venture capital (VC) firm purchased $12 million worth of MakerDAO’s MKR tokens. A year later, Andreessen Horowitz purchased a further $15 million, equivalent to 6% of MakerDAO’s total supply.

This example reveals how venture capital’s pursuit of control can directly compromise decentralization. According to Chen, certain steps can be taken to balance the need for VC investment and decentralized governance.

“It’s always a balancing act. One way to preserve decentralization is by introducing vesting schedules for VC tokens, so their influence grows gradually over time. Another approach is issuing non-transferable governance tokens to community members, which keeps voting power spread out. Transparency is also really important—large investors should disclose how they’re voting and why. And honestly, giving the community a say in approving major investments can go a long way in building trust and keeping things balanced,” Chen told BeInCrypto.

The list of examples of centralization also spills over to other areas of governance.

Centralization Risks Across Blockchains

Over the years, the EOS blockchain has faced criticism from its community for not prioritizing decentralization. One of the most notable cases concerning the network’s block producers came to light in November 2019.

EOS uses a delegated proof-of-stake model for blockchain security. Similar to miners on Bitcoin’s proof-of-work system or staking nodes on proof-of-stake protocols, EOS employs 21 elected block producers who exclusively operate the network’s nodes.

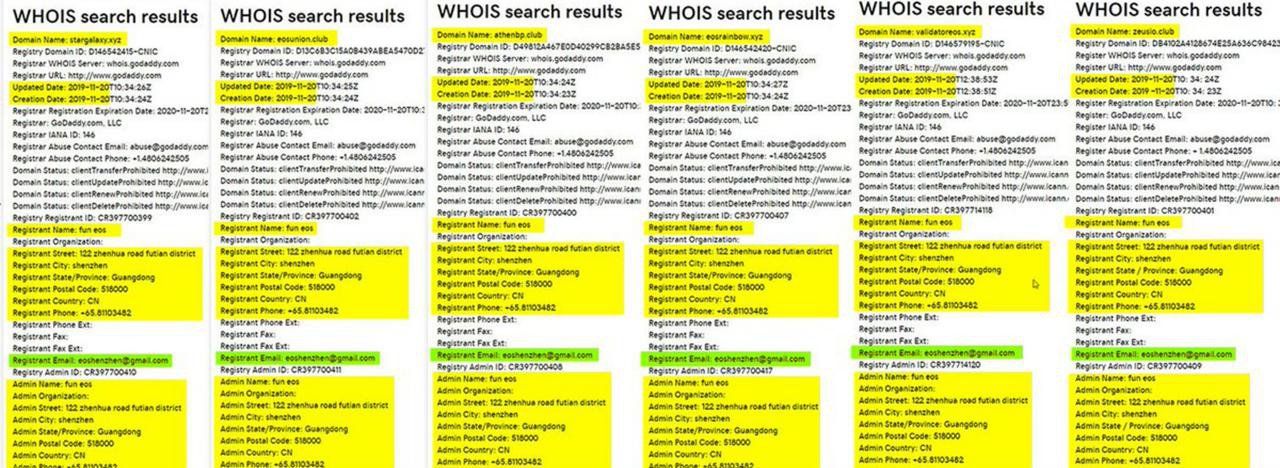

The blockchain came under intense scrutiny when block producer EOS New York published data on social media purportedly showing that a single entity managed six registered producers on the network. Screenshots revealed that six domains were registered by a single company based in Shenzhen, China, operating under the same name.

The Solana blockchain has also faced scrutiny due to the presence of large staking pools. These pools, by their very nature, aggregate significant amounts of SOL tokens.

This aggregation concentrates power within the hands of the pool operators, leading to a more centralized decision-making process regarding network governance and validation.

Given this consistent theme of concerns over the years, certain blockchains and DAOs have redesigned their governance strategies to curb whale activity.

The Case for Quadratic Voting

Although whale influence is a challenge for decentralization, there are ways to manage it.

Over the years, the concept of quadratic voting, for example, has gained traction. This method can be used to address situations where an indifferent majority overlooks a passionate minority’s interests.

“Quadratic voting is a great example—it makes it harder for whales to dominate because their voting power increases at a diminishing rate. Another approach is setting caps on voting power, so no single entity can dominate decisions.” Chen explained.

Compared to a simple one-token-one-vote system, Quadratic voting can incentivize participation from those with less ownership or voting power while still acknowledging the greater influence of large holders.

Other mechanisms have also been developed to encourage participation among smaller token holders.

Delegated Representation

The concept of delegated voting has become popular across DAOs to counter the outsized influence of large token holders.

Sometimes referred to as liquid democracy, delegated voting refers to a governance system where voters can either vote directly or delegate their voting rights to a trusted individual.

This allows community members who lack the time, expertise, or interest in all issues to still participate in decision-making. They can assign their vote to someone they deem more knowledgeable or aligned with their preferences.

“Delegated voting is another strong tool. It allows smaller token holders to pool their influence by assigning their votes to someone they trust, ensuring everyone has a voice,” Chen said.

Other mechanisms can be used to increase participation among all token holders. Some DAOs have developed strategies to compensate participants for contributing to the organization’s governance process.

“It’s also crucial to get more people involved in governance—rewarding participation through incentives or gamified features can help ensure decision-making reflects the whole community, not just a few big players,” Chen added.

The possibilities don’t end there.

Other Mechanisms for Representative Governance

Chen also discussed other strategies for limiting the influence of large token holders, including time-weighted voting. This mechanism gives more weight to votes cast by users who have held their tokens for a longer period.

It’s a way to reward long-term commitment and discourage short-term speculation or “voting and dumping.” Essentially, it tries to differentiate between casual participants and those who are truly invested in the project’s long-term success.

Chen also discussed the benefits of a dual governance model. In the context of decentralized DAOs or blockchain projects, this model refers to a system where decision-making authority is divided between two distinct groups or mechanisms. It is often implemented to balance different priorities or stakeholder interests.

“I also think dual governance models are worth exploring, where token holders and regular users share decision-making power. The key is to design a system where everyone feels they have a stake in the process,” she explained.

Multi-signature wallets can also be leveraged to distribute governance power more evenly among a group of stakeholders.

“They require multiple people to sign off on key decisions, which prevents any single person from having too much control. You could also use them to set up governance committees where diverse stakeholders share responsibility,” Chen told BeInCrypto.

However, a more resource-efficient and faster method exists that can be integrated with current protocols to promote democratic governance: transparency.

Transparency for Open Governance

Greater transparency around token ownership and voting power can help to reduce the potential for abuse by whales.

“Transparency is absolutely critical. If platforms make token ownership and voting activity visible on-chain, it’s easier for the community to hold big players accountable,” Chen said.

DAOs can leverage the inherent benefits of blockchain technology to ensure transparency. A blockchain’s immutability ensures that governance records can be recorded on an unalterable record.

“Public voting records are another great tool—they keep whales from hiding behind closed doors. Requiring disclosure for anyone holding a significant share of tokens can also deter bad behavior. And analytics tools that track whale activity can give the community early warnings about potential risks. At the end of the day, transparency builds trust,” she added.

Ultimately, while large token holders present a significant challenge to decentralized governance, a constantly developing cryptocurrency ecosystem has spurred the development of resourceful mechanisms.

These proactive strategies offer promising ways to mitigate whale influence and foster an equitable and representative future for decentralized ecosystems. Implementing these mechanisms and ensuring their consistent enforcement will be crucial for establishing truly democratic governance.