CryptoPunks remains one of the most talked-about NFT collections in the space. Sales of the 10,000 pixelated cartoon heads are still generating tens of millions of dollars in monthly volume.

Unfortunately, the highs that Larva Labs (developers behind CryptoPunks) was reaching in 2021 have not been replicated in 2022.

On May 8, CryptoPunk #273 exchanged hands for around $139,000 after selling for $1.03 million in October 2021. The seller of the NFT lost around 80% of their investment.

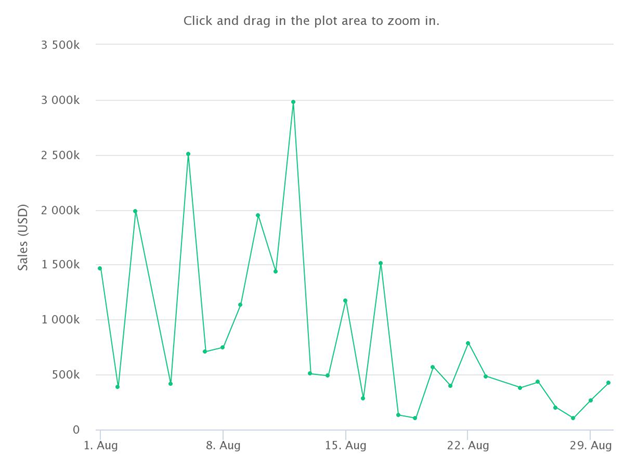

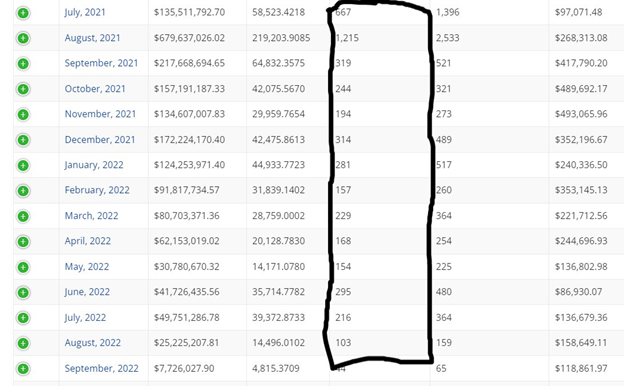

After reaching an all-time high (ATH) of approximately $680 million in August 2021, sales of CryptoPunks began to stall during the final months of that year.

CryptoPunks began the year with a monthly sales volume of around $124 million in January. An overall decline in all facets of the crypto industry led to sales sinking to just $25 million in August.

This was the seventh consecutive month that sales fell below $100 million. Aside from that, this was the lowest sales since June 2021’s $19 million — a 14-month low.

While several analysts attributed the decline in sales to the switch from highly volatile assets to non-volatile assets such as bonds and bills, the consistent plunge in the number of unique buyers, and total transactions confirmed a severe downward trend.

Unique buyers reached a 20-month low

The total number of unique buyers for CryptoPunks fell to just 103 in August 2022. This was a 92% drop from the peak of 1,215 from the same time in August of last year. The last time that the number of unique buyers was less than this was in December 2020 with 96.

Average sales marked a four-month high

Despite a fall in unique buyers and total transactions, CryptoPunks’ average sales value soared to a four-month high to reach $158,649. This was a 68% and 55% drop from the sale values of the all-time high of $493,066 in November 2021 and this year’s high of $353,145 in February respectively.

The average sales value in August was also 82% above June’s figure of $86,930.

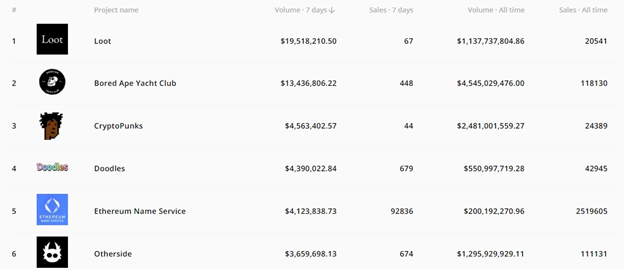

CryptoPunks surpassed several NFT projects in monthly sales

Despite reaching new lows, CryptoPunks sales still surpassed Axie Infinity ($6 million), Otherdeed for Otherside ($23 million), NBA Top Shot ($7 million), Azuki ($9 million), CloneX ($12 million), Moonbirds ($19 million), and Art Blocks ($10 million).

On the other hand, the collection trailed Bored Ape Yacht Club and Mutant Ape Yacht Club which generated $58 million and $26 million respectively.

CryptoPunks still a top NFT by weekly sales

The digital collectibles remain a top-selling collectible by weekly sales. It trailed only Loot and Bored Ape Yacht Club and was followed by Doodles, Ethereum Name Service, and Otherside in the ranks.

Are CryptoPunks dead?

The plunge in sales has led to several stakeholders of the digital collectibles industry asking whether CryptoPunks will start to gradually get surpassed by other NFT collections.

In August, Bored Ape Yacht Club flipped CryptoPunks, and this has become a point of reference for many analysts.

Be[In]Crypto reached out to mainstream experts to solicit their views on the subject.

Oliver Mann, the founder and CEO of trustINwine.com, a marketplace for high-end wines sold as non-fungible tokens (NFTs) added his voice on the subject.

“The idea that a blue-chip NFT collection is dead because of a few months of lower than $100 million in monthly sales needs to be taken into a larger context. Generally, sales of non-utility NFTs have been in decline, both in floor prices and volume, apart from a few exceptions. CryptoPunks Intellectual Property (IP) was recently acquired by Yuga Labs, where still there is no clarity around what that means in practical use cases. In fact, the whole IP of NFTs is something that is up in the air, which means there is a level of uncertainty around value,” said Mann.

He added “In an even larger picture, with the Merge upon us, a bear market, and general financial turmoil in real life, making any judgments on whether a collection is over is premature. We have seen revivals of old projects before and as with all things, these things go in waves. We are still in the early stages of NFTs, and those who come to market early, like CryptoPunks, will continue to have value.”

“As some have said, CryptoPunks is like Mona Lisa and will have real long-term value. Strong projects survive, perhaps even thrive, in bear markets,” he concluded.