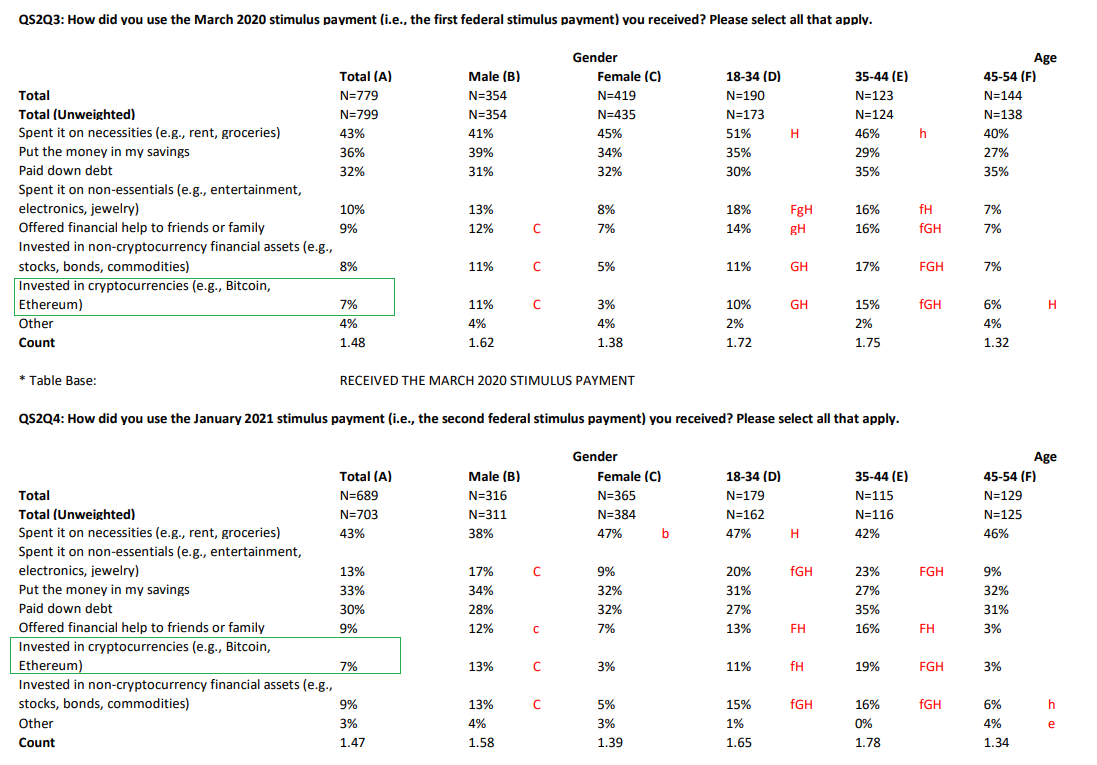

According to a Harris poll, nearly 7% of Americans have purchased cryptocurrencies with the latest round of stimulus checks.

According to data from a Harris Insights poll, roughly 7% of Americans surveyed have used their stimulus checks to buy cryptocurrencies like Bitcoin and Ethereum.

Given the rise of the market in recent times, these investors could have pocketed decent profits depending on when they bought.

The study included over 1,000 Americans aged 18 and over. It also took demographics into account, with gender, educational background, and region all considered.

The overall outlook of the poll is more worrying — 29% said that their financial state has become worse following the COVID-19 pandemic. About 52% have said that they are more or less the same following after the pandemic. Only 20% said they are in a better position now than before.

What’s more interesting is that 53% of respondents said that they would invest in cryptocurrencies with the newest stimulus check. The general consensus appears to be that Americans are looking for assets other than cash in order to safeguard their net worth.

Generally speaking, cryptocurrency investments have shot up during the past six-to-eight months.

Market analyst Willy Woo says that around 100,000 new bitcoin users could be entering the market each day. He even believes that the market could reach one billion users over the next four years.

That figure could be even higher, given that it is a little hard to track these metrics. However, it’s clear that the average user base is going up.

Number of Cryptocurrency Investors Grow

Many investors have turned to cryptocurrencies and equity during the global lockdown. Platforms like Robinhood have seen a tremendous rise in their user bases.

Younger investors, in particular, have been turning to cryptocurrency and stock investing as a way to bring in extra income.

Before the market rally, Bitcoin was around the $20,000 level before skyrocketing to its current value of roughly $52,500. It peaked at a remarkable value of $61,400.

The same goes for Ethereum, which is seeing great growth built on the success of decentralized finance (DeFi) and non-fungible tokens (NFT). Both have been the center of attention in the past six months and look good for continued expansion.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.