Grayscale Investments is the world’s largest digital currency asset manager. Its aim is to give investors the tools to make informed decisions in a new and interesting asset class.

On Oct 15, Grayscale released its digital asset investment report that covered the third quarter of 2019.

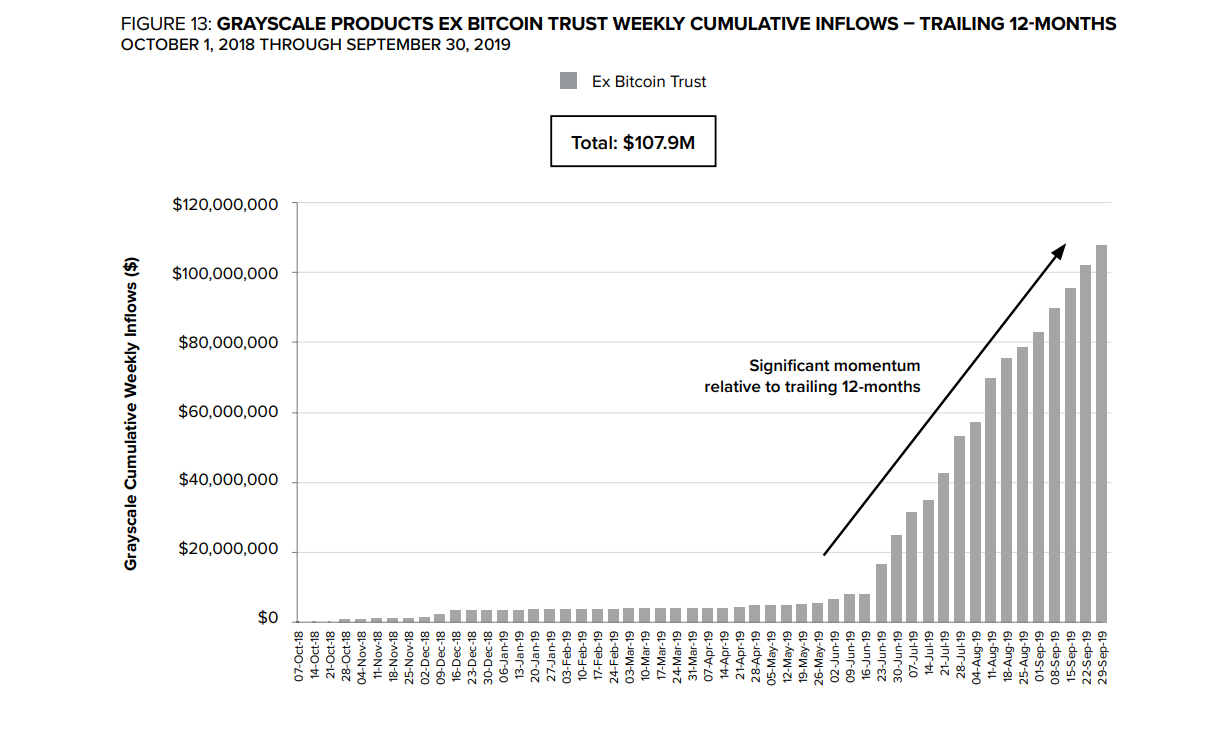

An analysis of Grayscale’s Q3 report shows a growing interest in cryptocurrencies from institutional investors, especially Ethereum (ETH) and Ethereum Classic (ETC).

The report also includes an analysis of the market movement for Bitcoin, showing strong support from the current price level all the way down until $6,900. However, if the price breaks below $6,900 it is very likely that we could see a rapid drop towards $5,400.

Cryptocurrency trader Josh Rager published a video in which he discusses the recent Bitcoin price movement combined with the facts from the 2019 Q3 Grayscale Investment report.

https://twitter.com/Josh_Rager/status/1184250700802473985

Bitcoin a Ticking Time Bomb

The price of BTC rallying to the $8,600 resistance level seems to only have been a relief in response to the prior dip from $10,000. Also, the daily price has not closed above the resistance. Therefore, we consider both of these as bearish signals. Looking at the volume profile, we can see strong support at the current price level until $7,600. Beyond that, there is very low support until $5,400. A breakdown below $7,600 could initiate a rapid decrease towards $5,400. Finally, the $7000-$7200 price area is right at the 0.618 fib level, so it is bound to get action by trading bots and algorithms.

Grayscale Report Honorable Mentions

The main takeaway from this report is that institutional investments have been steadily increasing, especially in Bitcoin and Ethereum. Grayscale raised $254.9 million in the past three months, $171.8 of which went to its Bitcoin trust, $62.7 to Ethereum, and the rest on ETC, XRP, LTC, BCH, ZEC, ZEN, and XLM. In the period from Oct 2018 to June 2019, the total investments in all other funds besides Bitcoin was less than $20,000,000. However, that began to change towards the end of June, when the cumulative investment exceeded $100,000,000 in the final week of September. The chart below shows the investment in all the Grayscale trusts except that of Bitcoin. The data seems quite bullish for the future of cryptocurrencies and gives an especially positive outlook for Ethereum. Do you think institutional interest in cryptocurrencies will continue to grow or was this quarter an outlier? Leave us your thoughts and opinions in the comments below.

Disclaimer: This article is not trading advice and should not be construed as such. Always consult a trained financial professional before investing in cryptocurrencies, as the market is particularly volatile.

Do you think institutional interest in cryptocurrencies will continue to grow or was this quarter an outlier? Leave us your thoughts and opinions in the comments below.

Disclaimer: This article is not trading advice and should not be construed as such. Always consult a trained financial professional before investing in cryptocurrencies, as the market is particularly volatile.

Top crypto platforms in the US

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored