In case you didn’t notice, there’s quite the bloodbath going on in the cryptocurrency markets right now. As usual, it looks like exchanges are struggling to keep up with demand for their services on a day when everyone wants to sell.

A number of cryptocurrency exchanges are feeling the pressure today, and the cracks are starting to show. Most notably, Binance appears to be suffering despite its CEO announcing that the exchange is handling the surge in traffic within its stride.

Exchanges Drop Services Amid Market Turmoil

The entire cryptocurrency market capitalization shed more than $50 billion in a matter of hours today. The plunge comes as fears of recession prompted by the coronavirus outbreak continue to mount. As traders rush to dump their positions, exchange platforms are feeling the strain. Reports of downtime at Binance, Bittrex, and other exchanges are starting to come in. Traders in the BeInCrypto Telegram group first reported outages at Binance earlier today. At 11:49 CET, one reports not being able to access either BitMEX or Binance.

Others later added the popular Bitcoin derivatives platform to the list of impacted services. James Kelly commented:

Traders in the BeInCrypto Telegram group first reported outages at Binance earlier today. At 11:49 CET, one reports not being able to access either BitMEX or Binance.

Others later added the popular Bitcoin derivatives platform to the list of impacted services. James Kelly commented:

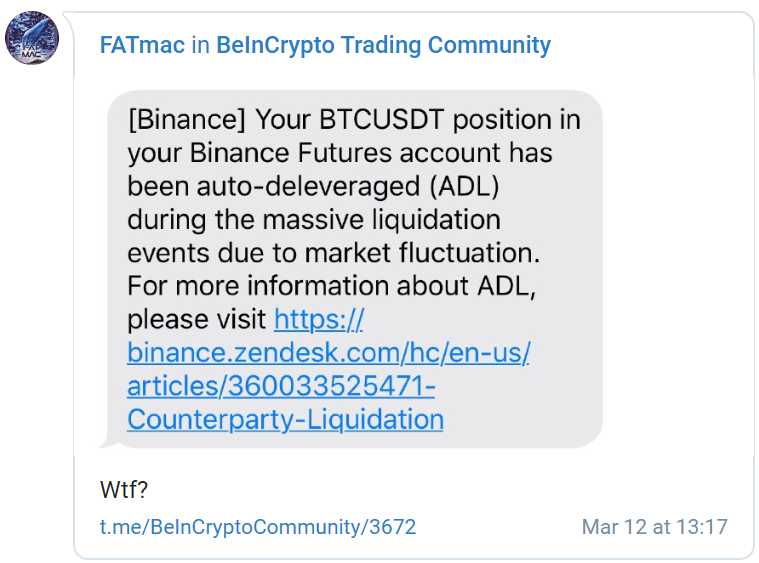

“Can’t even put in trades on bitmex rn”.Perhaps most concerning of all is the story of an “auto-deleveraging” on Binance. At 13:18 CET, a BeInCrypto Trading Community member posted:

The same trader later wrote that the decision by Binance to deleverage them meant that they had lost out on substantial profits. Meanwhile, other users of the popular trading venue reported similar issues.

Highlighting once again that cryptocurrency stored on exchanges is really the property of the trading venue not the user, Binance appears to have also suspended withdrawals:

https://twitter.com/LLLuckyL/status/1238101207673176067

The same trader later wrote that the decision by Binance to deleverage them meant that they had lost out on substantial profits. Meanwhile, other users of the popular trading venue reported similar issues.

Highlighting once again that cryptocurrency stored on exchanges is really the property of the trading venue not the user, Binance appears to have also suspended withdrawals:

https://twitter.com/LLLuckyL/status/1238101207673176067

CEO Celebrates Binance’s Handling of Demand Swell

At the same time as traders started to report various outages and other signs that not everything was running as it should at Binance, Changpeng Zhao, the CEO of the trading venue, tweeted about how well the company’s systems had held up: https://twitter.com/cz_binance/status/1238082847744954377 Zhao makes no mentions of any auto deleveraging or issues with withdrawals. Similarly, neither Bittrex nor BitMEX report any issues on their exchange status websites.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rick D.

A former professional gambler, Rick first found Bitcoin in 2013 whilst researching alternative payment methods to use at online casinos. After transitioning to writing full-time in 2016, he put a growing passion for Bitcoin to work for him. He has since written for a number of digital asset publications.

A former professional gambler, Rick first found Bitcoin in 2013 whilst researching alternative payment methods to use at online casinos. After transitioning to writing full-time in 2016, he put a growing passion for Bitcoin to work for him. He has since written for a number of digital asset publications.

READ FULL BIO

Sponsored

Sponsored