An executive for the digital payment service of cryptocurrency exchange Coinbase has announced that it has made the tough call to remove native Bitcoin and other UTXO support on its Commerce platform.

Lauren Dowling, the product lead for Coinbase Commerce, stated that customers were facing operational challenges with the product.

Coinbase Commerce Stops Offering Native Bitcoin Payments

In a series of posts on X (formerly Twitter), Dowling emphasized that customers were facing significant challenges with Coinbase Commerce due to crypto volatility risk, manual effort required to resolve incorrect payments and limited asset support.

Dowling clarified that to tackle these issues, the platform developed an on-chain payments protocol utilizing smart contracts and other tools to enable seamless off-chain commerce.

“In addressing these concerns, we saw an opportunity to build an open onchain payments protocol leveraging smart contracts and other EVM tools to enable seamless onchain commerce without the operational and financial burdens of the old system.”

However, Dowling notes that the exchange is constantly exploring other ways to bring payment solutions to customers, including the use of the Lightning Network and Solana.

Read more: Bitcoin Price Prediction 2024/2025/2030

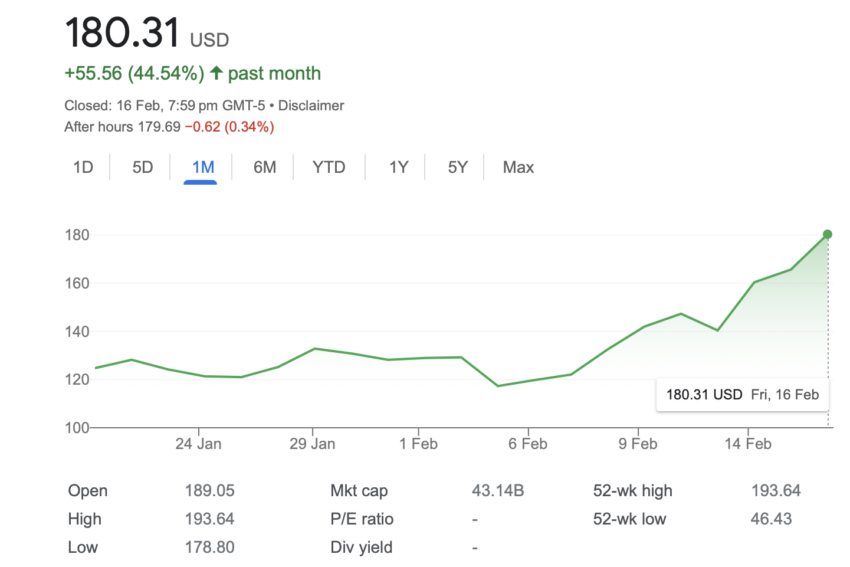

COIN Stock Price Update

Meanwhile, Coinbase’s stock price recently surged following positive remarks from a major investment bank.

COIN rose 10% after JPMorgan upgraded the exchange’s stock to neutral. The bank’s expert sees potential for COIN, given its strong links to the sustained Bitcoin price momentum.

COIN’s price reached $180.31 USD before markets closed on February 16 for the weekend.

JPMorgan analyst Kenneth Worthington upgraded COIN to neutral from underweight as Bitcoin touched $52,400. Last month, Kenneth downgraded share prices to $80, indicating a potential 35% drop. At the time of publication, Bitcoin’s price is $52,014.

Read more: Who Owns the Most Bitcoin in 2024?

Meanwhile, Coinbase customers are advised to be cautious about clicking on any email links claiming to be from Coinbase. There is a likely chance that it could be a scam in an attempt to steal all their crypto.

The scheme is known as the Coinbase reset fraud. It involves crypto scammers gathering personal information from users to deceive them into resetting their Coinbase login credentials. BeInCrypto recently reported that these scammers deprived a victim of over 1,400 ETH, valued at an estimated $4 million.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.