The Dot Com Bubble has often been compared to the 2017 cryptocurrency crash. However, what emerged from the Dot Com Bubble was real user growth—and our modern internet.

Could the future of cryptocurrencies look similar to the history of the internet? According to one analyst, the parallels are too obvious to ignore.

Lessons From the Early Internet

According to analyst Anthony Bertolino, the rise of Google and the growth of users online has parallels to our own time. In the early 2000s, the number of users on Google had a direct relationship with its stock appreciating—and it will play out similarly in the history of cryptocurrencies. It’s no surprise that users drive growth and the valuation of a given platform or network. According to Thomas Lee, co-founder of Fundstrat, “70% of the price appreciation in internet stocks was simply due to the growth of the internet.” This may sound intuitive, but the numbers speak for themselves. In just two decades, Gmail users grew by 100x. Similarly, Google’s stock posted a 1,400% return in this same period, says Bertolino.

In short, internet adoption mirrored the price appreciation of internet stocks.

It’s no surprise that users drive growth and the valuation of a given platform or network. According to Thomas Lee, co-founder of Fundstrat, “70% of the price appreciation in internet stocks was simply due to the growth of the internet.” This may sound intuitive, but the numbers speak for themselves. In just two decades, Gmail users grew by 100x. Similarly, Google’s stock posted a 1,400% return in this same period, says Bertolino.

In short, internet adoption mirrored the price appreciation of internet stocks.

Will Cryptocurrencies Follow the Same Path?

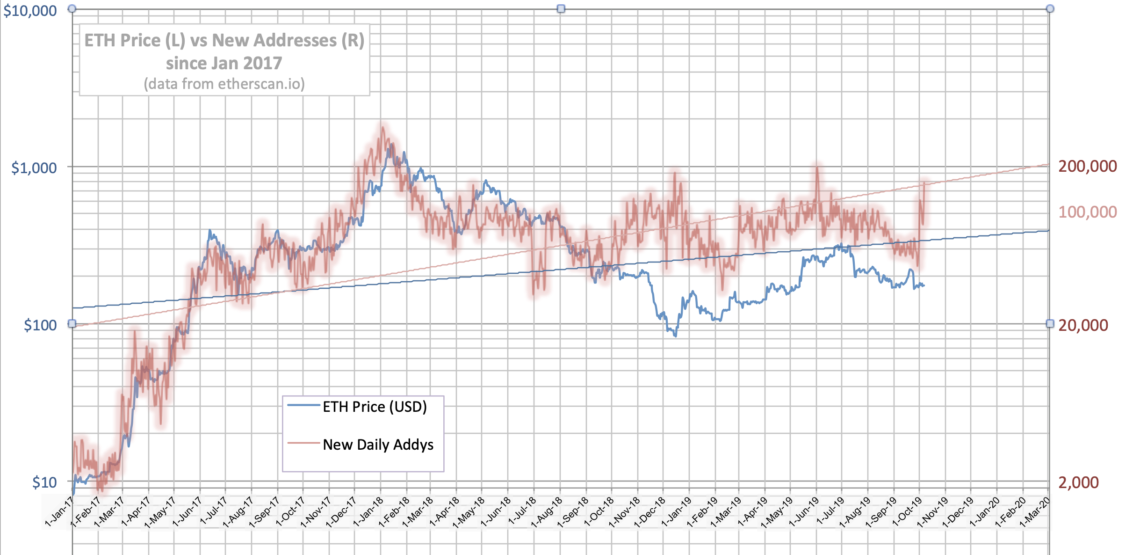

However, you might be wondering: will the same happen to the cryptocurrency industry? Luckily, we already have some metrics which demonstrate that, yes, more users means higher prices. Let’s look at Ethereum, for example. In October 2015, the platform was processing only a couple thousand transactions. Now, in October 2019, it is processing some 700,000 daily. That’s a 100x increase in just four years. However, there’s an even better metric we can use to track future price movements based on users: the number of new addresses. As Bertolino graphs based on EtherScan data, the price of Ethereum seems to mirror the number of new addresses quite closely. In fact, the price is currently lagging behind new addresses which indicates that the leading smart contract platform is likely undervalued. In a market ripe with speculation, these clear metrics—such as new addresses, dApp activity, and transactional output—give us real standards on which to judge value. As of now, we are still in a largely speculative phase.

The lesson to be learned is to not forget what followed after the Dot Com bubble. It was then, too, that the internet was considered something of a novelty, yet it ended up transforming our world. We are currently at a critical juncture in the history of cryptocurrencies. What we need to realize is that the most important metric is, ultimately, the users themselves.

Do you believe that the future of cryptocurrencies will mirror the history of the internet? Let us know your thoughts below in the comments.

In a market ripe with speculation, these clear metrics—such as new addresses, dApp activity, and transactional output—give us real standards on which to judge value. As of now, we are still in a largely speculative phase.

The lesson to be learned is to not forget what followed after the Dot Com bubble. It was then, too, that the internet was considered something of a novelty, yet it ended up transforming our world. We are currently at a critical juncture in the history of cryptocurrencies. What we need to realize is that the most important metric is, ultimately, the users themselves.

Do you believe that the future of cryptocurrencies will mirror the history of the internet? Let us know your thoughts below in the comments.

Images are courtesy of Shutterstock, EtherScan.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Advertorial

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

READ FULL BIO

Sponsored

Sponsored