In the last 24 hours, Ethereum, Bitcoin, and altcoins encountered significant volatility, resulting in a notable decline, with the overall crypto market capitalization dropping by approximately 8%, settling at $2.53 trillion.

This swift market fluctuation may have taken many retail traders by surprise. However, insights from on-chain data reveal that certain large-scale investors, colloquially known as crypto whales, foresaw the downturn and offloaded a substantial portion of their holdings.

Crypto Whales Offload Holdings

On-chain analysts reported that several institutional investors strategically sold portions of their holdings during the market downturn. Four crypto whales collectively offloaded 31,683 ETH, valued at approximately $106 million.

Among the identified crypto whales were notable entities such as Cumberland, an address linked to the bankrupt Alameda/FTX estate, and two undisclosed altcoin wallets.

Cumberland, a prominent institutional crypto investment firm, deposited 17,206 ETH, amounting to $57.3 million, across various exchanges. On the other hand, two crypto whales, ‘0xC3f8’ and ‘0x1717’, moved 7,976 ETH worth $26.6 million and 4,000 ETH worth $13.32 million, respectively, to Binance and other exchanges.

Similarly, the FTX/Alameda estate transferred 2,500 ETH, valued at around $8.33 million. Interestingly, this is not the first time the failed exchange has effectively been able to time the market before drastic sell-offs.

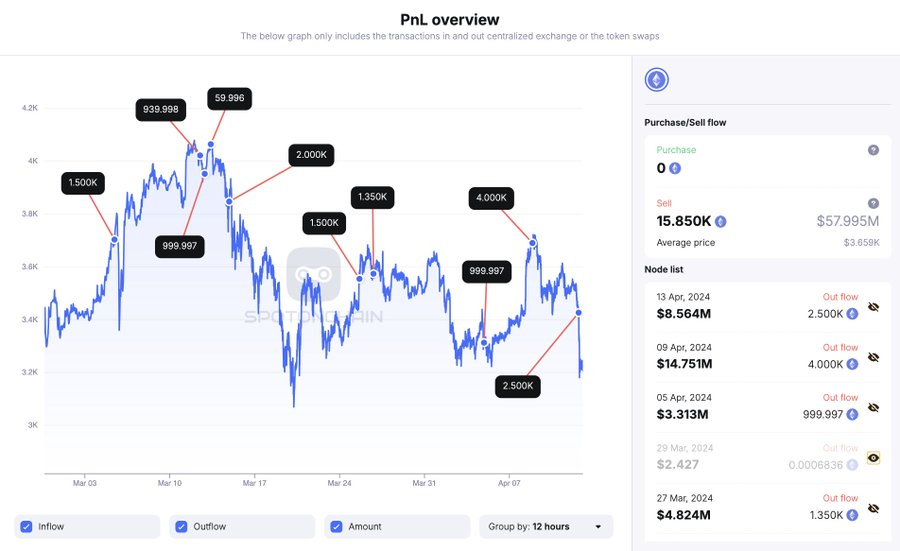

“Since March 1, FTX and Alameda have deposited 15,850 ETH, worth $58 million into centralized exchanges at roughly $3,659, and dramatic price changes tended to follow afterward,” blockchain firm SpotOnChain said.

These significant trading activities exerted additional selling pressure on the market, contributing to the downturn. During the reporting period, Ethereum’s price dropped by 13%. It went from $3,500 to reach as low as $3,062 for the first time in nearly a month.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Meanwhile, Bitcoin’s price experienced a sharp decline, plunging to as low as $65,100. Although the leading cryptocurrency has slightly rebounded to around $68,000 at press time, its volatility led to a decrease in market capitalization to $1.3 trillion. According to data from CompaniesMarketCap, this positions Bitcoin behind Meta, the parent company of Facebook, in the global ranking of top assets.

Regardless, computer scientist Edward Snowden ridiculed the industry’s reaction to the recent dip, noting that the price of Bitcoin had remained relatively stable during the week.

“[I] see crypto people freaking out over prices [then I] open bitcoin chart [and see that the] price is the same as it was seven days ago,” Snowden remarked.