After the rapid industry-wide retracement that followed the brief USDC-deg on March 10, the global crypto market cap bounced back above $1.2 trillion in April. Will the intensifying activity from the whales push the rally further?

Ethereum’s Shapella upgrade and Bitcoin’s surge above $30,000 have dominated the media headlines recently. However, On-chain data reveals that strategic large investors have been paying lopsided attention to a handful of altcoins.

The Crypto Market Cap has jumped by 5% since the start of April. On-chain data reveals the direction that large institutional investors are turning their attention to make the most of the crypto rally.

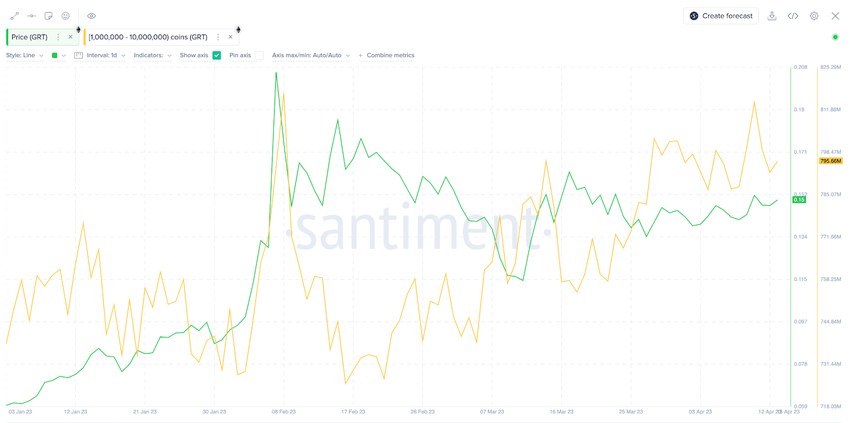

Crypto Whales Defend The Graph (GRT) at the $0.10 Support

The Graph is a blockchain data indexing protocol that powers many applications in DeFi and the wider Web3 ecosystem. By March 11, the GRT token had declined nearly 48% from its year-to-date high of $0.20.

Between the recent local low of $0.11 recorded on March 9, the whales holding 1 million to 10 million coins have added 13 million tokens worth about $2 million.

With GRT now trading around $0.15, the accumulation wave among whale investors appears to have triggered a price resurgence.

Lido DAO (LDO) Whales Front-Running the Shapella Upgrade Success

Lido DAO (LDO) is the native token for Lido Finance, a DeFi platform that facilitates Ethereum 2.0 staking via liquidity staking derivative. Soon after the Ethereum network upgrade was announced in March, crypto whales began to stack their LDO bags. The timing implies that the large investors looked to front-run gains from increased trading activity that could follow the network upgrade.

In recent weeks, the LDO coin has witnessed increased buying momentum from crypto whales holding million to 10 million LDO. The chart below shows how whales bought nearly 33 million tokens between March 5 and April 12. At the press time market value of $2.39, the accumulated tokens are worth about $80 million.

When whales invest such significant sums within a short period, it instills confidence in other network participants. If the crypto whales continue to HODL, LDO could soon break above the $3 milestone.

Crypto Whales Cohort Remain Undeterred Despite Litecoin (LTC) Struggles

On Feb. 15, Litecoin briefly broke above $100 for the first time since May 2022. However, the rally was shortlived as LTC quickly retraced below $70 by March 11. Interestingly, this volatility has not deterred the cohort of crypto whales holding 1 million to 10 million LTC coins.

According to Santiment, this whale cohort began buying weeks before LTC reached the year-to-date high of $102 on Feb. 15.

The following chart shows that the whales bought 2.37 million LTC between Feb 3 and April 12.

At current prices of $94, the newly added tokens are worth over $220 million. If the whales continue to pile on, it is only a matter of time before LTC breaks the $100 barrier again.

Optimism (OP) Whales Remain Positive Despite Sideways Price Action

Optimism (OP) is a layer-two blockchain built on the Ethereum network. It improves the scalability of Ethereum, keeping trustless roll-up records of transactions before they are ultimately secured on Ethereum.

OP has delivered a see-saw performance the past week, but on-chain data shows that crypto whales remain optimistic. Between March 1 and April 12, the whales with 1 million to 10 million OP in their wallet balances have added 256 million tokens.

The newly added 256 million OP tokens are worth nearly $490 million at current prices of $2.39. Though the price has declined 13% within the same period, the whale accumulation trend could soon trigger a rebound.

Toncoin (TON) Whales Are Back in Action

Toncoin (TON) is the native token of the decentralized layer-1 blockchain developed by the encrypted messaging platform, Telegram.

According to blockchain forensics firm Santiment, TON whale holders are back in accumulation mode after taking profits in early March. Between March 20 and April 13, the whales cluster with individual balances of 100,000 to 1 million TON added another 44 million coins.

At the current market value of $2.22, the whale’s newly acquired coins are worth $97 million. Notably, the buy/sell pattern of this cohort of whales has been closely correlated to price action since September 2022. If this condition holds, TON holders can expect more upside in the coming weeks.

In conclusion, the activity of crypto whales can have a ripple effect across the cryptocurrency market. Strategic sharks and retail investors could also choose to keep a close eye on these assets that are drawing large investors’ attention.