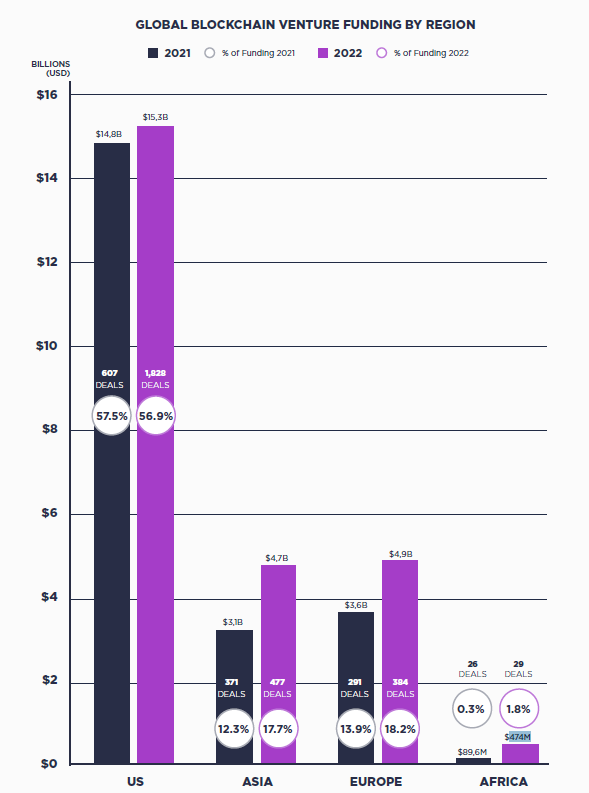

Crypto venture capital investment grew over 400% in Africa in 2022 to about $470 million, outstripping global VC investment’s 4% growth that saw the industry rake in about $27 billion.

According to a new report by CV VC and South Africa’s Standard Bank, African crypto firms raised about $474 million in 2022, outpacing investment in other sectors by almost 400% and beating the 4% global crypto investment growth.

Africa’s Share of Global Crypto VC Investment Jumps to 1.8%

Seychelles and South Africa secured 81% of African funding, securing $208 million and $176 million. Crypto exchanges and custody platforms snapped up 52% of the money.

At the same time, fintech and blockchain infrastructure and development were the second and third-most funded categories, accounting for 24% and 15% of the funds raised, respectively. International exchange KuCoin reached unicorn status, raising $180 million in Seychelles.

In addition, the number of blockchain deals grew by 12%, including firms involved in personal identification and financial independence.

Africa’s share of $26.8 billion in global blockchain venture funding rose from 0.3% in 2021 to 1.8% in 2022.

Despite the growth, however, most crypto VC funding remains concentrated in the United States (57%), Asia (17.7%), and Europe (18.2%). The U.S. surrendered 10% of its year-on-year share of sector-agnostic VC funding to Asia in 2022.

Devalued Currencies and Regulatory Ambiguity Ahead

Despite the growth in crypto venture capital in Africa, a Bloomberg report earlier this year revealed that stalled growth and currency devaluation in Africa’s most developed economies may have restricted funding to African startups. Such economies include Kenya, South Africa, Egypt, and Nigeria.

Lazerpay, a B2B crypto payments company, recently announced it would close up shop after failing to close a successful funding round. Last year, the firm also could not raise money in a seed round after a key investor pulled out.

A patchwork of regulations and implicit and absolute bans has complicated crypto adoption in African nations.

While cryptocurrencies are not illegal in Nigeria, its banks are banned from participating in cryptocurrency transactions. Nigeria’s securities watchdog, the Nigerian Securities and Exchange Control, will formalize new crypto rules in an upcoming Finance Bill.

The Bank of Ghana, while categorizing cryptocurrencies as digital assets rather than currencies, is still working on a new framework. The bank has yet to indicate when the framework will be ready.

African-focused P2P crypto marketplace Paxful recently suspended withdrawals amid key staff departures. The platform was popular in Nigeria and Ghana.

Recently, the South African Reserve Bank issued guidance implicitly legalizing cryptocurrencies. Kenya recognizes crypto assets as securities, while Seychelles only requires compliance with anti-money laundering and counter-terrorism financing rules.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.