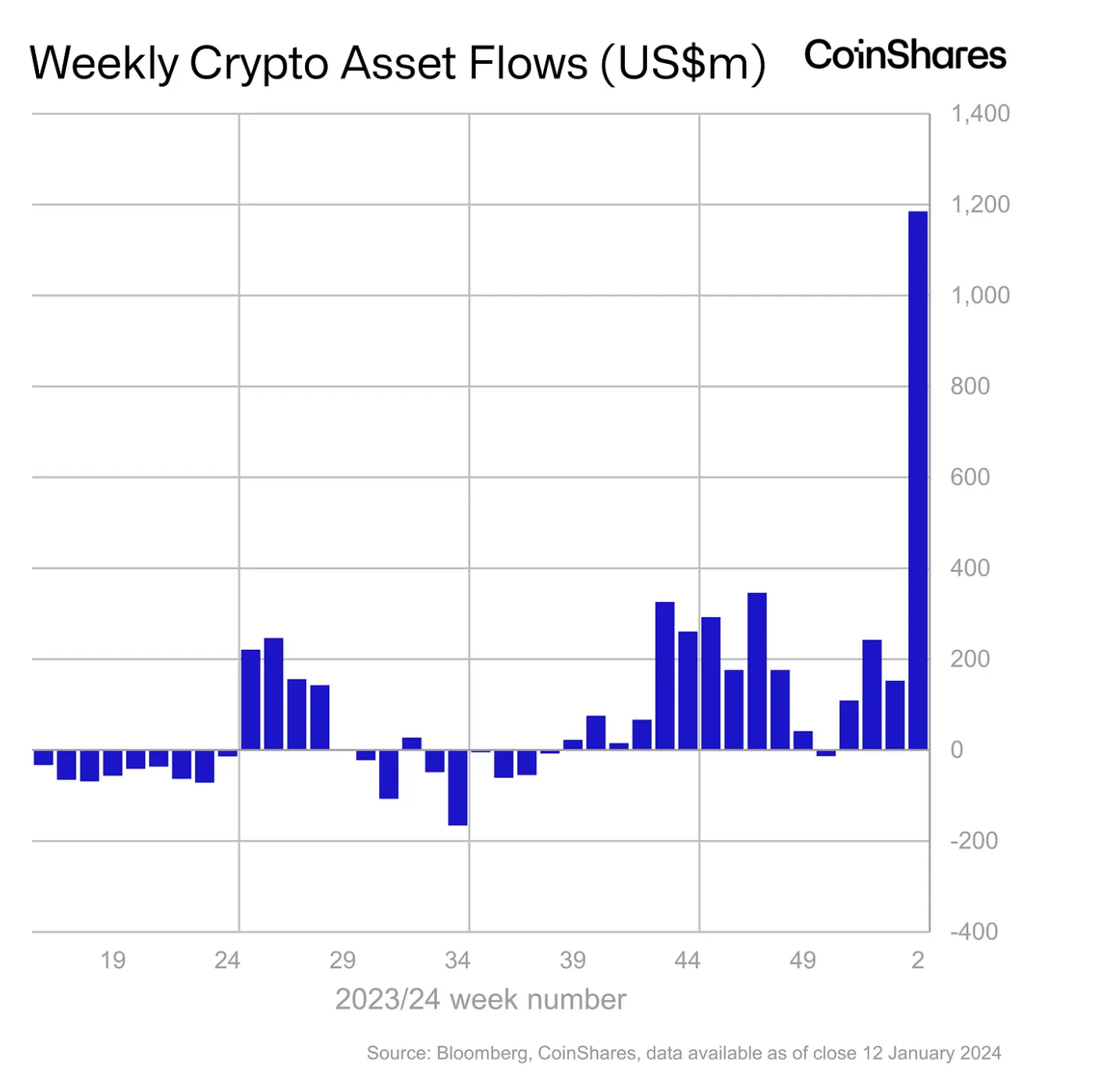

Last week marked a historic moment in the cryptocurrency market as exchange-traded products (ETPs) trading volumes surged to an unprecedented all-time high of $17.5 billion. Meanwhile, the crypto inflows for the ETPs have been the highest since October 2021.

This record-breaking figure is a staggering leap from the $2 billion weekly average of 2022. Indeed, it underscores a growing investor interest and confidence in cryptocurrency markets.

Record-Breaking Crypto Trading Volumes

According to CoinShares, digital asset investment products witnessed $1.18 billion in inflows last week. Still, this impressive number fell short of the record set by the launch of futures-based Bitcoin ETFs, which reached $1.5 billion in October 2021.

SponsoredThe large spike in weekly crypto asset flows is mainly due to the US Security and Exchange Commission’s (SEC’s) approval of spot Bitcoin exchange-traded funds (ETFs). Industry leaders, such as Mati Greenspan, CEO of Quantum Economics, believe that the Bitcoin ETF approval will bring significant institutional adoption.

“In the mid-term, spot Bitcoin ETFs should provide a frictionless on-ramp for institutions to add Bitcoin to their books in a way that’s both regulatory friendly and compliant with various fund structures,” Greenspan told BeInCrypto.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

The United States led the charge with inflows totaling $1.24 billion, followed by Switzerland’s $21 million. However, these inflows contrast with minor outflows in Europe and Canada. In fact, Canada, Germany, and Sweden witnessed outflows of $44 million, $27 million, and $16 million, respectively.

Bitcoin, the flagship cryptocurrency, experienced inflows of $1.16 billion last week, representing a significant 3% of its total assets under management (AuM). Even short-Bitcoin products saw minor inflows, totaling $4.1 million.

Read more: How to Short Bitcoin: A Step-by-Step Guide

Other cryptocurrencies also reported positive inflows. Ethereum garnered $26 million, XRP attracted $2.2 million, while Solana saw a modest inflow of $0.5 million. This diversified interest across various digital currencies suggests a maturing market with investors spreading their bets across different assets.

Notably, blockchain equities have also received substantial attention, with inflows totaling $98 million last week. This brings the total inflows over the last seven weeks to an impressive $608 million.