The Cosmos (ATOM) ecosystem, known for its interoperability and scalability, hosts a variety of ambitious projects that aim to redefine aspects of decentralized finance (DeFi).

Among these, dYdX Chain, THORChain, and Osmosis have garnered attention for their innovative approaches and contributions to the DeFi space.

dYdX Chain: Decentralized Trading

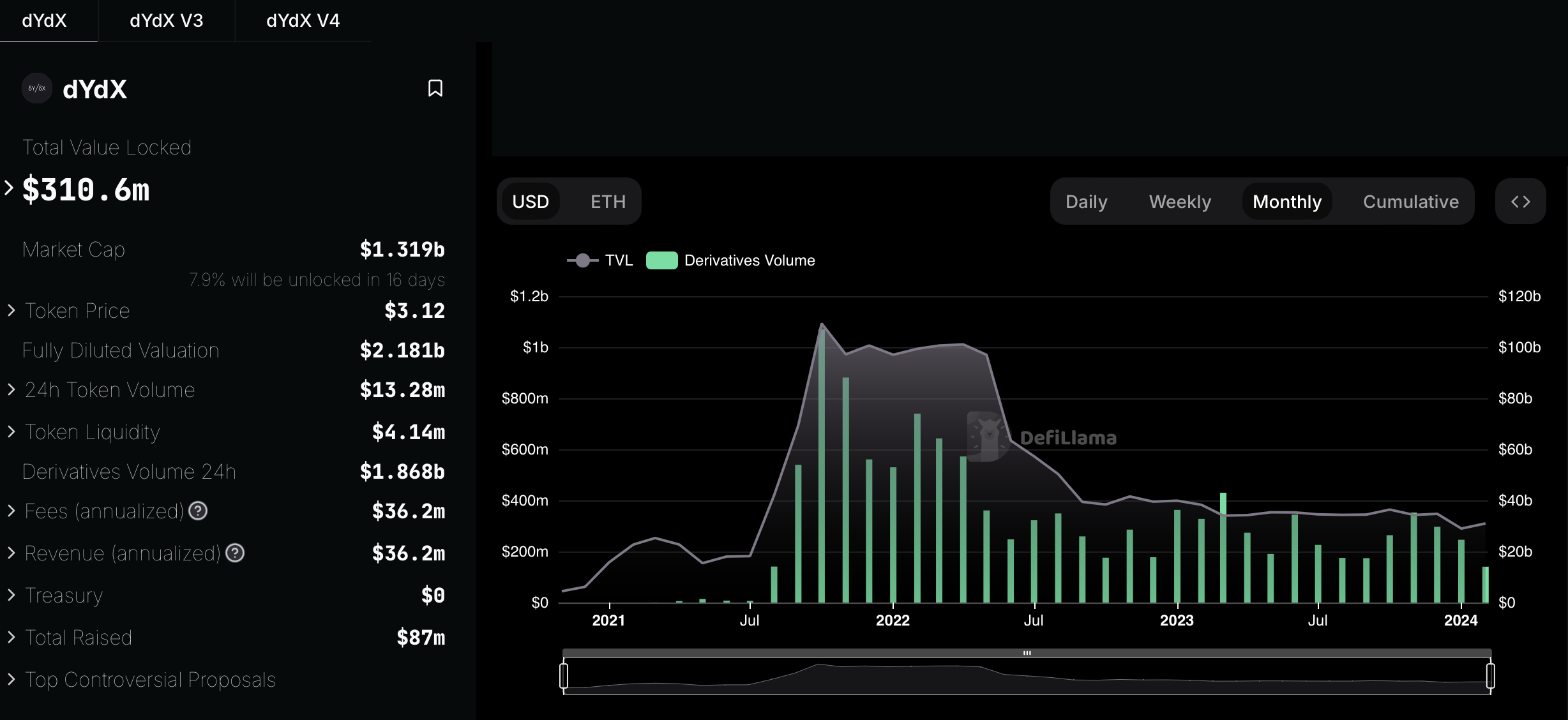

dYdX Chain, a decentralized exchange (DEX) built on the Cosmos SDK, has ascended to prominence. Three months post-launch, it achieved over $33 billion in trading volume. It also reached a total value locked (TVL) of $50 million in USDC.

The DEX has positioned itself as the largest by daily trading volumes, surpassing dYdX v3 and Uniswap. Therefore, it underscores the market’s demand for high-performance and fully decentralized trading platforms.

A vibrant community of 2,500 unique active traders highlights the platform’s success. This reflects its effective governance model and incentives, such as the Launch Incentives Program. Despite these achievements, the sustainability of its growth amidst the competitive DeFi environment remains an area for close observation.

THORChain: Bridging Assets

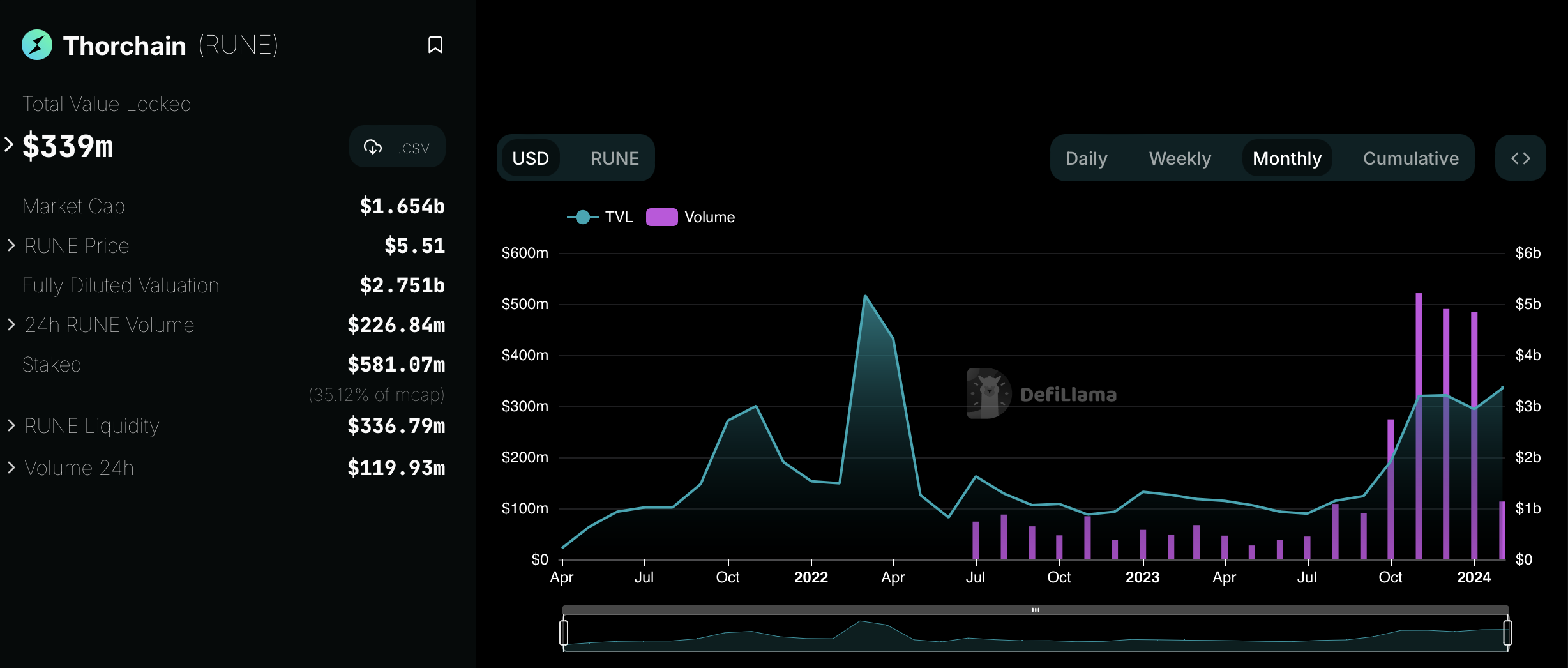

THORChain’s unique value proposition lies in its cross-chain liquidity protocol that enables direct swaps between disparate cryptocurrencies. It has carved a niche in enhancing DeFi interoperability by avoiding the need for token wrapping.

Recovering from early security vulnerabilities, THORChain has introduced features like streaming swaps to reduce slippage. Its daily swap volume has seen highs of $382 million. Meanwhile, a TVL of $330 million demonstrates robust participation and liquidity.

THORChain’s affiliate program and recent foray into lending services highlight its continuous innovation and introduce new dimensions of risk and complexity to its operations.

Osmosis: Liquidity Aggregation

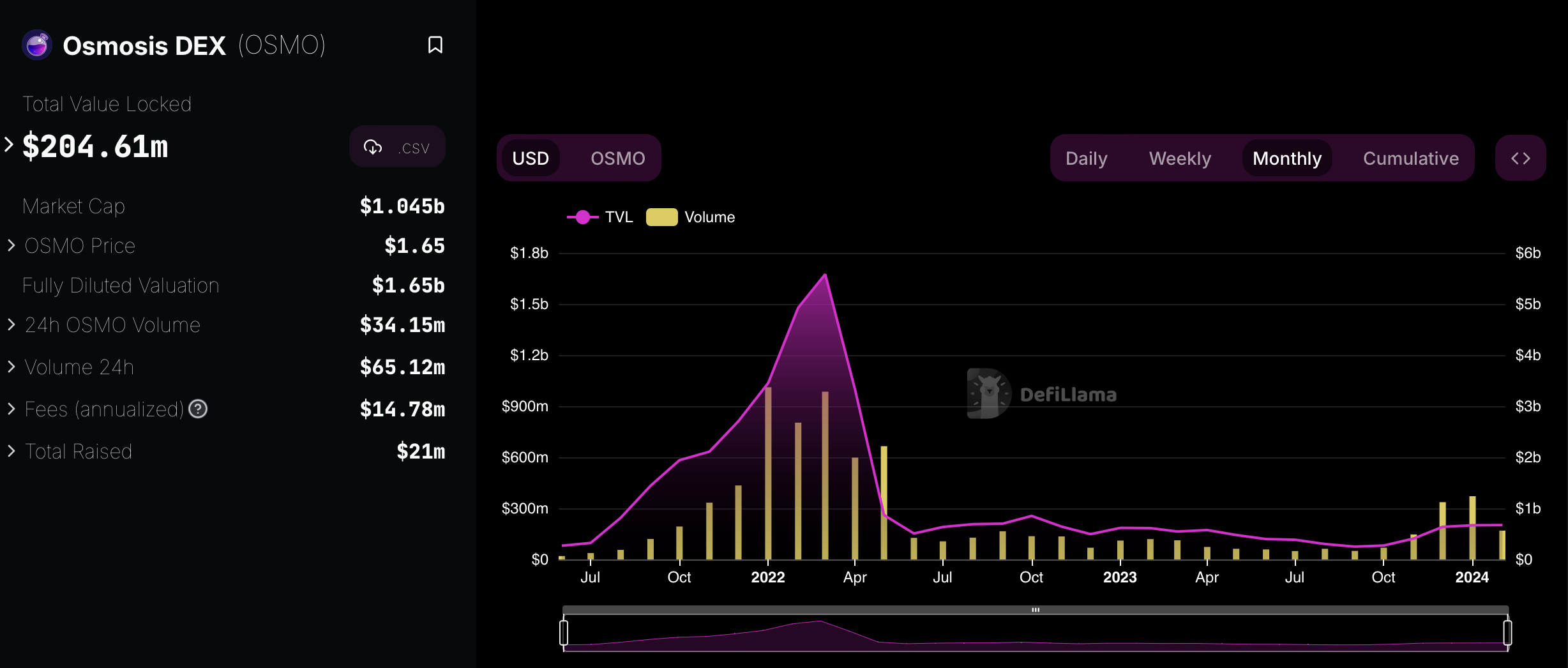

Osmosis commands attention as the primary liquidity layer for the Cosmos ecosystem. It has a reported $7.7 billion in cumulative trading volume. The platform’s ability to draw approximately 45,000 daily active users at its peak indicates its critical role in facilitating DeFi transactions across Cosmos.

Osmosis’s innovative features, such as superfluid staking, alongside a strategy that has generated approximately $12.9 million in cumulative swap fees, underscore its importance.

However, the fluctuating TVL and the competitive pressures from other liquidity protocols pose ongoing challenges to maintaining its market position and user base.

The Future of Cosmos

These projects illustrate the diverse potential and challenges of building on the Cosmos ecosystem. dYdX Chain’s growth trajectory highlights the demand for decentralized trading platforms. Meanwhile, THORChain’s innovations in cross-chain swaps reflect a move towards greater interoperability in DeFi.

On the other hand, Osmosis, with its focus on liquidity, plays a crucial role in the ecosystem’s infrastructure.

Read more: A Guide to Keplr Wallet: The Cosmos Wallet of Choice

Through its successes and hurdles, each project contributes to the ongoing development of DeFi on Cosmos. As the ecosystem evolves, these projects’ sustainability, security, and user adoption will be critical factors in their ability to make lasting impacts.