The magnitude of the effect from the current pandemic on the global economy has yet to be fully realized. However, most projections expect a considerably negative impact that could trigger a recession.

One such prediction, made by the Goldman Sachs Group, indicated that advanced economies could shrink by as much as 35%. However, predictions for the Bitcoin price are not as grim. On the contrary, the upcoming halving event could provide a boost to the price. While predictions vary, the majority are expecting a substantial price increase.

Without further ado, let’s take a look at some Bitcoin and altcoin charts to try and figure out where the markets will be moving.

Bitcoin (BTC)

The Bitcoin price was trading inside an ascending wedge in the period from March 13-April 9. After the April 9 breakdown, the price increased to validate the wedge as resistance and dropped sharply afterward. This type of movement suggests that the bears are in control and the current trend is about to move bearish.

- Short-Term Outlook – Bearish

- Medium-Term Outlook – Bearish

- Long-Term Outlook – Bullish

Ethereum (ETH)

Similar to BTC, the Ethereum price has been increasing since the rapid downward move o March 13. However, the decrease has taken the shape of an ascending channel instead of a wedge, which is a neutral pattern, while the wedge is considered bearish.

- Short-Term Outlook – Neutral (Because of BTC)

- Medium-Term Outlook – Bullish

- Long-Term Outlook – Bullish

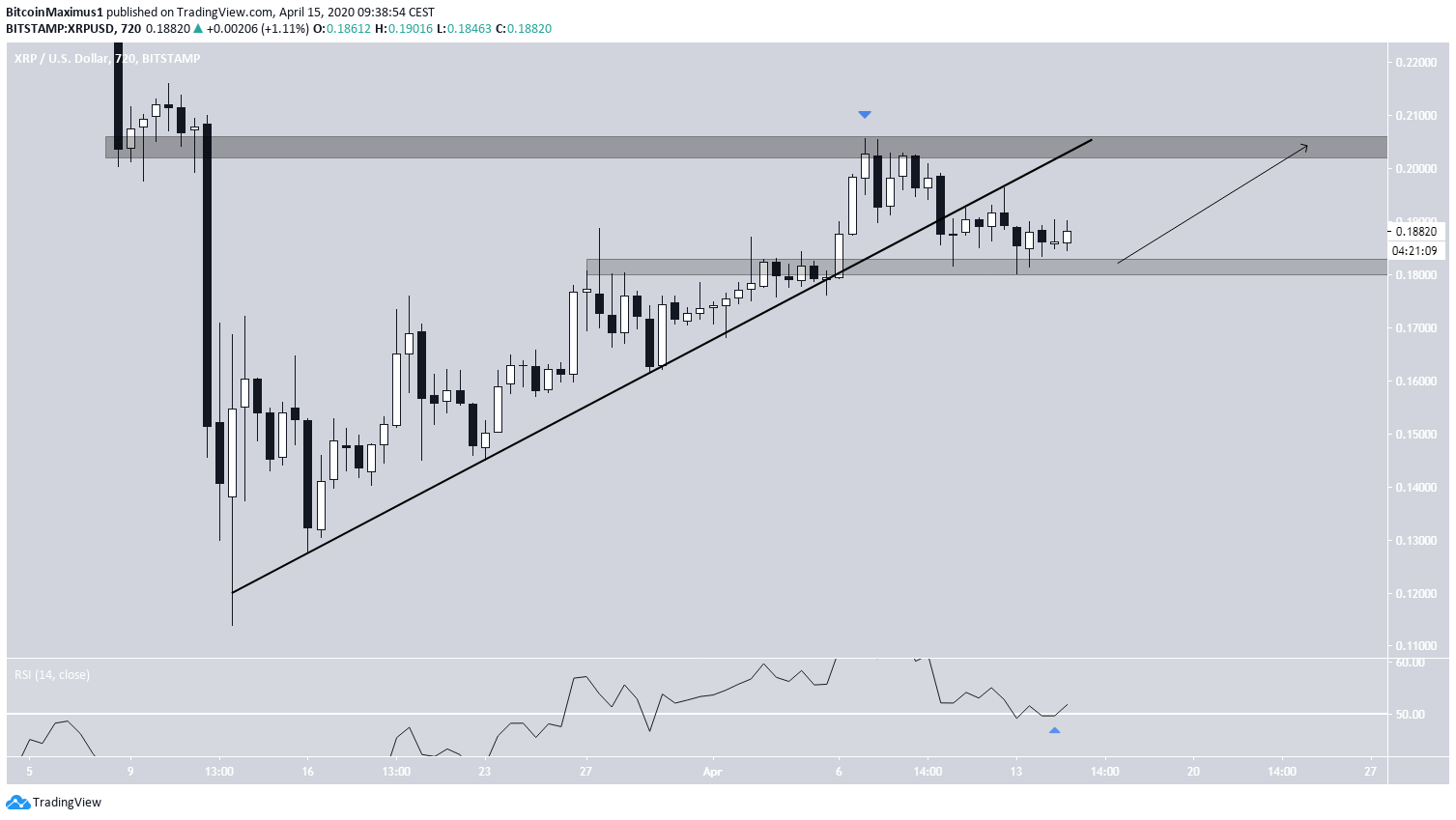

XRP (XRP)

Similar to BTC but unlike Ethereum, the XRP price has broken down from an ascending support line that had been in place since March 13. The increase ended as soon as the price reached the closest resistance area, which was found at $0.205. The price broke down from the ascending support line shortly afterward.

- Short-Term Outlook – Neutral

- Medium-Term Outlook – Bearish

- Long-Term Outlook – Bullish

Bitcoin Cash (BCH)

The BCH price has also broken down from an ascending support line. It did so once it reached the $270 resistance area along with the 50-day moving average (MA), which is also providing resistance. At the time of publishing the price was trading between resistance and support at $240 and $210, respectively. Interestingly, after breaking down from the support line, BCH did not have enough strength to increase and validate this line as resistance afterward, indicative of a lack of buying power by the bulls.

- Short-Term Outlook – Bearish

- Medium-Term Outlook – Bearish

- Long-Term Outlook – Bullish

Bitcoin Cash SV (BSV)

The BSV movement is characterized by two lines instead of one. First, there is the ascending support line that the price has broken down from, which is very similar to the rest of the cryptocurrency market. In addition, the price is following a descending resistance line that has been in place since Jan 20. The price has validated this line thrice at this point — most recently on April 9. This was the catalyst of the ensuing downward move.

- Short-Term Outlook – Bearish

- Medium-Term Outlook – Bearish

- Long-Term Outlook – Bullish

Litecoin (LTC)

The Litecoin price has also broken down from an ascending support line and is currently resting on the $40 support area. As long as this level holds, LTC could begin an upward move in order to validate the line it has just broken down from. If the area fails to support the price, the next support area can be found at $37.

- Short-Term Outlook – Neutral

- Medium-Term Outlook – Bearish

- Long-Term Outlook – Bullish

EOS (EOS)

The EOS chart looks quite bullish when compared to that of most other major altcoins. The price might have not yet broken down from the ascending support line, but its slope is unclear, as can be seen in the chart below. However, the price has broken out from a long-term descending resistance line, similar to that of BCH and has validated it as support.

- Short-Term Outlook – Neutral (because of BTC)

- Medium-Term Outlook – Bullish

- Long-Term Outlook – Bullish

Binance Coin (BNB)

The BNB chart does not yet show a breakdown. There is definitely an ascending support line that is clearly intact. However, there is a possible resistance line, whose slope is not yet confirmed, that would create an ascending wedge when combined with the current support line.

- Short-Term Outlook – Bullish

- Medium-Term Outlook – Neutral

- Long-Term Outlook – Bullish

ChainLink (LINK)

Since March 13, the LINK price has seen the best gains of the other altcoins analyzed here. The increase has been so rapid that the price has moved way above the ascending support line, which it has not validated since March 29.

- Short-Term Outlook – Bearish

- Medium-Term Outlook – Bearish

- Long-Term Outlook – Bullish

Tezos (XTZ)

The XTZ price movement is very similar to that of Ethereum, in which the ascending support line is still intact and the price seems to be trading inside an ascending channel. To further confirm these similarities, XTZ also seems to be following a short-term descending resistance line.

- Short-Term Outlook – Neutral

- Medium-Term Outlook – Neutral

- Long-Term Outlook – Neutral

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored