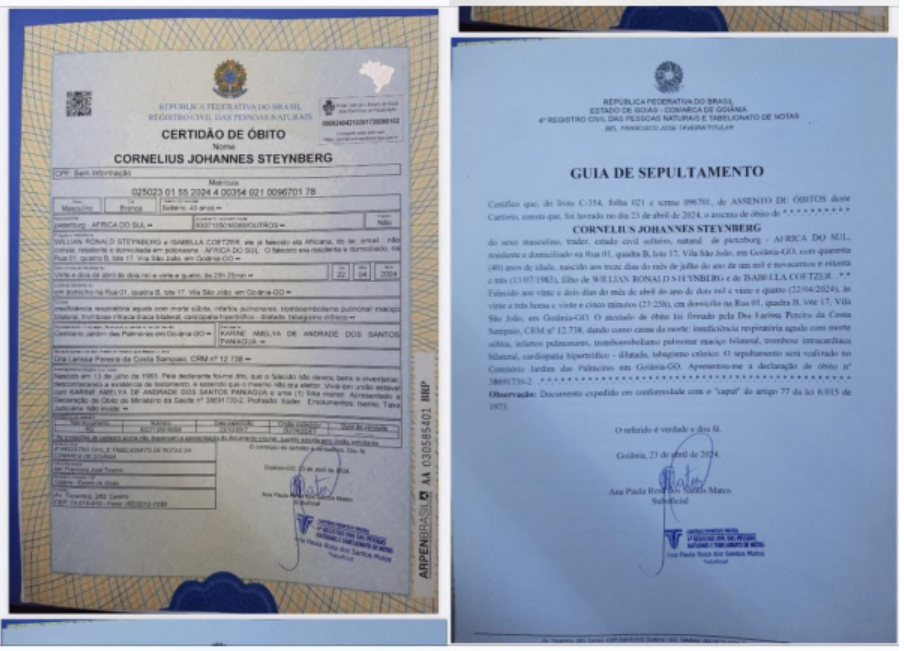

The cryptocurrency world is facing fresh turbulence with reports from O Popular that Johann Steynberg, the figure behind the alleged $1.8 billion Mirror Trading International (MTI) Ponzi scheme, has died in Brazil.

His unexpected demise due to a heart attack comes amidst intense legal proceedings and could potentially complicate efforts to recover substantial funds.

Steynberg, Fined $3.46 Billion by US Court, Dies Awaiting Extradition

Steynberg, who had been under house arrest on a farm in Pirenópolis since December 2021, was awaiting extradition to South Africa when he suffered a severe health crisis. Reports indicate escalating mental health issues in the weeks leading to his death, as confirmed by his lawyer, Thales Jayme.

In April last year, a US court fined Steynberg and MTI a record $3.46 billion for “systematic and pervasive fraud” against tens of thousands of members. This was the highest-ever monetary penalty in the history of a case involving the Commodity Futures Trading Commission (CFTC).

The Financial Sector Conduct Authority (FSCA) in South Africa exposed the massive Ponzi scheme under investigation, which promised exorbitant monthly returns to investors and involved the MTI boss. The scheme’s unraveling prompted Steynberg to flee South Africa in December 2020.

Consequently, MTI’s operations were halted, and the Western Cape High Court declared the company a Ponzi scheme.

Read More: 15 Most Common Crypto Scams To Look Out For

Investor Worries Spike as Steynberg’s Death Clouds Bitcoin Recovery

The recent passing of Steynberg has only deepened the uncertainty surrounding the recovery efforts for thousands of bitcoins, collectively valued at over $1 billion. On the MTI platform alone, transactions involving over 29,000 BTC have occurred. Despite ongoing efforts by authorities, the exact number of missing bitcoins remains elusive, with estimates ranging between 3,000 and 10,000 BTC presently, although the actual figure could be higher.

While liquidators have managed to reclaim nearly 1,200 bitcoins, court documents indicate that a significant portion of the cryptocurrency remains unaccounted for. Steynberg’s unexpected demise has triggered suspicions and anxieties among investors, many of whom are still grappling with the aftermath of the scheme’s unraveling.

The liquidation process, already a contentious issue with former MTI investors due to the court’s ruling that any withdrawals must be repaid at current Bitcoin prices, is now facing additional challenges. Steynberg’s death might obscure the full accounting of the missing assets and the potential for recovering the lost funds.

Read More: Crypto Scam Projects: How To Spot Fake Tokens

The saga leaves a trail of unanswered questions and a complex legacy involving alleged international fraud, broken trust, and the murky waters of unregulated financial dealings. As investigators continue to probe the circumstances, the crypto community watches closely, noting the profound impact such schemes have on the industry’s credibility and the urgent need for clearer regulatory frameworks.