Despite an ongoing bear market, crypto payments processors BitPay and Coingate recorded a notable uptick in crypto payments in 2022, with Bitcoin still the most preferred crypto asset.

In its 2022 report, Coingate noted that payments at merchants rose 63%, with customers spending Bitcoin in 48% of transactions, a figure down 7.6% from the previous year.

More Consumers Used Altcoins in 2022

According to Coingate, altcoins claimed 7.6% of Bitcoin’s 2021 market share in 2022, with customers using USDT, Ethereum, Litecoin, TRON, BNB, and ADA. Tether’s USDT was used in around 15% of transactions, while newcomers ADA and BNB broke into the top 10, accounting for 1.1% and 3.5% of payments, respectively.

BitPay’s CEO Stephen Pair noted that consumers were less concerned about the price of the cryptocurrency and more about the transaction fees in 2022. Accordingly, customers favored Litecoin over Bitcoin for smaller purchases because of LTC’s lower transaction fees.

Consumers used Litecoin in 27% of merchant transactions and Bitcoin in 41%. Customers likely chose Bitcoin for larger purchases because of its more extensive network and considerable “mining power,” Pair added.

Coingate predicts that Bitcoin’s Lightning Network developments could see Bitcoin’s throughput and volume increase dramatically in the coming years.

In 2022, almost 6.29% of Coingate’s Bitcoin payments were done on the Lightning Network, up from 4.5% the previous year.

BitPay and Coingate protect merchants from price volatility through instant crypto-to-fiat settlements.

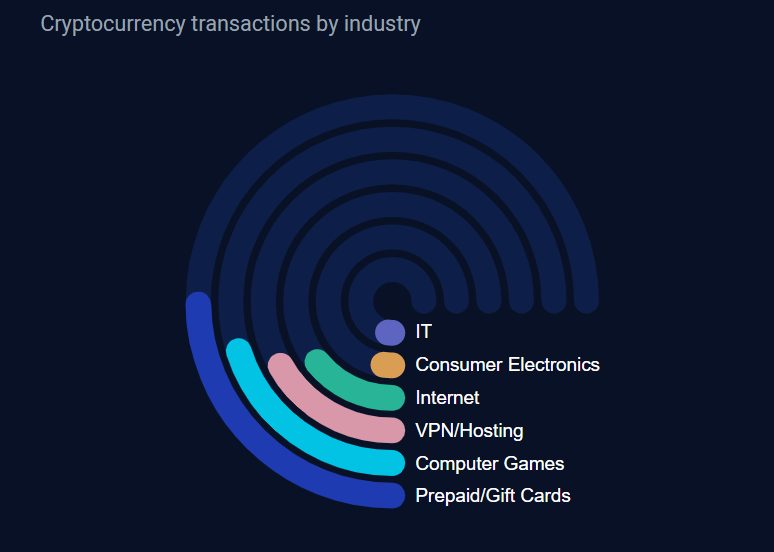

What Are People Using Crypto Payments For?

Data from BitPay and Blockdata suggests that consumers spent crypto on VPN and hosting services to bolster their online privacy. Consumers also used crypto to pay for prepaid gift cards, electronics, and computer games.

A 2022 report co-authored by PYMNTS and BitPay reveals that tech-driven consumers, roughly a quarter of college students and those earning $100,000 or more annually, account for most crypto purchases.

Thirty-five percent of tech-driven consumers favor a merchant offering crypto payments. Twenty-six percent of that group said they would be willing to change where they shop if the vendor provided a crypto option.

The report suggested that merchants can target crypto promotions for each category of connected device that tech-driven consumers own.

BitPay’s CEO pointed out that crypto payments do not make sense for vendors catering to a lower-income demographic.

Pros and Cons of Crypto Payments

According to blockchain research firm Blockdata, consumers used crypto for payments in 2022 because of their security, speed, and low fees.

However, without scalability improvements like the Lightning Network, several blockchains’ transaction throughputs are still well below traditional payment networks.

Until developers implement sharding, Ethereum can only process about 20 transactions. Bitcoin processes seven transactions per second, while TRON claims a throughput of 6,000 transactions per second. To put those numbers into context, traditional payment networks like Visa offer transaction throughput in the tens of thousands.

Additionally, relying on payment processors such as BitPay introduces additional fees and a single point of failure.

For Be[In] Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.