A large number of Ethereum options contracts are due to expire soon, but will they rattle ETH price and crypto markets?

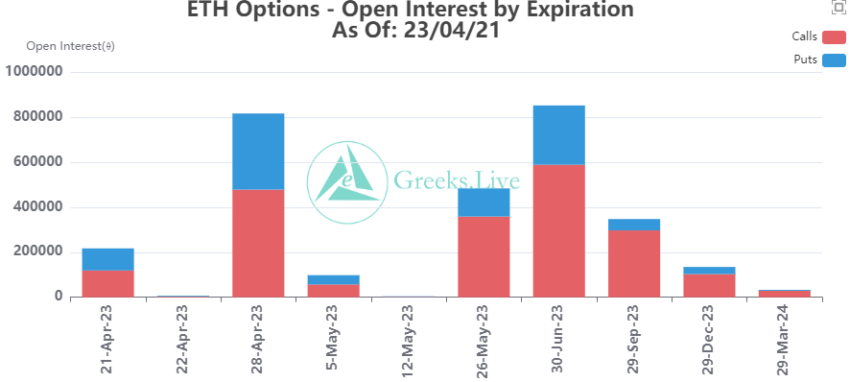

Crypto derivatives traders have recently been dabbling in more Ethereum options than those for Bitcoin. As a result, around 217,000 ETH options contracts are about to expire.

Furthermore, they have a max pain point of $1,950 and a notional value of $4.2 billion.

The max pain point is the strike price with the most open Ethereum options contracts. Additionally, it is the price at which the asset would cause financial losses for the largest number of contract holders at expiration.

It also happens to be very close to the price at which Ethereum is trading at the moment.

Options allow speculators to buy or sell Ethereum at a specific price, the strike price, with the ‘option’ to sell at any time. They are more flexible than futures contracts which have fixed expiry dates.

Ethereum Options Bearish

The put/call ratio for Ethereum options is 0.83, and anything higher than 0.7 to 1 is generally considered bearish.

The put/call ratio is calculated by dividing the number of traded put (short) contracts by the number of call (long) contracts. Values higher than 0.7 or 1 are bearish because more traders are buying short contracts than longs.

Furthermore, around 25,000 Bitcoin options contracts are also due to expire soon. These have a max pain point of $29,000 and a notional value of $0.72 billion, according to Greeks Live.

The put/call ratio for BTC options is 0.7, which is generally considered neutral.

Therefore, the current ratios are not overwhelmingly leaning in any direction, so the market impact should be minimal when they expire.

ETH Price Retreats

Kraken wallets have withdrawn a large chunk of staked ETH over the past day or so. The move has been bearish for Ethereum, which has started to retreat from its eleven-month high.

The ETH price has declined 8.5% since its 2023 high on April 17. They are trading flat on the day at $1,947 at the time of writing.

Resistance at $2,100 has been too strong to overcome, and markets are due for a correction. Further downsides could see ETH find support in the $1,850 price zone.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.