A falling knife is a term for an asset’s rapid drop in value. Catching a falling knife is a dangerous trading method in which a trader attempts to buy close to the bottom of such a drop.

What is a Falling Knife?

Catching a “Falling Knife” means buying into an asset that has extreme downward momentum and has not given any bullish reversal signs.

In simple terms, the benefits of the tactic are that if timed perfectly, a trader can buy the exact bottom and book considerable profit once the price of the asset recovers.

However, the drawback is that the price may continue falling to no avail. The use of leverage exacerbates this drawback. This is because the continuation of the decrease can quickly cause liquidations.

Why Should You Avoid Falling Knives?

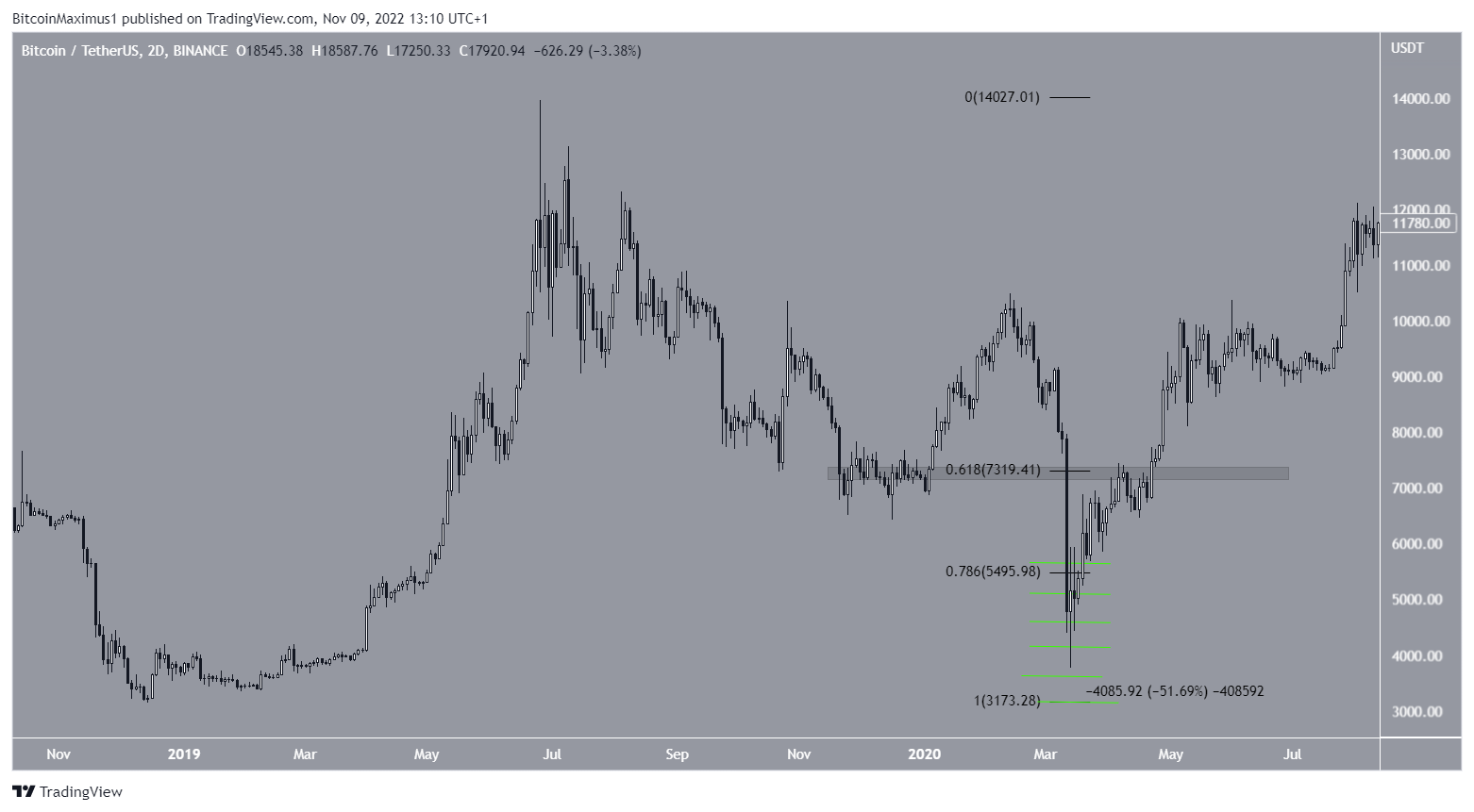

The main reason to avoid a falling knife is that there is nowhere to place a stop loss. Therefore, the losses could be unlimited. This can be illustrated by the Bitcoin (BTC) price movement in March 2020, during the “Coronavirus crash”.

Between March 10 and 12, the BTC price decreased by 52%, leading to a low of $3,782.

The decrease accelerated once the BTC price broke down from the $7,300 horizontal support area, which was also the 0.618 Fib retracement support level.

A potential method to catch this “falling knife” would be buying close to the 0.786 Fib retracement support level at $5,495. However, the Bitcoin price decreased to $3,782 the next day.

If a trader were to try and catch a falling knife in the spot market, he/she would still be in profit once the market eventually reversed. However, he/she would have most likely been liquidated if high leverage was used.

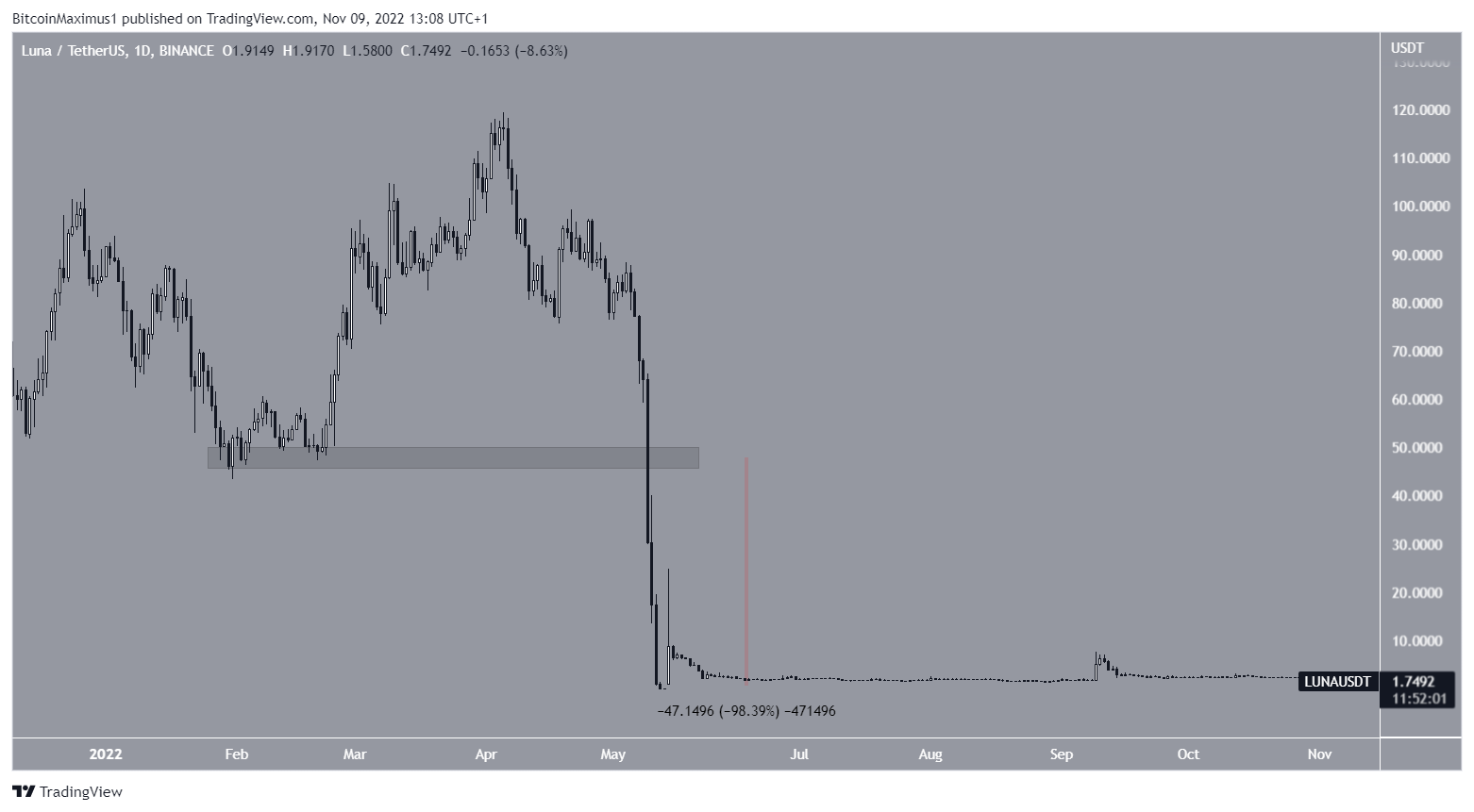

A scenario that would have ended badly in even the spot markets comes from Terra (LUNA). A sharp downward movement began on May 9, and the logical place to catch the ”falling knife” would have been at the $50 support area.

However, the area was unsuccessful in initiating a reversal. The LUNA price fell by an additional 98% after breaking down from the support area and has not recovered.

LUNA/USDT Chart By TradingView

How To Catch Falling Knives

If you are adamant in trying to catch a falling knife, the proper way to do it would be dollar cost averaging in the spot market. Going back to the BTC example, it would have been possible to set six equal buy orders (green lines) at $500 intervals from $5,600 to $3,100. This would have caught bounces at the 0.786 Fib retracement support level and deviations below it.

The drawback is that the profit would have been lower in case of a reversal, since not all the orders would have been triggered. However, if the trade goes bad, the average buying price would be $4,350, greatly reducing losses.

Cryptocurrency Market – Breakdown or Reversal?

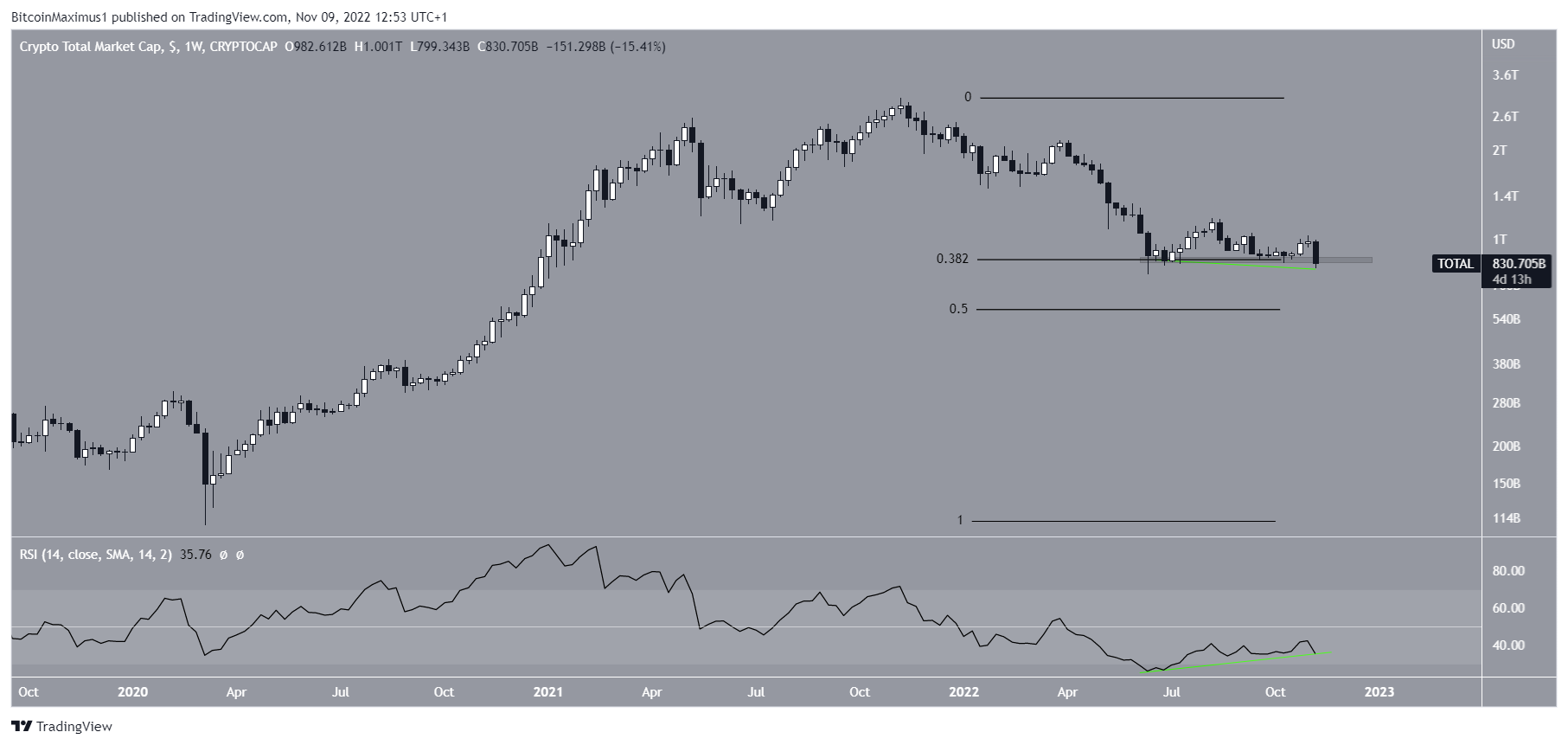

The cryptocurrency market cap is sitting at a very crucial support level at $860 billion. This is both the 0.382 Fib retracement support level and a horizontal support area. The support has been in place since June. So, the next support would be at $585 billion if a breakdown occurs. The 0.5 Fib retracement support level creates it.

The crypto market cap is currently breaking down from this area, though it has yet to reach a weekly close below it. Additionally, the weekly RSI could be in the process of generating bullish divergence (green line). This has also yet to be validated since the resumption of the downward movement would invalidate the divergence.

Therefore, whether the cryptocurrency market cap breaks down or bounces at the $860 billion support area will be crucial for the future long-term trend.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.