The crypto market (according to some) is currently in the most challenging phase of the bear market. Many traders and investors have abandoned the crypto sector entirely at this point in an effort to de-risk their portfolios. But for those that have stuck around, what might be in store for 2023?

The cryptocurrency market lost a whole lot of steam in 2022. Last year, numerous investors got burned by fraudsters, crypto scams, and the implosion of major crypto institutions. Unsurprisingly, this has severely damaged investors’ confidence and prolonged the ‘crypto winter.’

This refers to a period of declining prices and reduced market activity in the cryptocurrency market. It is often seen as a corrective phase after rapid growth and speculation, as seen throughout 2021. Many investors refrain from participating in the market during these times due to heightened risk and uncertainty.

However, others view this as a buying opportunity, believing that the market’s long-term potential remains intact. Ultimately, investing in digital assets is a personal choice and should be based on an individual’s financial goals, risk tolerance, and investment strategy.

Keeping Away From Crypto

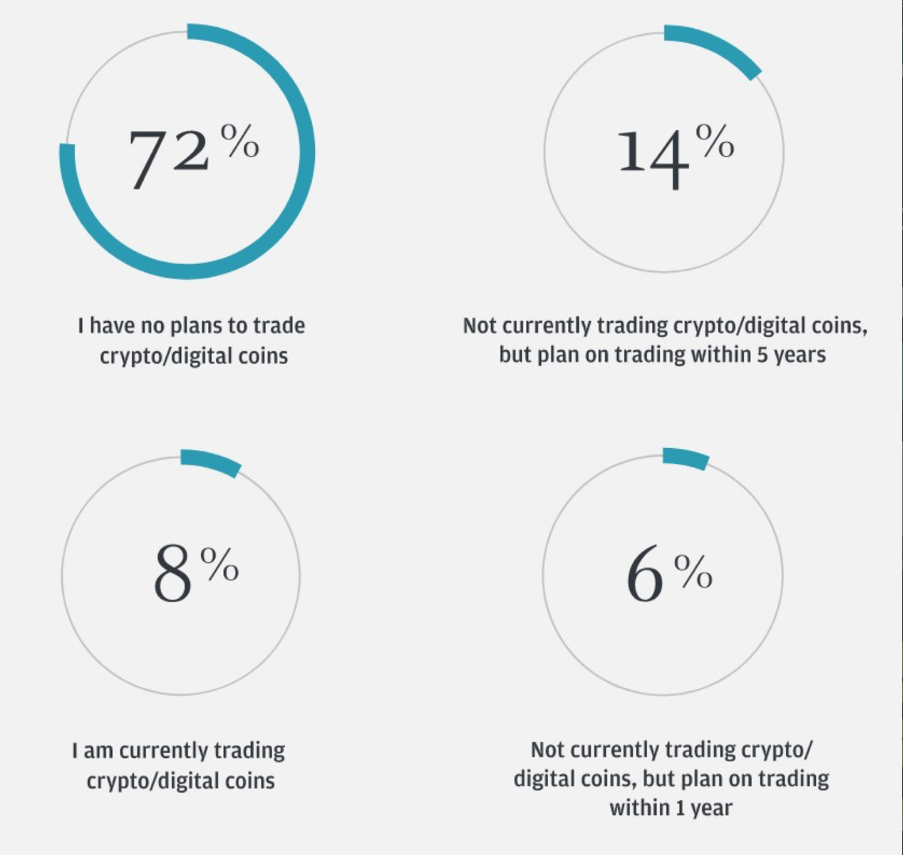

However, recent reports highlight the prevalence of the former. Finance giant JPMorgan shared its latest trading trends study with BeInCrypto which incorporates feedback from 835 institutional traders across 60 locations globally. Herein more than 70% of respondents showed hesitation about jumping into bed with crypto anytime soon.

The visual below shows that 72% of institutional e-traders signaled “no plans to trade crypto/digital coins” in 2023:

Per another finding, more than 90% of the surveyed traders don’t hold any cryptocurrencies in their portfolios. Not so surprisingly, the respondents blamed the market’s volatility for keeping them away.

Bear markets will often test investors’ patience and commitment. By the end of the bloodshed, only a fraction of the market participants will remain. Many that threw in the towel will never come back.

Stages of the Crypto Bear Market

Blockworks founder Jason Yanowitz discussed what he feels are the primary stages of a bear market in a recent Twitter thread:

According to Yanowitz, the first stage consists of unwinding. ‘The excitement and greed from the bull still existed. Narratives popped up. Valuations got cut, but companies didn’t kill products or do layoffs,’ he tweeted.

The second stage is where the ‘ugly’ side of the market begins as prices crash significantly. We are now at the third stage, according to Yanowitz. This stage is particularly tough primarily because due to the boredom and sideways action that can grip the market.

“This is the toughest part of the bear market. This will be the year you work long days and ship great products, only to see your key metrics go down day after day. Your friends will leave. Your coworkers will leave. You’ll question every assumption you had about crypto.”

Many might argue against this narrative, especially when considering the recovery across the crypto markets in the past month. Whether this recovery holds or not is still up in the air.

Only a Few Remain

Even the International Monetary Fund’s World Economic Outlook predicts that a crypto market recovery could be likely along with a potential decrease in inflation.

It also stated that regulatory developments are expected to provide greater clarity and stability while the increasing number of countries exploring and adopting cryptocurrencies as a legitimate asset class could boost the market. Additionally, technological advancements, such as the development of new blockchain-based platforms and the increasing use of decentralized finance (DeFi) applications, are expected to drive incredible innovation and growth in the industry.

What Does the Crypto Market Need to Succeed?

Increasing institutional adoption of cryptocurrencies could also play a key role in driving market recovery. Major corporations and financial institutions are beginning to invest in cryptocurrencies, recognizing their potential as a store of value and a hedge against inflation.

This institutional investment could provide much-needed stability to the market while reducing the volatility that has deterred many retail investors in the past.

Speaking to BeInCrypto, Raoul Pal summed up his thoughts on the previous year:

“The adoption of blockchain technology is ongoing and relentless, but the liquidity of how much money’s around drives the (crypto) space. Last year was a massive withdrawal of liquidity. All the money came out, the central banks tightened rates, and all the banks stopped lending money. It meant that all assets went down, and crypto goes down the most because it’s a high-risk asset.”

Looking into 2023, he added, “We are right near the end of the rate hikes. The economy is probably going into recession; when liquidity comes back into the system, prices rise again, so we’re at that point.”