Crypto companies take on multi-million dollar debts to finance their operations to meet the ask during a bull run. However, failing to repay the obligations leads to defaults, buyouts, and even bankruptcy, as was the case last year.

In 2022, massive chunks of crypto industry funding were wiped from the market. Multiple factors led to this shrinkage, but one not-so-common factor was the massive loans and debts taken on by crypto firms to expand their operations during the 2020-2021 bull run. Nonetheless, suffer when bears attack the bulls.

This is a common theme in market cycles. Optimism around a particular product or idea grows, and people start building and expanding on it, which requires more resources and funding.

During the last crypto bull cycle, many people started investing their money and life savings into the markets. This fueled more companies to build crypto products to try and capitalize on the frenzy. Many of these companies resorted to borrowing funds from lending entities to bridge the supply and demand gap. Now, after a year-long bear market, most of these debt-financed companies are starting to crack and break, leading to defaults and buyouts.

Bitcoin Miners Hit a Wall

Bitcoin miners took on debts during the 2020 and 2021 bull run to expand their operations. BTC mining powerhouses such as Core Scientific, Marathon Digital, and Greenridge Generation undertook massive obligations to mine a continuous supply of Bitcoin.

However, the 2022 crypto winter took a heavy toll on their financial operations and caused Core Scientific to go bankrupt while Greenridge had to enter into debt restructuring. ASIC financing loans were likely a large component of this.

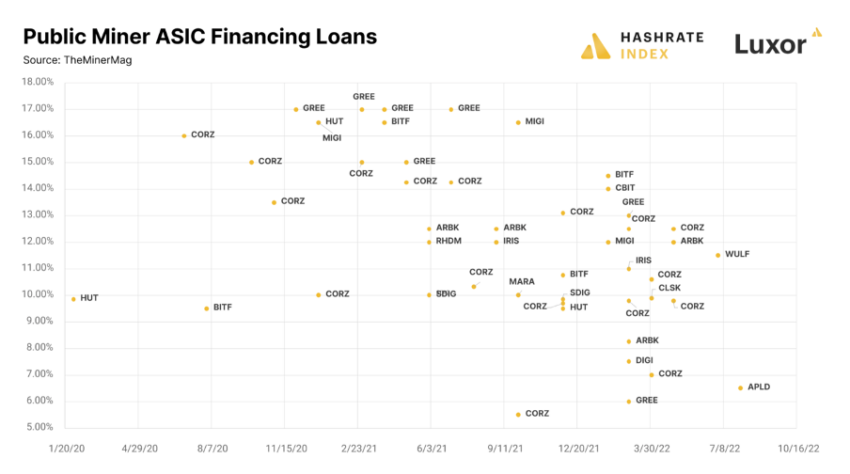

Data shared with BeInCrypto by Hashrate Index shows that several mining vendors raised funds against their Bitcoin ASICs and BTC reserves amid the 2020-2021 bull run. ASIC-financing deals worth more than $47 million and $600 million were executed in 2020 and 2021, respectively.

Crypto Companies See Staggering Declines Throughout 2022

In 2022, 18 BTC mining deals were made, valued at around the $640 million mark—16 of which ($576.80 million) were made in the first half of the year.

The report found that ‘deal flow dried up in the second half as market conditions went from bad to horrendous.’ This led to the said decrease in the number of deals. Several miners defaulted on the loans, while miners’ revenue declined. This caused strains in regard to paying back their loans.

The report noted,

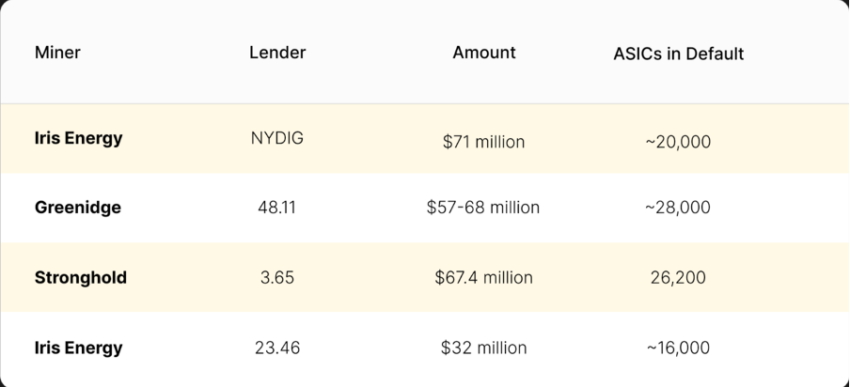

“Our tally (of known defaults from public miners) puts the total default amount at $227.40 million on the low end and $238.40 million on the high end.”

The executives estimated a maximum of $4 billion worth of ASIC finance debt on public and private miners’ balance sheets. But will 2023 bring more of the bear? Or will we see a bullish resurgence that can help keep these firms afloat?

2023 Off to a Lukewarm Start

Bitcoin miners got a little breathing room in the first month of 2023. BTC is currently trading for $22,780 after briefly hitting a five-month high of $23,375 on Jan. 21. However, the crypto market as a whole will still need some time to fill the considerable void left from last year.

Two of the largest cryptocurrency banks, Signature Bank and Silvergate, are struggling after raising debt capital from the United States Federal Home Loan Banks System. This came to light after they saw a hike in withdrawals request. Silvergate lent nearly $10 billion to Signature Bank in Q4 2022. At the same time, Signature was lending around $3.60 million to Silvergate to offset the cash liquidity.

Senator Elizabeth Warren echoed concerns about this type of intermingling while speaking to the Wall Street Journal:

“This is why I’ve been warning of the dangers of allowing crypto to become intertwined with the banking system. Taxpayers should not be left holding the bag for collapses in the crypto industry.”

She also referred to the crypto market as full of “fraud, money laundering, and illicit finance.” Zooming out, crypto companies failing on debt obligations can lead to more anti-crypto sentiment.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.