The crypto lending industry has been hit with a major blow as Nexo, one of the leading crypto lending platforms, has seen withdrawals worth over $158 million in the last 24 hours following a raid by Bulgarian authorities on its offices.

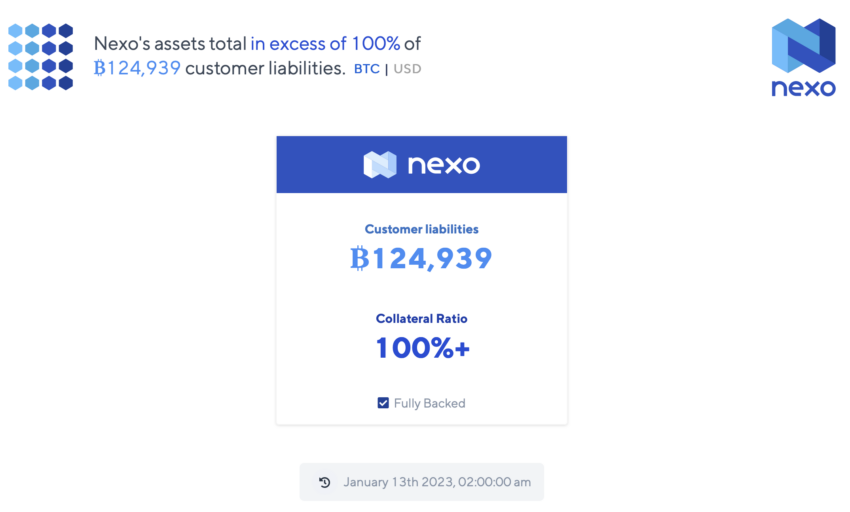

This comes as a surprise to many as Nexo had 133,263 BTC, worth around $2.5 billion, in customer liabilities on Thursday and by Friday its holdings came down to 124,939 BTC, worth $2.37 billion.

Within less than 24 hours, around 8,324 BTC ($158 million) were withdrawn from crypto lending platform, according to real-time attestation provided by Nexo’s auditor Armanino on its website.

Nexo Could Be Compromised

The raid by Bulgarian authorities is part of an investigation into alleged illegal activities conducted by Nexo.

In a statement, Nexo said that Bulgaria is “the most corrupt country in the EU. They are making AML and tax-related inquiries about a Bulgarian entity of the group that is not customer facing but only has back office functions — payroll, customer support, compliance.”

Despite the raid, Nexo’s co-founder Antoni Trenchev has stated that “all systems are up and running and everything is being processed in real-time as always.” He also added that the activity is “orders of magnitude smaller that post-Celsius and post-FTX.”

This is a reference to the crypto lending platforms Celsius and FTX. These have also seen large withdrawals in recent months leading to a collapse of the latter.

The situation at Nexo is being closely watched by the crypto lending industry. Especially, because it raises concerns about the safety and security of funds on these platforms. With the crypto market being highly volatile, any negative news or events can cause panic among investors and lead to large withdrawals.

The raid by Bulgarian authorities and the subsequent withdrawals at Nexo are a reminder of the risks involved in the crypto lending industry and the need for proper regulation and oversight.

It is unclear at this time what the outcome of the investigation by Bulgarian authorities will be and how it will affect Nexo and its customers. Still, it serves as a warning to other crypto lending platforms to ensure that they have proper measures in place to protect customer funds and comply with regulatory requirements.

Crypto Lender Under Fire

Nexo has recently come under fire in the United States as well. In September, eight states – California, Kentucky, Maryland, New York, Oklahoma, South Carolina, Washington and Vermont – filed cease-and-desist orders against the company. This move by state regulators is a significant blow to Nexo, which has been growing in popularity in recent years.

In addition to the cease-and-desist orders, Nexo is also facing a lawsuit in New York. The lawsuit, which was filed by the state, alleges that the company failed to register with the state as securities and commodities brokers or dealers, and for lying to investors about their registration status.

This is not the first time that Nexo has faced legal challenges in the United States. In the past, the company has been subject to various regulatory actions, including fines and penalties. However, these recent developments represent a significant escalation in the regulatory pressure that the company is facing.

Nexo has yet to comment on the situation, but it is expected that they will take steps to address the allegations and concerns raised by regulators. It is unclear how this legal battle will play out, but it is certain that it will have a significant impact on the future of the company and the crypto lending industry as a whole.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.