As May approaches, the crypto speculates about the annual query: Should investors “sell in May and go away”?

Historical data presents a mixed bag, with Bitcoin showing an average return of 7.66% in May yet a median return of -3.17%. This disparity raises the question of whether this month is truly a time to step back or seize an opportunity.

Sell Crypto in May and Go Away?

Crypto SunMoon, a notable Korean analyst, offers a bullish perspective. According to SunMoon, if Bitcoin remains in a bull market, the Short-Term Holder (STH)-Realized Price, at $59,000, is a critical support line.

This metric represents the average buy price of short-term market participants over the last six months. Therefore, it indicates a potentially lucrative buying opportunity if tested and if Bitcoin continues its bullish trend.

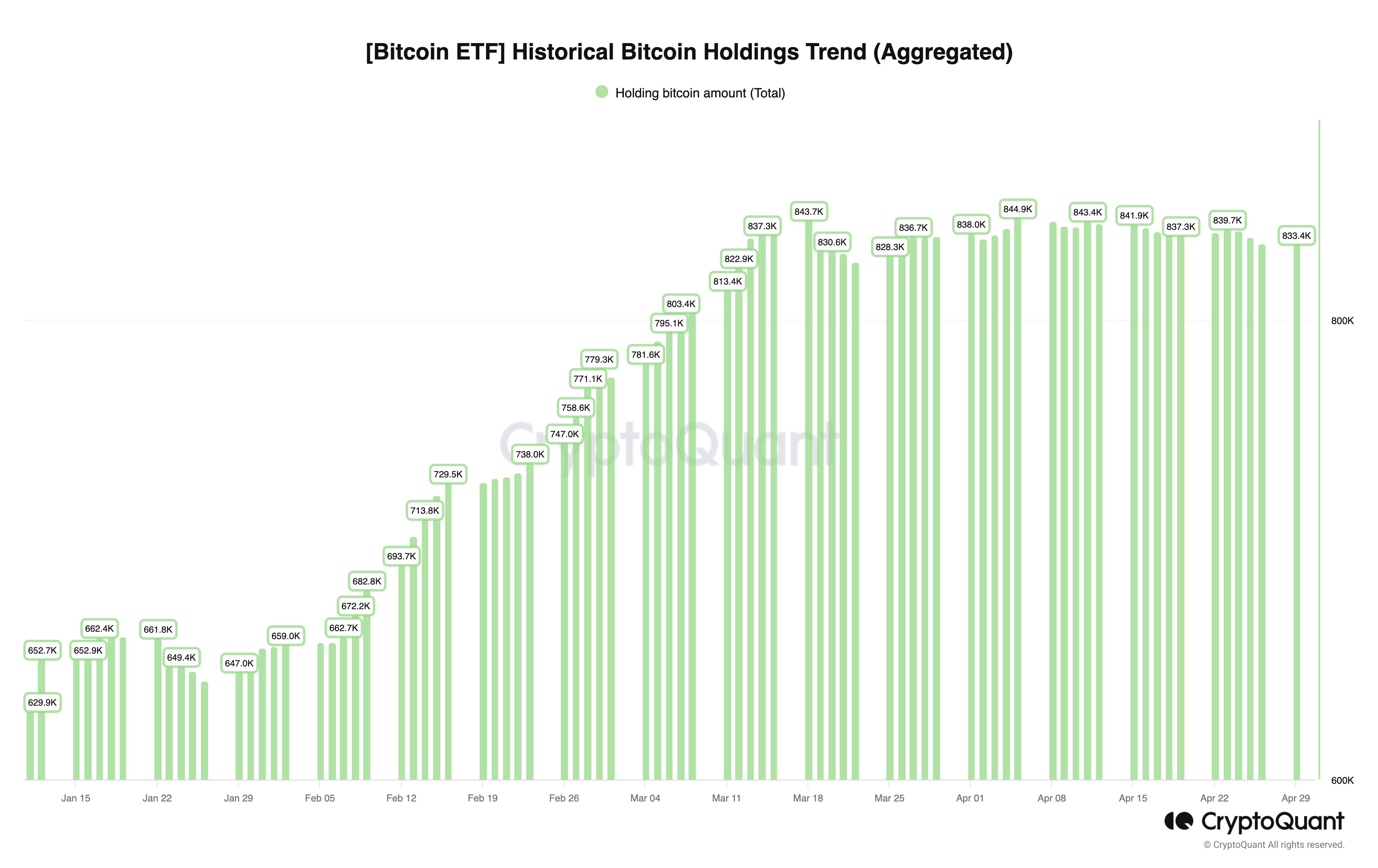

Adding to the bullish sentiment, Lark Davis highlights an impending supply shock that could reshape the crypto market. With the Bitcoin halving reducing mining output to only 450 BTC daily and the introduction of spot Bitcoin ETFs in markets like the US, Hong Kong, and Australia demand is surging while supply tightens.

“Institutions worldwide are lining up to own a piece of the Bitcoin pie. Bitcoin supply on all exchanges is at an all-time low. OTC desks are running dry. This bull run is going to be way crazier than you think,” Davis noted.

Meanwhile, Bill Barhydt, CEO of Abra, further accentuates this optimism. Barhydt projects a massive increase in global crypto market capitalization, potentially reaching $50 trillion over the next decade.

This growth is expected to revolutionize credit markets, particularly in developing economies.

“I think that we’re just still in the very very beginning of the global investment community getting exposure to the cryptos, like Bitcoin, Solana, and Ethereum. That’s going to push the crypto market capitalization from what it’s now, $2.5 trillion, to $50 trillion over the next 10 years and if not sooner,” Barhydt said.

Read more: Bitcoin Price Prediction 2024 / 2025 / 2030

Given these insights, deciding to “sell in May and go away” is not straightforward. Investors must weigh historical trends against current market conditions and future forecasts. With expert opinions suggesting a bullish continuation and significant market developments on the horizon, May might be more about strategic buying than selling.