In a resounding testament to the growing confidence in crypto ventures, funding in the crypto space has surged to an impressive $3.67 billion across 604 funding rounds in 2024.

This figure sets a brisk pace, poised to surpass the $9.3 billion raised in the previous year, according to data from industry analytics firm RootData.

Early Stage Investment Remains Crypto VC Focus in 2024

Crypto venture capital funding has maintained momentum, crossing the $1 billion mark for the second consecutive month. April witnessed a substantial influx of $1.02 billion, distributed across 161 investment rounds. This is slightly lower than March’s $1.09 billion across 186 rounds, as reported by RootData.

However, alternative data from DefiLlama presents a nuanced perspective. It indicates a slightly lower figure of $935 million in April 2024, just shy of the billion-dollar milestone.

Read more: How To Fund Innovation: A Guide to Web3 Grants

Examining the distribution of fundraising sizes, a notable 40.53% of funding falls within the $1 to $3 million range, underscoring the continued interest in early-stage projects. Conversely, only 2.16% of funding rounds boast sizes exceeding $50 million, signaling a concentration of larger investments in select endeavors.

Seed fundraising dominates the crypto funding ecosystem. It comprises over 51% of total fundraising rounds, highlighting the pivotal role of early-stage capital in nurturing innovation within the crypto sphere.

“This year is proving to be a founders’ market with over $2.49 billion invested in 600+ deals. However, the vast majority of deals are being done at the earliest stages, where valuations have come back (relatively speaking) from the bare bottom of Q1 2023. Late stage valuations still remain stagnant with some of the largest “winners” of 2021 remaining “at cost” or in need of a bridge round,” a crypto venture capitalist said on X (Twitter).

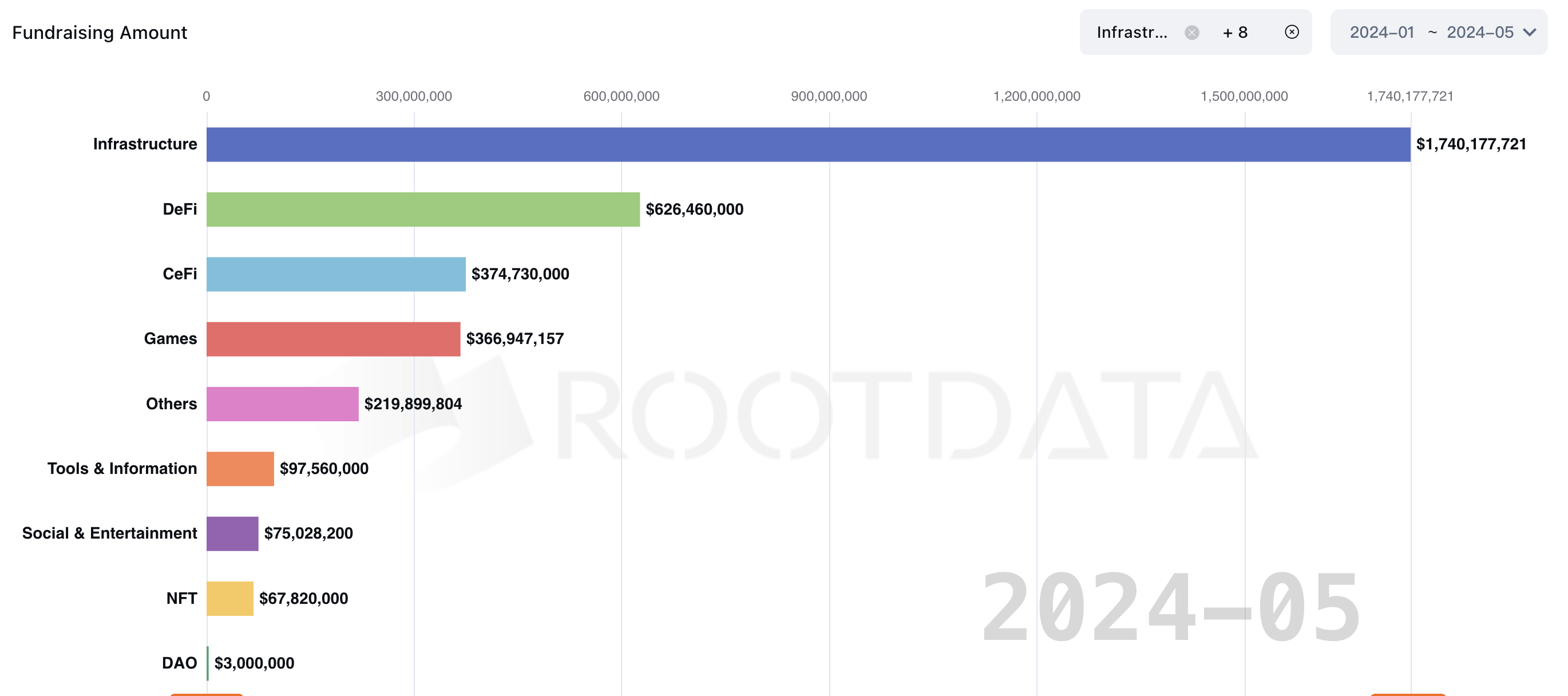

Delving into sector-specific allocations, blockchain infrastructure firms emerge as frontrunners, securing a substantial $1.74 billion in venture capital funding. However, decentralized autonomous organizations (DAOs) present a contrasting narrative, receiving a modest $3 million in funding thus far in 2024.

Key players continue to make significant strides in reshaping the industry’s funding environment. Noteworthy investments include BlackRock’s leadership in a $47 million round for Securitize, emphasizing the growing importance of tokenization in real-world asset management.

Read more: Crypto Hedge Funds: What Are They and How Do They Work?

Pantera Capital’s ambitious plans, aimed at garnering over $1 billion, reflect ongoing optimism in the crypto sector. Not to mention, Pantera Capital has already invested an undisclosed amount in The Open Network (TON) blockchain.

Moreover, Paradigm is also negotiating to raise between $750 million and $850 million for a new fund.

Venture capital powerhouse Andreessen Horowitz’s monumental $7.2 billion fundraising further highlights the sector’s broader appeal. While the latest fund is not crypto-specific, it targets sectors such as Artificial Intelligence, Apps, Games, Infrastructure, and Growth.