Venture capital (VC) giant Andreessen Horowitz (a16z) announced a massive $7.2 billion fundraising on April 16, 2024.

The funds will strategically target several key sectors, including American Dynamism ($600 million), Apps ($1 billion), Games ($600 million), Infrastructure ($1.25 billion), and Growth ($3.75 billion).

a16z Puts Focus on Gaming as Crypto Sector Springs Back to Life

Co-founder Ben Horowitz called the raise “an important milestone” in a blog post titled “New Funds, New Era.”

Reflecting on the firm’s journey and future ambitions, Horowitz highlighted how dramatically the venture capital sector has expanded since a16z’s founding in 2009.

He emphasized the need for specialized expertise in sectors like gaming and infrastructure to support founders.

Read more: What Is GameFi?

“A great investor with the right help, the right networking, and the right expertise at the right time can be the difference between success and failure,” Horowitz asserted.

Echoing Horowitz’s enthusiasm, a16z General Partner Anjney Midha took to X (formerly Twitter), stating that the firm has $1.25 billion in fresh capital to invest in the future of AI infrastructure.

Similarly, General Partner Martin Casado conveyed his passion for infrastructure as “the foundation of value in tech.” Moreover, he also confirmed a16z’s deepening commitment to the sector.

In addition to the broader focus, General Partner Andrew Chen unveiled a16z Games Fund Two. The new fund builds on its 2022 predecessor and will target investments across various stages of game development. This includes backing early-stage startups through the SPEEDRUN accelerator program, where each select company receives $750,000 in funding.

Chen highlighted the transformative potential of emerging technologies like generative AI within the gaming industry. The a16z Games Team is also expanding, drawing talent from industry leaders like Blizzard, Twitch, and Riot.

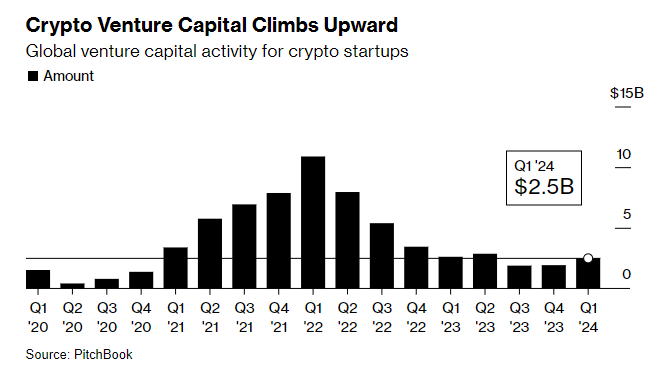

The firm’s latest fundraising coincides with a renewed surge of investor interest in the crypto industry. According to PitchBook data, VC investment in crypto startups reached $2.5 billion during the first quarter of 2024. The number represents a 32% increase from the last quarter and roughly even with the same period the previous year.

Robert Le, crypto analyst at PitchBook, attributes this renewed enthusiasm partly to the approval of Bitcoin exchange-traded funds (ETFs) in January. Furthermore, Le also mentioned growing interest in the intersection of crypto and artificial intelligence as one of the drivers.

Read more: How To Fund Innovation: A Guide to Web3 Grants

After hesitancy in tapping into funds raised during the previous crypto bull market, VCs appear to be changing course in 2024. This suggests that renewed interest and broader crypto market recovery may be catalysts for VCs to increase their investments in the industry.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.