The Australian Securities and Investment Commission (ASIC) has permanently banned Brian Jacques Creigh, the director of crypto venture capital fund – Panacea Capital Pty Ltd. The Australian regulator now prohibits him from participating in the financial services industry.

This ruling follows the discovery that Creigh operated the Panacea Capital Cryptocurrency Investment Fund without a valid license, engaging in misleading conduct.

How Panacea Capital Director Misled Investors

ASIC found that Creigh falsely claimed Panacea Capital was authorized under an Australian Financial Services license (AFSL). Moreover, he issued fact sheets to investors that presented incorrect information.

These documents suggested a capital guarantee, overstated the fund’s operational history, and exaggerated potential returns. They also misrepresented the company’s expertise.

Consequently, Creigh funneled invested funds into a fraudulent scheme overseas, leading to significant financial losses. Specifically, investors faced a collective loss of about $7.7 million. ASIC criticized Creigh for his failure to detect clear warning signs of fraud, emphasizing his dishonesty and incompetence.

“There was reason to believe that Mr Creigh was likely to contravene a financial services law due to his fundamental lack of competence as well as his lack of fitness and propriety,” ASIC wrote.

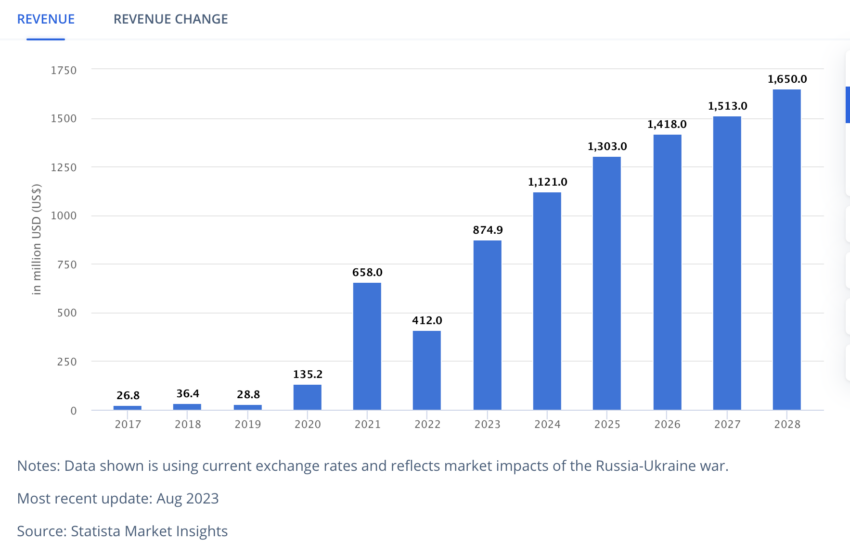

Furthermore, ASIC has been tightening its oversight of the crypto market. This is necessary amidst the forecast of crypto revenue growth in Australia. According to Statista, the crypto revenue in Australia would skyrocket to $1.65 billion by 2028.

Read more: Crypto Hedge Funds: What Are They and How Do They Work?

In September 2023, the commission took action against Bobbob Ltd. and its director, Byron Goldberg. After an eight-month campaign marketing crypto-based investment products, the regulator imposed a fine of AUD 53,280 (~ $35,177) on Bobbob Ltd. for misleading representations.

These suggested that their products were endorsed by ASIC and offered bank-like security, which was far from reality.

Moreover, ASIC has also targeted global entities such as Binance. The Australian government banned major banks from transacting with this crypto exchange and conducted investigations into its operations.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.