Hong Kong-based cryptocurrency exchange Gate.HK has declared the cessation of its operations.

This announcement aligns with its decision to withdraw its application for a local trading license, signaling a major strategic realignment ahead of new licensing requirements, which will commence on June 1, 2024.

Gate.HK Takes a Step Back to Reevaluate Its Approach

Effective immediately, Gate.HK has ceased accepting new user registrations and asset deposits. Furthermore, the exchange plans to delist all major tokens, including Bitcoin (BTC), Ethereum (ETH), and Tether (USDT), by May 28, 2024.

Thereafter, Gate.HK will cease all trading activities. However, the platform will allow asset withdrawals until August 28, 2024.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

This decision mirrors Gate.HK’s strategic shift in response to the Securities and Futures Commission’s (SFC) upcoming regulatory changes. In an interview with BeInCrypto, Gate.HK CEO Kevin Lee emphasized that the company is strategically realigning its business direction.

“Currently, we are actively exploring the possibility of applying for other regulatory licenses. This includes, but is not limited to, reconsidering the application for a virtual asset trading platform license in Hong Kong, or other types of regulatory licenses in our jurisdiction,” Lee told BeInCrypto.

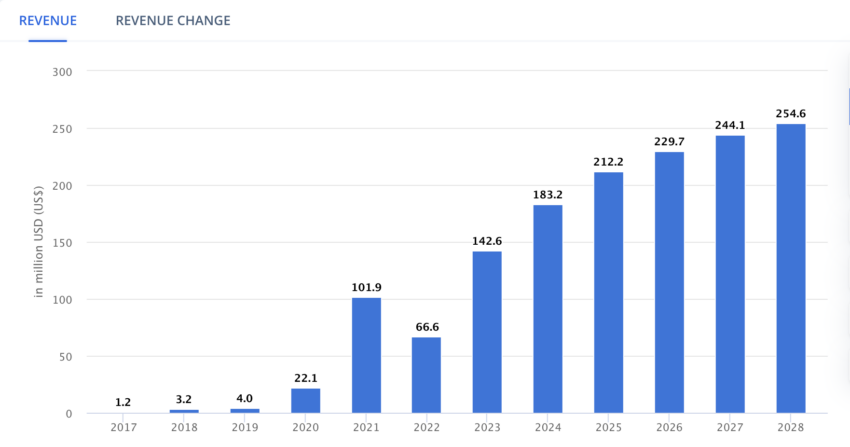

Despite the current regulatory uncertainties and increased scrutiny of crypto exchanges by Hong Kong authorities, the crypto market is poised for growth. It generated $142.6 million in revenue in August 2023 and is projected to expand to $254.6 million by 2028.

The Hong Kong crypto market is navigating through a significant transitional period. Several other exchanges, including Huobi HK and Amber, have also withdrawn their licensing applications recently. Also, the SFC flagged Bybit as a “suspicious” entity due to unlicensed products, highlighting the regulatory challenges facing the sector.

Read more: 10 Best Crypto Exchange Reviews for May 2024

The SFC is also taking proactive steps in favor of the crypto industry. For instance, it has approved spot Bitcoin and Ethereum ETFs. Moreover, it also plans to allow staking for Ethereum-based ETFs, which could offer up to a 4% annual yield.

These initiatives are part of a broader strategy to enhance investor protection and establish a robust regulatory framework for virtual asset trading platforms.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.