Hong Kong’s Securities and Futures Commission (SFC) has categorized crypto exchange Bybit as a “suspicious” entity. On Thursday, the regulator updated its list of questionable virtual asset trading platforms, singling out Bybit and 11 of its offerings.

Notably, these include futures contracts, options, leveraged tokens, and a range of services like dual asset 2.0 and shark fin.

Why Hong Kong Scrutinized Bybit

The SFC’s alert emphasizes that these products lack the requisite licensing in Hong Kong. Consequently, this raises serious concerns about their legality and the protection of local investors.

The crypto exchange – Bybit, associated with Seychelles-based Bybit Fintech Limited, operates internationally through its primary website. Meanwhile, Spark Fintech Limited, a separate entity in Hong Kong, is not linked to the listed suspicious products. Interestingly, Spark Fintech has applied for a crypto exchange license, a step Bybit Fintech has yet to take.

“The SFC is concerned that these products have also been offered to Hong Kong investors and wishes to make it clear that no entity in the Bybit group is licensed by or registered with the SFC to conduct any “regulated activity” in Hong Kong,” the SFC wrote.

As Hong Kong’s crypto market evolves, the SFC’s February 29 deadline for licensing applications has prompted action from 24 crypto exchanges. Only OSL and HashKey have successfully obtained their licenses, setting a precedent for others.

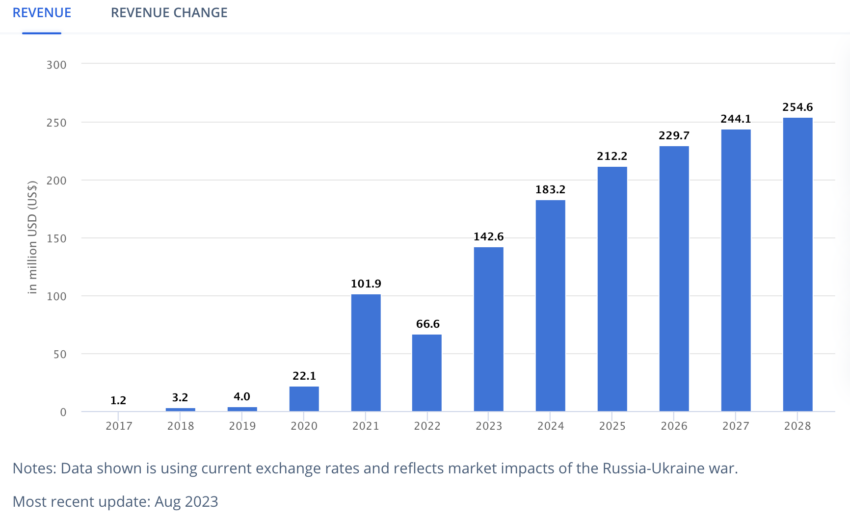

The SFC aims to protect investors by distinguishing between licensed and unlicensed platforms. This distinction is crucial, especially given the city’s crypto market, expected to grow significantly in the coming years. The market’s revenue reached $142.6 million in August 2023, with projections suggesting a rise to $254.6 million by 2028.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

The spotlight on Bybit is part of the SFC’s wider scrutiny of the crypto sector.

“Bybit has always sought and will continue to seek to collaborate with regulators around the world, including Hong Kong, and to ensure we continue to provide a positive and safe experience for all our users,” a Bybit spokesperson told BeInCrypto.

Previously, the regulator had also flagged the Floki staking program and the TokenFi staking program for promising unrealistic returns. These programs, which advertise returns from 30% to over 100%, do not have the necessary approval in Hong Kong.

Moreover, the SFC frequently updates its Suspicious Investment Products list, alerting investors to potential risks. This practice is crucial in an arena where high returns often signify high risks. Therefore, the SFC’s efforts to enforce regulatory compliance are vital for maintaining market integrity and investor confidence.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.