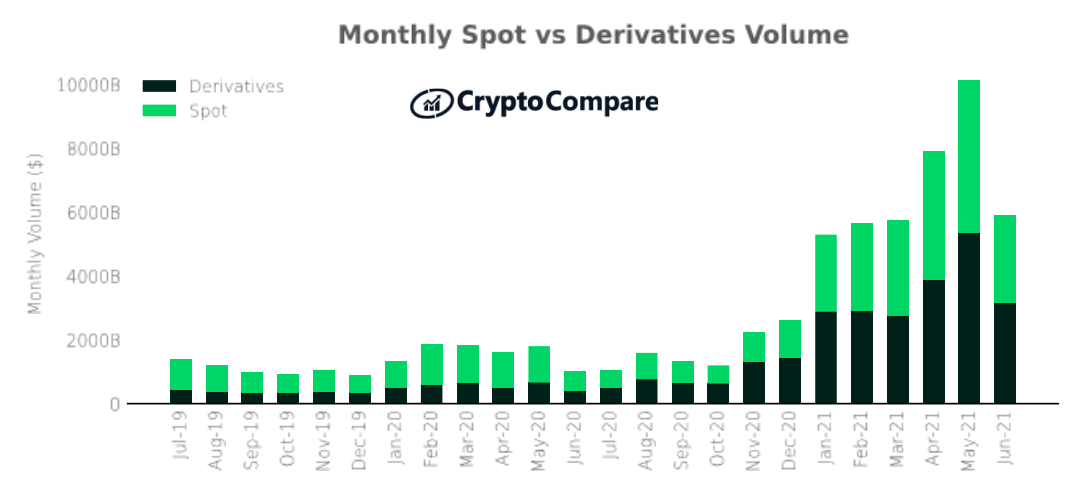

A report from CryptoCompare shows that crypto derivatives volumes have exceeded that of spot volumes for the first time in this year, as the market undergoes a recovery phase.

Data from market data platform CryptoCompare shows that derivatives trading volume for the cryptocurrency market beat that of the spot market in June. Last month, derivatives volumes totaled $3.2 trillion, while total spot volumes were half a billion lower at $2.7 trillion.

Typically, the spot market experiences far more activity during a bull run, but as volatility and price drops set in, traders tend to move towards derivatives products. The shift in market dynamics reflects that, with spot trading easing as the crypto market fell sharply.

Spot volumes decreased by 42.7%, while derivatives volumes decreased by 40.7%. June saw the latter gain 53.8% of the market share, which is about 4% up from the month prior. Binance, OKEx, and Bybit were the top platforms for derivatives trading.

Other interesting facts from the report include that Binance continues to dominate the market, even as it finds regulators breathing down its neck. The exchange still saw spot trading volumes drop by a whopping 56% to $668 billion, with CryptoCompare pointing to China’s mining ban as one possible reason.

What will the crypto market look like for the rest of 2021?

The market is one of its most novel phases yet. It can now reasonably be said that the market has gone mainstream, with financial institutions, businesses, and prominent individuals all getting themselves involved one way or the other.

On the other hand, the extra attention and performance have attracted the attention of governments, who are both concerned and cautiously approving of the asset class. Of course, the exact regulatory stance varies from government to government, but the overall take is that cryptocurrencies can be allowed with certain restrictions.

To that end, authorities are executing an almost global level of oversight of crypto exchanges, with South Korea, Canada, and the U.K. among those leading this charge. South Korea, in particular, is asking exchanges to take regulation very seriously and has ordered them to follow new guidelines if they wish to be deemed fully regulated.

Consequently, the market is poised to undergo one of its most unique phases yet, with the public showing increasing interest while authorities try to impose some limits. Of course, it’s not for sure that there will be a clear-cut bull or bear market — Elon Musk can affect the market with a single tweet after all — but it will be a more involved phase, but the looks of it.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.