The intersection of traditional banking and crypto has led to significant growth and innovation. Still, this convergence has also exposed businesses and consumers to financial fraud and challenges.

Five crypto companies now figure in some of America’s biggest financial fraud cases. Each of these companies has significantly impacted the crypto market, and their downfall serves as cautionary tales for the sector.

Celsius Network: The Icarus of Crypto Lending

Celsius Network, a crypto lending company, was founded in 2017 by serial entrepreneur Alex Mashinsky, the mind behind Voice over IP (VoIP). The firm’s main offering was a platform allowing users to deposit, earn, borrow, and transfer cryptos.

By 2021, Celsius claimed to have over one million users and $20 billion in assets under management. However, the company’s operations started to show cracks due to regulatory scrutiny, legal challenges, and security breaches.

The situation escalated, severely undermining the company’s credibility.

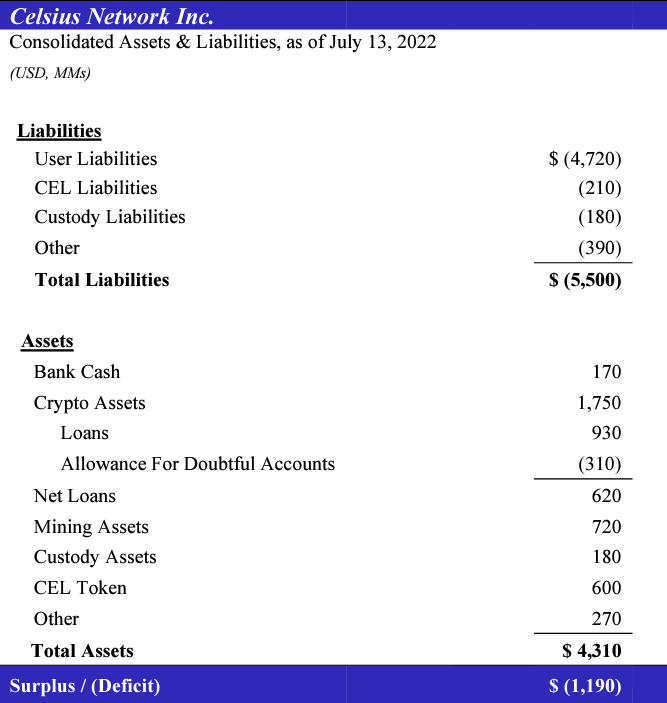

In July 2022, the Celsius Network filed for bankruptcy following its customers’ and creditors’ massive withdrawal of funds. It revealed a $1.2 billion deficit in its bankruptcy filings, becoming one of the biggest financial frauds in America.

In a bid to manage the crisis, Celsius Network selected NovaWulf Digital Management as the winning bidder for its bankruptcy exit in February 2023. The idea was for NovaWulf to take over the operations and honor the claims of Celsius customers and creditors.

FTX: The Fall of a Crypto Titan Plagued by Financial Fraud

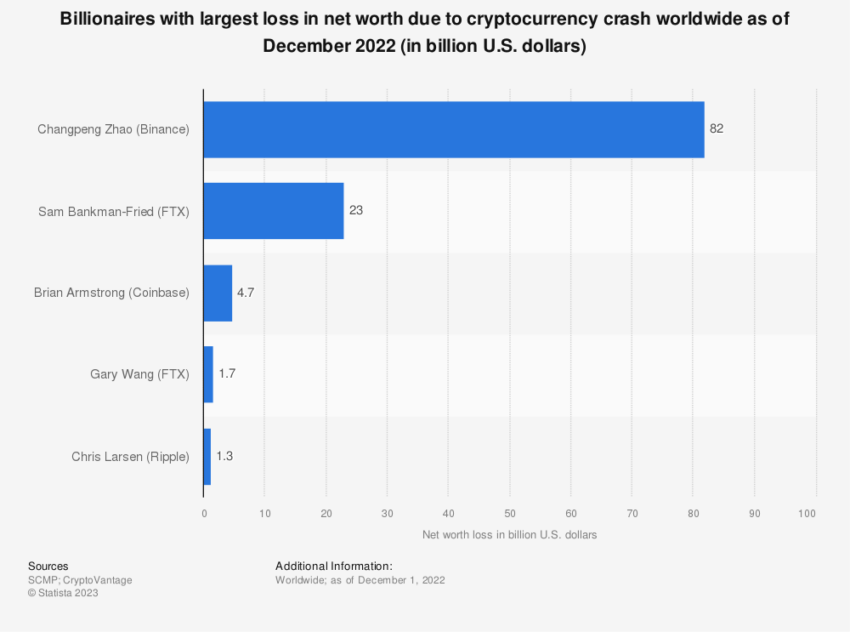

FTX is one of the biggest financial fraud cases in America. It was a centralized crypto exchange founded by Sam Bankman-Fried in 2019.

The firm specialized in derivatives and leveraged products, quickly becoming one of the world’s largest crypto exchanges. It enabled customers to trade digital currencies for traditional forms of fiat currency and tokenized stocks.

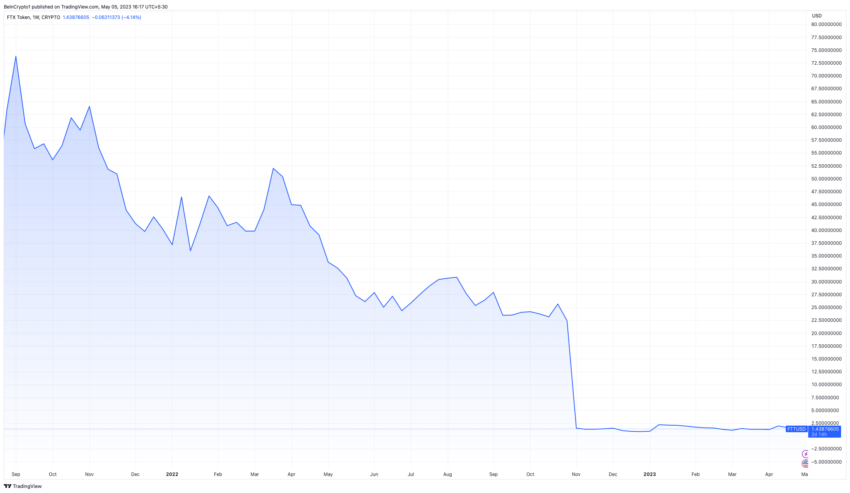

In November 2022, the company’s reputation took a hit when a news report revealed that Alameda Research, the quantitative trading firm behind FTX, had been manipulating the crypto market using fake trades and bots.

The news led to a loss of trust and a sell-off of FTT tokens, causing the value to drop by 90%.

The company filed for bankruptcy protection in the US shortly afterward. FTX was also slapped with legal actions from regulators and investors. Authorities accused it of fraud, market manipulation, and violating securities laws.

BlockFi: High Risks in the Crypto Lending Space

BlockFi, a digital asset lender based in New Jersey, was founded by Zac Prince and Flori Marquez in 2017. The company was once valued at a whopping $3 billion. In July 2022, FTX made a deal with an option to buy BlockFi for up to $240 million.

However, FTX’s declaration of bankruptcy in November 2022 disrupted this promising acquisition plan. BlockFi responded by halting withdrawals on its platform.

On November 28, the company officially filed for Chapter 11 bankruptcy protection, with more than 100,000 creditors, according to filings.

In March 2023, following the collapse of Silicon Valley Bank, the US Trustee watchdog overseeing BlockFi’s bankruptcy revealed that BlockFi had around $227 million in uninsured funds.

Silvergate Bank: The Downfall of a Crypto Banking Pioneer

Silvergate Bank, a California-based bank founded in 1988, has been a specialist provider of services for crypto users and businesses since 2016. The bank offered a platform called the Silvergate Exchange Network (SEN). It enabled fast and secure transactions between crypto exchanges and institutional investors.

However, in March 2023, a series of shocks hit the crypto market, leading to the bank’s collapse. The fall of FTX, one of Silvergate Bank’s major customers and partners, triggered a massive run on the bank’s deposits. The bank also faced losses from the fall in crypto prices and a regulatory crackdown on crypto activities.

Unable to secure a bailout or find a buyer, the bank announced its closure and the liquidation of its assets.

The collapse of Silvergate Bank led to a wave of panic and uncertainty in the crypto sector. Many customers and businesses found themselves without access to their funds and services. The bank’s failure also raised serious questions about the viability and sustainability of crypto banking and innovation.

Signature Bank: The Collapse of a Crypto-Embracing Bank

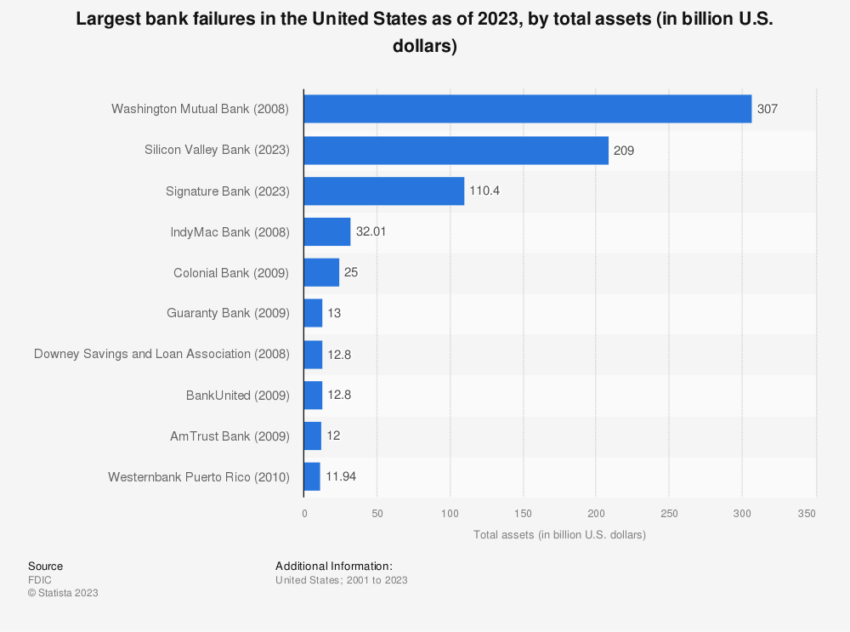

Signature Bank was a full-service commercial bank headquartered in New York City with 40 private client offices across New York, Connecticut, California, Nevada, and North Carolina. By the end of 2022, the bank reported total assets of $110.4 billion and deposits worth $82.6 billion.

The bank initially focused on the New York City area but began to expand geographically and service-wise in the late 2010s. It was most noted for its 2018 decision to open its doors to the crypto markets. By 2021, crypto businesses accounted for 30% of its deposits.

However, on March 12, 2023, banking officials in New York closed the bank, just two days after the failure of Silicon Valley Bank (SVB).

The closure of the crypto-friendly Silvergate Bank earlier in the week, coupled with the fall of SVB, led to nervous customers withdrawing more than $10 billion in deposits. It marked the third-largest bank failure in US history.

A week later, on March 19, the Federal Deposit Insurance Corporation (FDIC) sold the resulting bridge bank, most of its deposits, and 40 branches to New York Community Bancorp to be absorbed by its Flagstar Bank subsidiary. However, around $4 billion in digital asset banking deposits and $60 billion in loans were excluded from the transaction.

The closure of Signature Bank emphasized the risks and uncertainty surrounding traditional banks’ foray into the crypto industry.

Financial Frauds Tarnish Crypto’s Reputation

The cases of Celsius Network, FTX, BlockFi, Silvergate Bank, and Signature Bank are a stark reminder of the volatile and risky nature of the crypto industry.

These companies experienced rapid growth and dramatic collapses, leading to significant financial losses and regulatory scrutiny.

While the allure of high returns continues to draw investors and businesses to the crypto market, these examples underscore the need for more robust regulation and financial controls to protect stakeholders.

As the crypto industry continues to evolve, it is crucial to learn from these crypto fraud failures to prevent similar incidents in the future.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.