Bitcoin’s path to becoming an official legal tender in regions has witnessed multiple setbacks. Bodies like the International Monetary Fund (IMF) clarified their narrative in the latest report. ‘No’ to BTC as legal tender, ‘Yes’ to regulating the space.

Bitcoin as a legal tender has seen multiple scenarios facing both directions. One was favoring the cause, and the other route censuring it.

The laws and regulations of individual countries ultimately determine the ability of Bitcoin to be recognized as legal tender. Some countries, such as El Salvador, passed legislation recognizing Bitcoin as a legal tender. But has since met obstacles on its way from regulators.

Bitcoin Adoption Across Regions

Legal tender refers to the currency law of a country recognizing an asset to discharge a debt. While Bitcoin is not currently accepted as legal tender, it can be used as a medium of exchange for goods and services in some countries.

For example, Bitcoin is considered property for tax purposes and not legal tender in the United States. However, it can be used to purchase goods and services. It’s worth noting that legal tender laws are typically enacted by governments to provide a standard currency for transactions and to regulate the money supply.

Bitcoin operates outside traditional government and banking systems as a decentralized digital currency. By doing so, Bitcoin challenges the idea of legal tender. As the use and acceptance of Bitcoin and other cryptocurrencies continue to grow, countries are recognizing them as legal tender. El Salvador was an early adopter and one of the first to accept Bitcoin as legal tender. Similarly, the Central African Republic became the first African nation to make Bitcoin legal tender.

However, adopting Bitcoin as legal tender raised several questions from different regulatory authorities, including the International Monetary Fund (IMF) last year.

Growing Debate Over Bitcoin’s Use

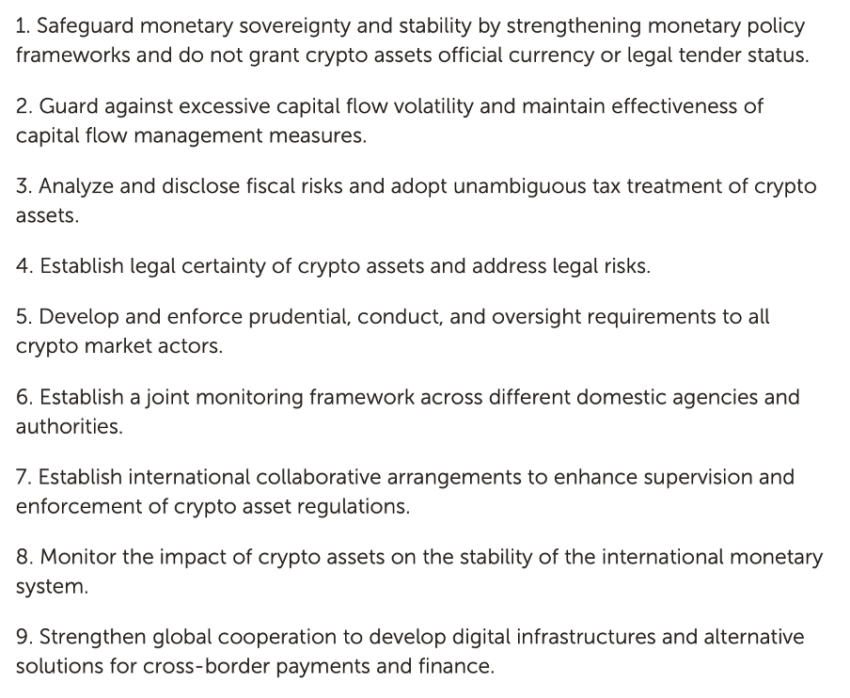

Reiterating the same stance, IMF, on Feb. 23, published a paper that highlighted different reasons for not accepting cryptos like BTC as a legal tender. The “Elements of Effective Policies for Crypto Assets” report developed a framework of nine policy principles that addressed macro-financial, legal and regulatory, and international coordination issues.

Later added:

“By adopting the framework, policy makers can better mitigate the risks posed by crypto assets while also harnessing the potential benefits of the technological innovation associated with it.”

Obvious Reasons to Not Choose Bitcoin

Generally speaking, Bitcoin does have a few pitfalls in the race to become a legal tender. Firstly, the volatility of Bitcoin’s price can make it challenging to use as a reliable medium of exchange. Its value can fluctuate wildly over a short period, creating significant uncertainty for users and merchants.

Secondly, the lack of a central authority that controls Bitcoin’s issuance and circulation can make it vulnerable to abuse, such as money laundering, terrorist financing, and other illegal activities. This could undermine the financial system’s integrity and pose risks to global financial stability.

Conversely, according to analytics firm Messari, fiat currency is used for money laundering 800 times more than cryptocurrency.

Thirdly, the limited adoption of Bitcoin as legal tender means that it may not be widely accepted in transactions, leading to challenges in its use as a medium of exchange. Nevertheless, the crypto community does see eye-to-eye with IMF’s crypto narratives. For instance, one user tweeted:

Another fellow narrated a viewpoint that shed light on countries adopting BTC regardless of censures.

Meanwhile, Twitter user and Bitcoiner Carl B Menger expressed happiness that countries are independent of the IMF and can “do their best for their citizens.”

Speaking to BeInCrypto, Dmitry Ivanov, CMO at the crypto payments ecosystem CoinsPaid, took a relatively neutral approach to describe the situation.

Pros and Cons to Consider

In a conversation over email, Ivanov said the IMF recently recommended regulators impose a significant restriction on digital currencies to safeguard monetary sovereignty. The monetary fund also advised countries to prevent granting crypto legal tender status in what appears to be a growing trend today.

“This position is against the tenets of financial freedom and negates the entire concept of decentralization that digital currencies like Bitcoin aim to institutionalize.”

The goal of the IMF is clear: to centralize crypto and control it like the US Dollar. Doing this will help create a framework for taxation, eliminating legal risks, supervision, and monitoring crypto market participants. ‘While this may raise the entry threshold, it is advantageous when viewed holistically, as it cleans the market from scammers and increases investor protection.’

“While the volatility of Bitcoin remains its biggest disadvantage, we can agree that the cryptocurrency has come of age to go mainstream,” he concluded.

Are Cryptocurrencies off the Table?

The simple answer is no, and IMF representatives are on the same page. But the sector needs work or regulatory measures to remove bad actors. IMF Managing Director Kristalina Georgieva, in an interview with Bloomberg, preferred to regulate crypto.

However, after commenting, Georgieva made another statement indicating that though the IMF may be interested in digital assets, they can be strict with the rules. Georgieva noted, “If the regulation is slow to come and crypto assets become a higher risk for consumers and potential for financial stability, the option of banning it (cryptocurrencies) should not be taken off the table.”

Overall, regulatory bodies are indeed taking steps to regulate the decentralized space. The Financial Stability Board (FSB), the International Monetary Fund (IMF), and the Bank for International Settlements (BIS) will deliver papers and recommendations establishing standards for a global crypto regulatory framework.

Only time will tell whether these (regulatory) measures will help the crypto sector.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.