A recent survey by CoinGecko has revealed that two in five crypto participants are optimistic about the potential of crypto artificial intelligence (AI) products and token prices in 2025.

However, while optimism is evident, a significant portion of the community remains uncertain. This indicates a mixed sentiment surrounding this emerging sector.

Are Crypto Participants Bullish on the Future of Crypto AI?

CoinGecko’s survey ran from February 20 to March 10, 2025, and gathered responses from 2,632 crypto enthusiasts worldwide. The respondents comprised a diverse mix, including long-term investors (51%), short-term traders (26%), builders (10%), and spectators on the sidelines (13%).

A closer look at experience levels revealed that 53% of participants were in their first crypto cycle (0-3 years), while 34% had 4-7 years of experience. The remaining 13% had over eight years in the space. Geographically, 93% of respondents hailed from Europe, Asia, North America, and Africa, providing a broad global perspective.

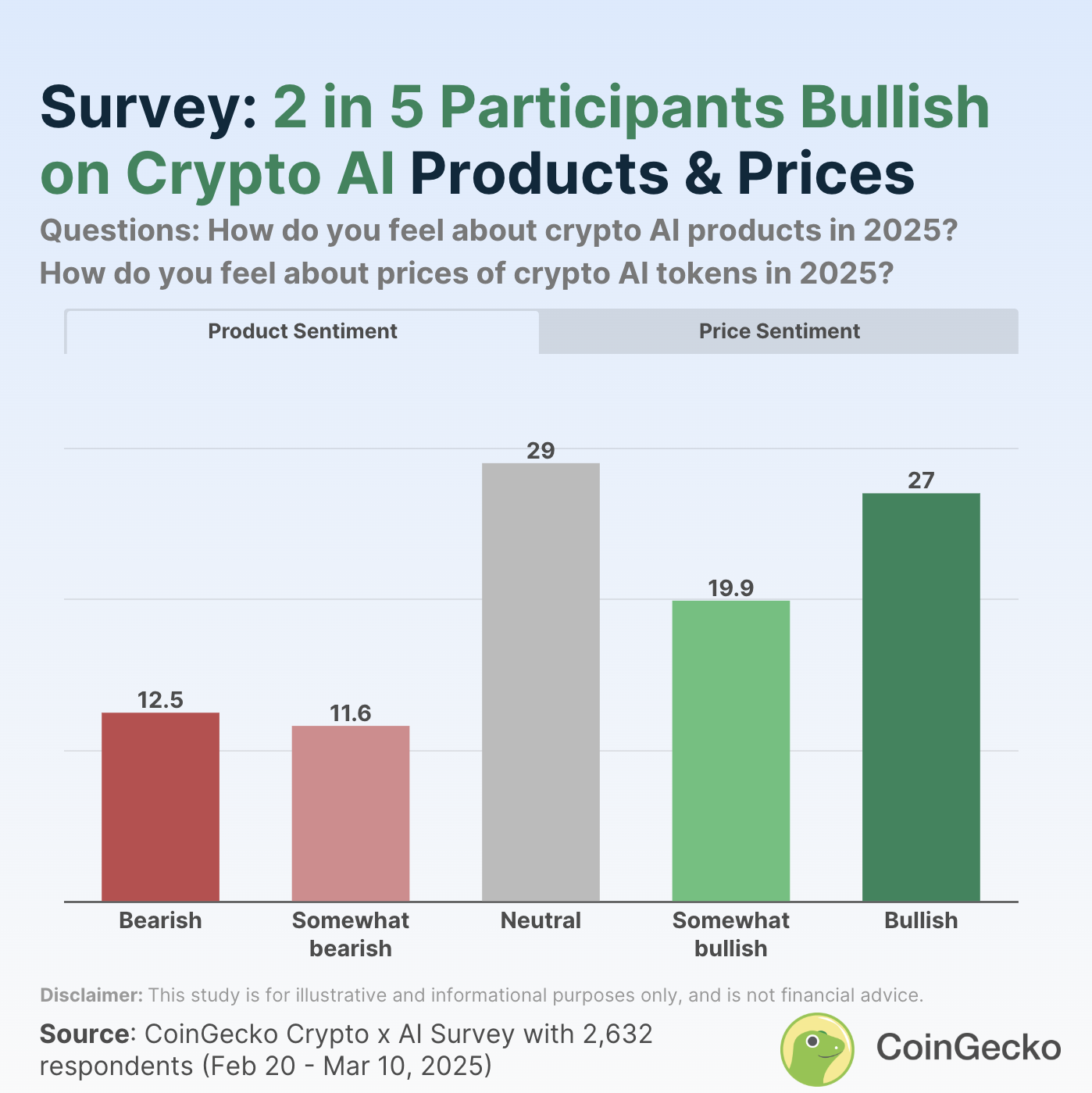

Importantly, the results indicated that 46.9% of respondents held a bullish outlook on crypto AI products, including their use cases and technology. This reflected confidence in the sector’s growth potential.

“Specifically, 19.9% felt somewhat bullish about crypto AI products, and a larger 27.0% of survey respondents were fully bullish,” CoinGecko reported.

Coingecko’s Research Analyst, Yuqian Lim, pointed out that the growing enthusiasm in the crypto sector might be linked to the enhanced and increasingly widespread applications of crypto when integrated with AI technology.

Conversely, 24.1% of respondents expressed bearish sentiments, signaling skepticism regarding the immediate prospects of crypto AI.

“Almost one out of every four survey respondents continue to feel skeptical about the potential of crypto AI technology and its use cases, at least in the immediate term,” the report added.

This divided sentiment also extended to perceptions of crypto AI prices, with 44.3% expressing optimism. Meanwhile, 26.4% leaned pessimistic.

“This perhaps shows that crypto participants are not differentiating between crypto AI’s investing or trading potential and the technology itself,” Lim noted.

She further emphasized that these market sentiments might reflect an expectation for crypto AI to move beyond conceptual stages and mature as a functional sector. Despite the divide between bullish and bearish perspectives, a significant portion of respondents maintained a neutral stance. 29.0% and 29.3% of the participants selected a neutral position on products and token prices, respectively.

In fact, survey results showed that the neutral response category received the highest selection compared to other sentiment options. This implied either indecision or a wait-and-see approach as the technology matures.

Additionally, sentiment varied significantly across different adoption groups. Despite being pioneers in the crypto AI narrative, only 46.8% of innovators were bullish on crypto AI products, with a similar 44.8% bullish on token prices. Notably, a significant portion, 28.9% for products and 30.0% for prices, were bearish.

In contrast, early adopters and the early majority showed greater optimism. The late majority displayed notably less bullishness. The laggards exhibited the strongest bearish sentiments, with 41.3% viewing crypto AI products negatively and 43.1% holding bearish views on token prices.

“The ‘Laggard’ group also had the smallest share of neutral sentiments, which suggests that this group has the strongest opinions despite being the latest to the crypto AI narrative,” the survey revealed.

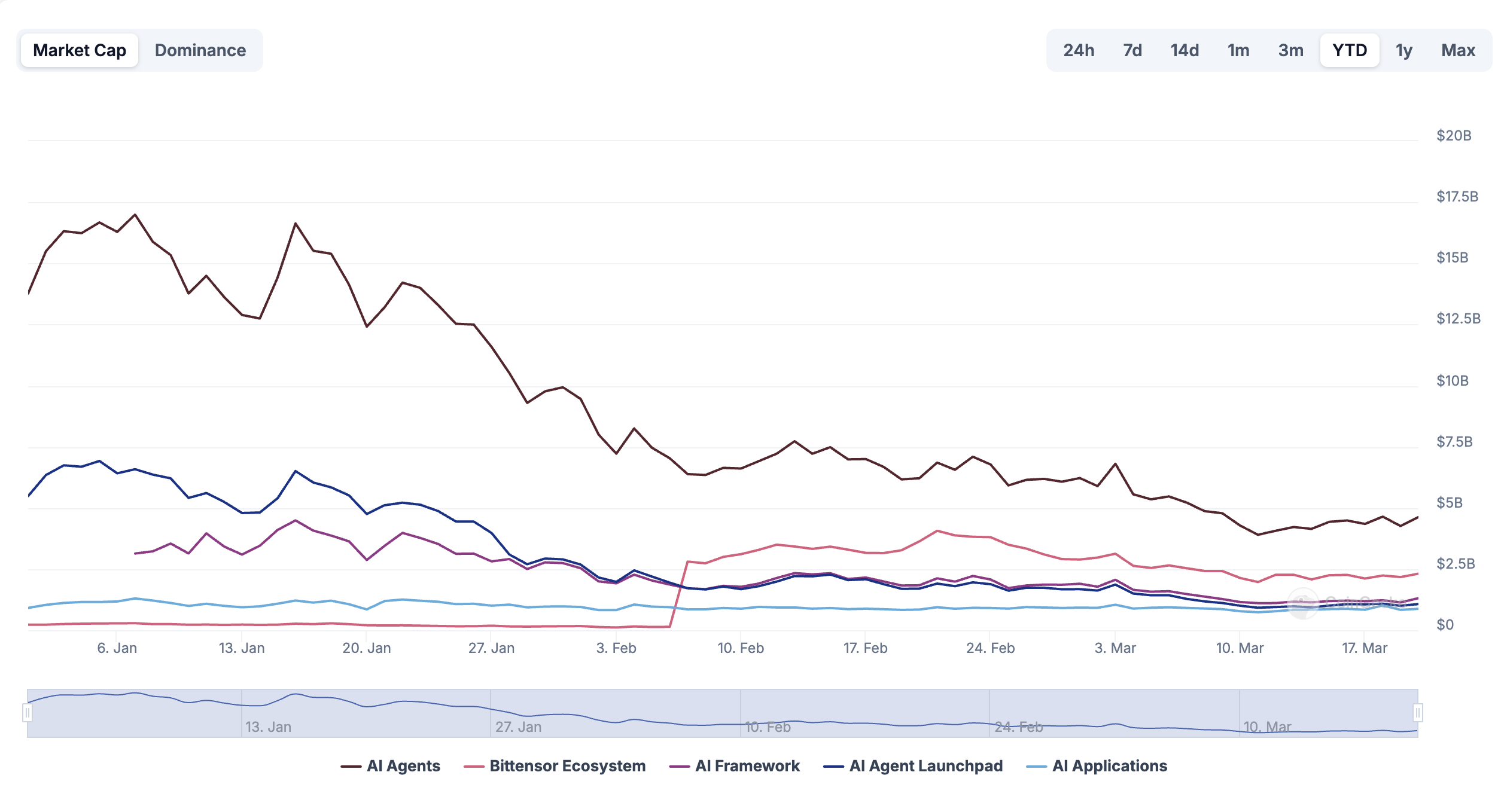

The survey comes at a challenging time for the sector. It has seen a significant downturn after peaking earlier this year.

Major catalysts that previously triggered rallies have recently failed to spark the same momentum. This is exemplified by the AI coins market cap taking a dip following Nvidia’s GTC Conference.

Despite the downturn, the sector has shown a slight recovery, with a 4.3% increase recorded over the past day. However, this recovery was not isolated. The broader market also saw an uptick following the Fed’s decision to keep US interest rates unchanged.