A recent court decision has greenlit the FTX’s liquidation of $3.6 billion in cryptocurrencies, leading to a decline in the market.

Post this order, Galaxy Digital, under the leadership of Mike Novogratz, is set to oversee the sale after the FTX’s dramatic downfall and subsequent bankruptcy in November 2022. The discussions around the FTX liquidation are predominantly influenced by traders apprehensive about an oversaturated market.

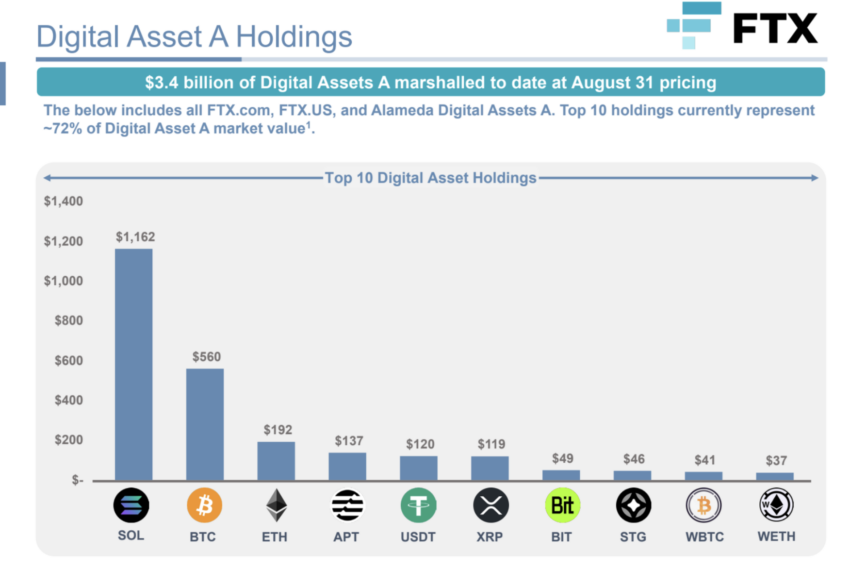

Full List of Cryptos FTX Will Liquidate

FTX is set to liquidate a diverse array of crypto assets. Indeed, here is the full list of cryptocurrencies FTX plans to liquidate:

- $1.16 billion in Solana (SOL)

- $560 million in Bitcoin (BTC)

- $192 million in Ethereum (ETH)

- $137 million in Aptos (APT)

- $120 million in Tether (USDT)

- $119 million in Ripple (XRP)

- $49 million in Biconomy Exchange Token (BIT)

- $46 million in Stargate Finance (STG)

- $41 million in Wrapped Bitcoin (WBTC)

- $37 million in Wrapped Ethereum (WETH)

This liquidation process will be initiated with blocks of $50 million weekly, gradually escalating to $100 million. Still, there are stricter guidelines for selling “insider-affiliated” tokens, which mandate a 10-day prior notice to both creditors and the US Trustee.

Furthermore, FTX plans to delve into cryptocurrency hedging contracts, initially focusing on Bitcoin and Ethereum.

Impact on Solana and Other Altcoins

The revelation of FTX estate’s considerable Solana holdings could have led to the 4% decrease in SOL’s price to $18.50 in the past week. Furthermore, the exchange’s holdings comprise nearly 16% of the total Solana circulating supply.

FTX’s liquidation approach involves releasing just $9.2 million of Solana tokens each month. Consequently, the goal is to minimize the asset’s immediate market impact.

Read more: This Is How Much Solana (SOL) You Need to Buy to Become a Millionaire

While FTX and Alameda Research’s combined Bitcoin holdings of $353 million account for roughly 1% of Bitcoin’s weekly trading volume — a sum easily absorbed by the market — it is the holdings in less liquid tokens like Dogecoin (DOGE), TRON, and Polygon (MATIC) that pose concerns.

These assets, ranging between $20 to $30 million, represent a substantial 6 to 12% of the weekly trading volumes for these cryptocurrencies.

Crypto Market Reaction to FTX News

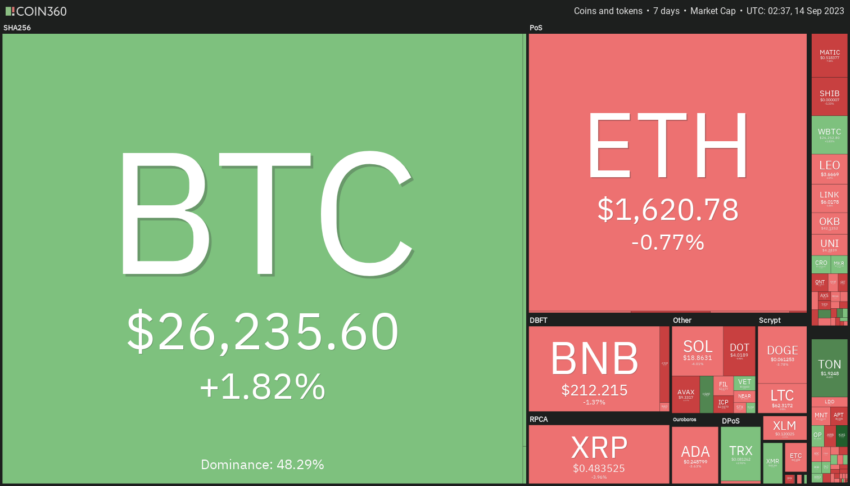

Bitcoin experienced a slight dip upon the news release, losing 0.9% of its value. Likewise, Ethereum dropped by 1%, while Solana suffered more significantly with a 2.2% decline.

Nevertheless, prior news earlier in the week had already factored in much of this impact.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

Currently, the company holds assets exceeding $3.4 billion in digital form. It also boasts a venture investment portfolio valued at approximately $4.5 billion, complemented by $200 million in Bahamian luxury real estate and $529 million in securities.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.