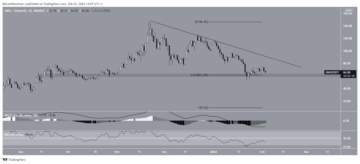

Avalanche (AVAX) has been trading in a range since bouncing on Jan 22. It is currently trading right in the middle of this range.

Back in January, AVAX dropped from its all-time high price of $147 (November 2021), nevertheless continuing to garner strong support.

So far, the downward movement has led to a low of $52.95 on Jan 22. The token bounced afterwards. While it is not exactly clear where the horizontal area is due to the presence of numerous wicks, it seems to be at $77.5 (red icon). Conversely, the closest support area is at $55.

Therefore, it is possible to state that AVAX is trading in a range between $55 and $77.5.

What is Avalanche (AVAX)?

Launched in September 2020 on Mainnet, Avalanche (AVAX) is an open-source programmable smart contract platform that believes in utilizing three interconnected blockchains, rather than one. It is one of the first decentralized smart contracts platforms built for scaling global finance, with near-instant transaction finality – developed by Ava Labs and CEO Professor Emin Gün Sirer, who teaches computer science research at Cornell University.

With a $16.9 billon market cap as of 2021, Avalanche experienced a price gain of over 3,000%, according to The Motley Fool. It began the 2022 year in 64th position in terms of market cap and finished in 10th place. More than 150 projects currently run on Avalanche, hopefully lending favor to AVAX continuing an upward trend.

Ongoing bounce

The daily chart shows that AVAX has bounced at the 0.618 Fib retracement support level at $61.70. However, the bounce has been weak so far.

Furthermore, technical indicators do not yet confirm the bullish reversal. While the MACD is moving upwards, it is not yet positive. Similarly, the RSI is increasing but has not yet moved above 50.

In addition to this, AVAX has been following a descending resistance line since the aforementioned all-time high price.

Therefore, while an upward movement towards this resistance seems likely, technical indicators do not yet confirm the possibility that the token will break out.

Short-term AVAX movement

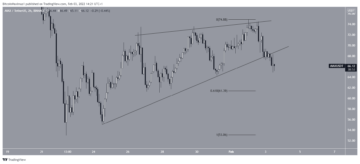

Cryptocurrency trader @PostyXBT tweeted a chart of AVAX, which shows that the token is trading inside a short-term ascending wedge. The wedge is considered a bearish pattern, thus a breakdown from it would be the most likely scenario.

Since the tweet, the token has broken down from the wedge.

The first area which could provide support is at $61.40. This is the 0.618 Fib retracement support level when measuring the upward movement since Jan 22.

It is possible that AVAX will create a higher low at this level before making an attempt at moving towards the long-term descending resistance line.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

What do you think about this subject? Write to us and tell us!

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.