The big news from the world of decentralized finance this week has been the launch and distribution of Compound’s COMP token. Within a day it became the largest DeFi token by market capitalization, surpassing the previous leader, MakerDAO.

On its first day of trading, Compound Finance’s COMP token became the most valuable DeFi asset, making it a market cap ‘unicorn’ as it reached a billion dollars.

First DeFi Unicorn

Industry observer, Camila Russo, noted the remarkable achievement in her DeFi newsletter, The Defiant. The former Bloomberg correspondent added that the market frenzy surrounding the COMP token distribution has ‘spread magic to the rest of DeFi.’

Compound initiated the token distribution on Monday with 4.3 million of the total 10 million tokens going out to users of the platform. Sebastian Aldasoro, who contributed to The Defiant, added that this week’s frenzy signals that traders view COMP as a way to gain exposure to one of DeFi’s most successful protocols,

Speculation driving demand: Token holders may eventually decide for COMP to receive a share of Compound’s earnings, and/or Coinbase may list COMP, causing it to shoot up further.

Token prices doubled during the first day of trading, topping $100 briefly before a pullback. This pushed its market capitalization beyond $1 billion, making COMP the largest DeFi token by a fully-diluted market cap. Defi Market Cap is currently reporting that Compound has actually surpassed market leader MakerDAO in terms of market capitalization.

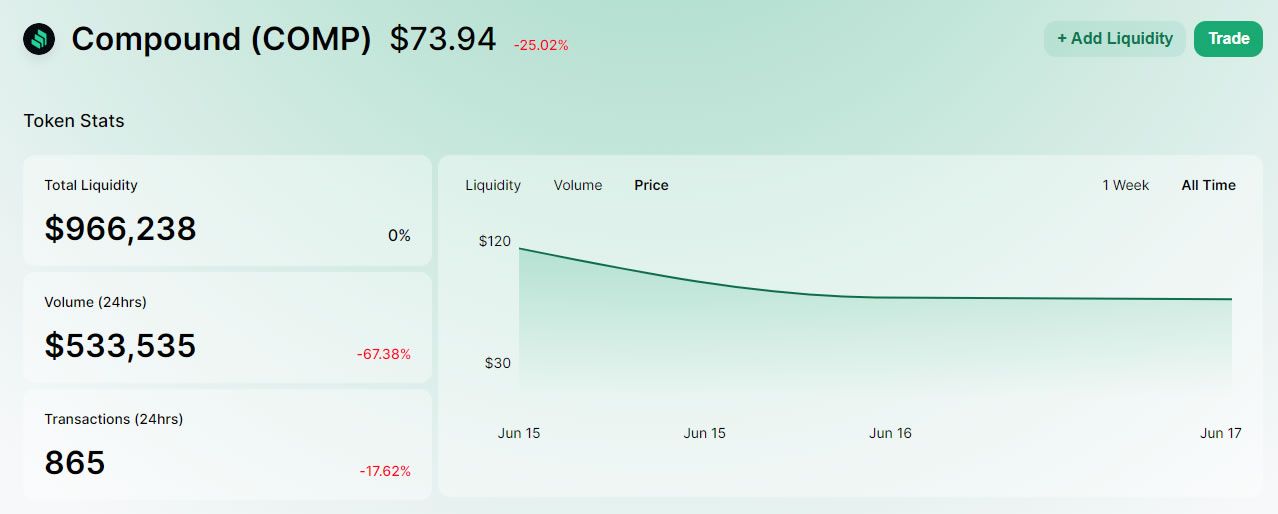

According to Uniswap, prices had retreated to below $80 by Tuesday and had leveled out just below $75 at the time of writing.

Total liquidity was still just shy of $1 billion and 24-hour volume for June 16 was $1.2 billion. Aldasoro added that Compound’s token listing was ‘rocket fuel’ for other DeFi platforms, with the COMP/ETH pair pushing Uniswap V2 to surpass Uniswap V1 on liquidity for the first time.

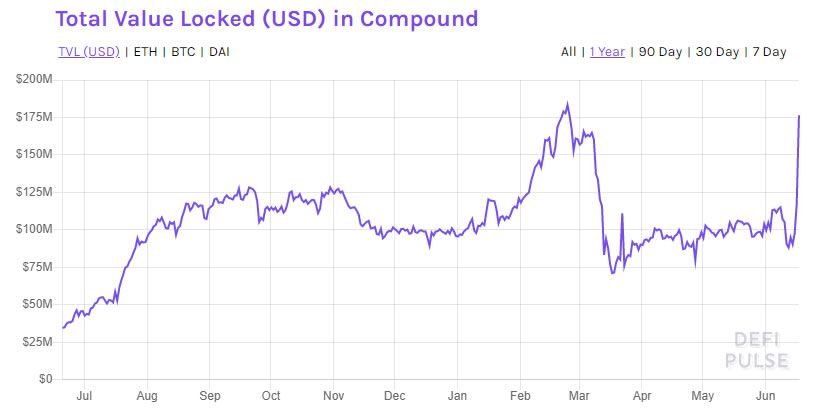

According to Defi Pulse, Compound is the second-largest DeFi protocol with $176 million in total value locked. This value has almost doubled this week as the token distribution got underway. The all-time high for Compound in terms of total value locked was in late February when it reached $183 million, and it’s nearly back at this peak.

In terms of Ethereum, which provides the foundation for the lion’s share of DeFi functions, there is almost 400,000 ETH locked into Compound smart contracts.

A number of arbitrage opportunities opened up between various platforms, as highlighted by MIT Bitcoin Club founder Dan Elitzer. In one example, users took DAI collateral to borrow USDT and allocated that to its corresponding market on Compound which received the highest amount of COMP tokens.

Compound Governance Drive

Compound is an autonomous Ethereum-based platform that lets users earn dynamically-adjusted interest through lending, or borrow assets against crypto collateral. Since its inception in late 2018, Compound has been striving for full decentralization, and it has finally been achieved.

As part of its drive for democratic governance, the platform has been testing the tokens for the past couple of months in preparation for the distribution on Monday. COMP tokens will be used as a voting mechanism on governance issues and proposal submissions. Holders with at least 1% of the total token supply can submit protocol upgrades, and all holders will be able to vote on these changes.

In an announcement on the launch, General Counsel at Compound Jake Chervinsky stated,

Yesterday’s launch was the final step in the decentralization process that we announced in February. Our core work on the Compound protocol is done.

COMP tokens have been placed into a ‘Reservoir contract,’ which transfers 0.5 COMP per Ethereum block into the protocol for distribution. Around 3,000 tokens are distributed per day, which are allocated to each market on the platform, proportional to the interest accrued for that market. Adjustments are made dynamically according to demand.

Liquidity suppliers earn half of the supply, the other half by borrowers, in real-time. A COMP distribution tracker shows how many tokens have been allocated, and to which markets. Tether is by far the largest market according to the tracker.

Of the remaining 57.8% of tokens, 24% goes to shareholders of Compound Labs, with Andreessen Horowitz (a16z) owning 3.45% of them, and Polychain Capital owning 3.26%. Compound founders and the team gets 22.25% of the COMP tokens, which are subject to 4-year vesting, and the remainder will be reserved for new team members and future governance participation incentives.

EthHub co-founder, Anthony Sassano, labeled the token distribution mechanism as ‘liquidity mining’ in his newsletter, The Daily Gwei. He added that instead of a traditional token sale, or ICO, Compound has awarded them to those who supply liquidity to or borrow assets from the platform.

The total supply of COMP tokens will eventually be 10 million, but the current circulating supply is around 2.4 million he continued. Assuming that this supply will not get instantly dumped, this would give COMP a market cap of around $235 million based on what is currently out there. This is much lower than the current market cap which makes valuation so high, Sassano concluded.

Comparing it to traditional crypto assets, the Ethereum advisor observed;

The emission schedule reminds me of a Proof of Work chain but the key difference here is that COMP farmers don’t have huge on-going costs like electricity and mining hardware upkeep/maintenance – but they do have capital opportunity cost

Compound certainly has introduced a novel way of distributing its tokens that could well pay off for investors if DeFi does become the financial landscape of the future.

DeFi Markets Back Over $1B

The COMP token distribution has no doubt contributed to the total value locked across the entire DeFi ecosystem, which has just topped $1 billion again.

Defi Pulse has reported the milestone and new four-month high of $1.05 billion in TVL across all markets. Since its mid-March crash, DeFi has recovered over 100% to current levels and is just $200k off its all-time high. The total amount of Ethereum locked into the DeFi markets remains at 2.6 million ETH.

The momentum from this week’s Compound token distribution, and recent solid fundamentals for the DeFi ecosystem, has boosted it higher than regular crypto markets which remain relatively flat in comparison.