During the week of March 9-16, the entire world economy took a beating. The majority of stock indices, commodities and cryptocurrencies all posted significant decreases. While gold and silver have been considered safe havens during times of uncertainty, they were not spared from the bearish market.

We have published several articles analyzing the recent Bitcoin price decrease. However, the decrease in the prices of gold and silver has not gotten a lot of attention. Full-time trader @CryptoMichNL tweeted a gold chart, stating that both gold and silver are decreasing rapidly. In light of the most aforementioned BTC price decrease, we will compare each of them individually to see which one has fared the best/worst.

Meanwhile; Silver and Gold absolutely getting hammered. pic.twitter.com/24Mso3yEop

— Michaël van de Poppe (@CryptoMichNL) March 16, 2020

Gold

The gold price began to decrease on March 9, when it reached a high of $1,703. Measuring from that date, the gold price has decreased by 13.6% in only a week. However, when looking at a slightly longer time-frame, more specifically since the beginning of 2019, the gold price is still in an upward trend, having increased by 15.1%. The price has returned to its December 2019 levels, effectively wiping out close to four months of gains.

Silver

The silver price has been decreasing since Feb. 24 when it reached a high of $18.94. The decrease was gradual until March 12, when the rate of decrease greatly accelerated. Since its Feb. 24 high, the silver price has decreased by 32.3%. Interestingly, the current price is also 17.1% lower than that in the beginning of 2019. The current price is $12.84. The previous time the price was below $13 was in July 2009. Therefore, it is safe to assume that silver has not fared well during this bearish week.

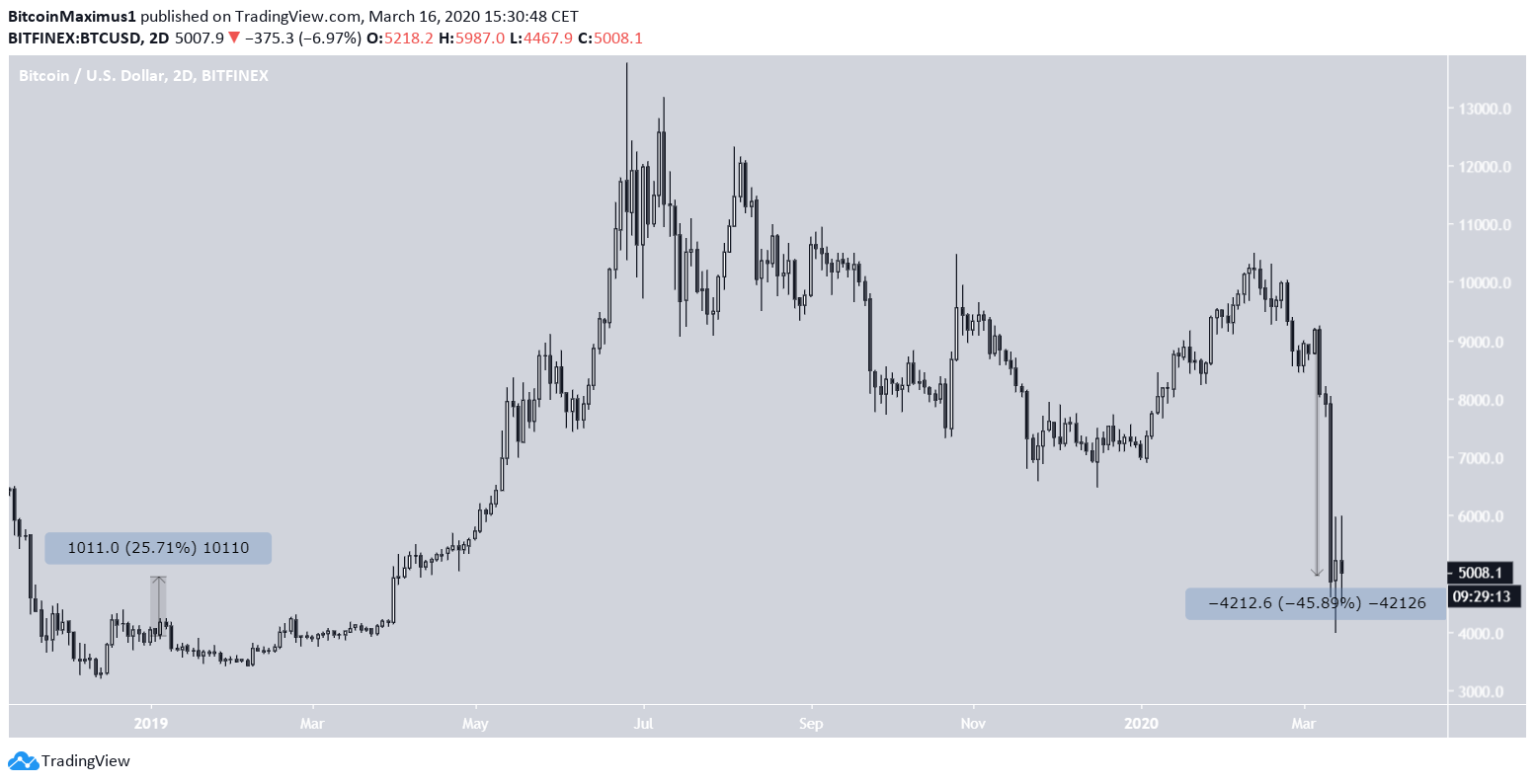

Bitcoin

The Bitcoin price has been decreasing since March 7, when it reached a high of $9,241. While the current decrease of 44% has been massive, being the biggest out of the three assets we are analyzing, the price is still above its January 2019 levels, being 25% higher than them. Interestingly, this rate is also the biggest of the three. This disparity makes sense since BTC has been known to be more volatile than both gold and silver, thus moves of a bigger amplitude are expected in either direction. The current price is the lowest since that on March 21, 2019.

Comparison

| % change since January 2019 | The current price level has not been seen since | |

| Gold | +15.1% | December 17, 2019 |

| Silver | – 17.1% | July 21, 2009 |

| Bitcoin | +25.1% | March 21, 2019 |

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored