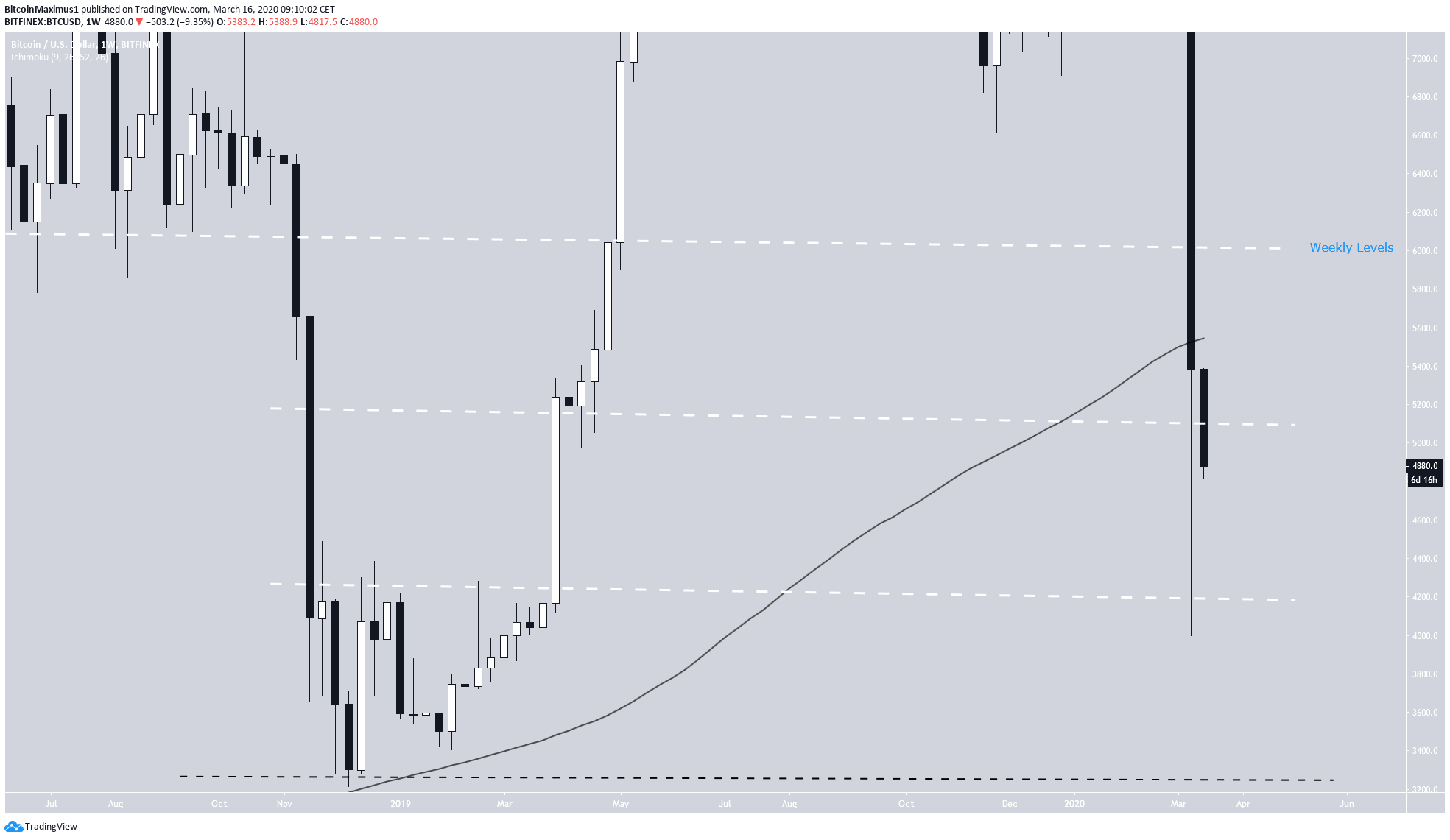

Over the week of March 8-15, the Bitcoin price fluctuated wildly, reaching a high of $8,245 and a low of $4,000. The closing prices were 32% lower than the opening. The price reached a weekly close right at its 200-week moving average.

Bitcoin (BTC) Price Highlights

- The Bitcoin price has reached a close below its 200-week moving average (MA).

- It is possibly trading in a range between $4,200-$6,000.

- The retracement has been weak.

- There is long-term support at $3,300.

Bitcoin’s 200-Week MA

The BTC price decreased rapidly over the past week, breaking down below significant support areas without experiencing any type of bounce. The weekly close was only slightly below the 200-week MA, even if the price has decreased below it since. It seems likely that the price is now trading in a range between $4.200-$6.000, with the $5.100 area acting as the midpoint (EQ) of the range. The price is currently below this level, so it is expected that it will move towards the bottom of the range unless it reclaims the EQ. If the current support fails, the next support area is found near $3,300, coinciding with the December 2018 bottom.

Fibonacci Levels

Looking at the Fib retracement levels on the decrease beginning on March 9, we can see that the recent bounce did not have considerable strength since it was twice rejected at the 0.382 Fib level of the decrease and failed to move above it. This sign also aligns with the price decrease below the middle of the range and suggests that BTC will revisit the $4,000 lows once more. The generation of bullish divergence in the RSI and the possible creation of bullish patterns such as the double-bottom will determine whether the price will make another attempt towards $6,000 or break down and head towards the next support area at $3,300. To conclude, the BTC price has decreased rapidly over the past week, breaking down below significant support levels. The price is expected to move towards the range low at $4,200 before possibly making another attempt at breaking out above $6,000.

For those interested in BeInCrypto’s previous Bitcoin analysis, click here.

To conclude, the BTC price has decreased rapidly over the past week, breaking down below significant support levels. The price is expected to move towards the range low at $4,200 before possibly making another attempt at breaking out above $6,000.

For those interested in BeInCrypto’s previous Bitcoin analysis, click here.

Top crypto platforms in the US

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored

![Bitcoin Analysis for 2020-03-16 [Premium Analysis]](https://beincrypto.com/wp-content/uploads/2020/01/BIC_btc_long_term.jpg.optimal.jpg)