CoinPulse is the third cryptocurrency exchange forced to halt operations due to financial issues in the space of one month.

Liquidity issues forced the small Panama-based cryptocurrency exchange to close for indefinite maintenance, starting from Feb 1. The exchange suspended all trading operations and stopped accepting deposits.

Customers have until Feb 7 to close their accounts and withdraw funds. CoinPulse provides clear instructions on how to claim the money and what to do in case of error messages or issues.

🚨Urgent Notice for CoinPulse Users! 🚨

Exchange headed for indefinite maintenance. We will have to suspend all trading and deposits from Feb 1, 2019. We will keep withdrawals open until Feb 7, 2019. Please read the article below for details. 👇👇https://t.co/ORNfpoJZTP

— CoinPulse Exchange (@CoinPulseEx) January 31, 2019

What Happened to CoinPulse?

As it turned out, the exchange had already been in trouble for some time. The owners tried to raise investment capital to keep the business afloat — but failed.

Now, the company is actively looking for investors ready to acquire CoinPulse with all its belongings — including the website, trademark, platform, and 50 million CoinPulse Tokens (CPEX). As such, the exchange may return from hibernation mode if there is a willing buyer — but, in this market, the chances are slim.

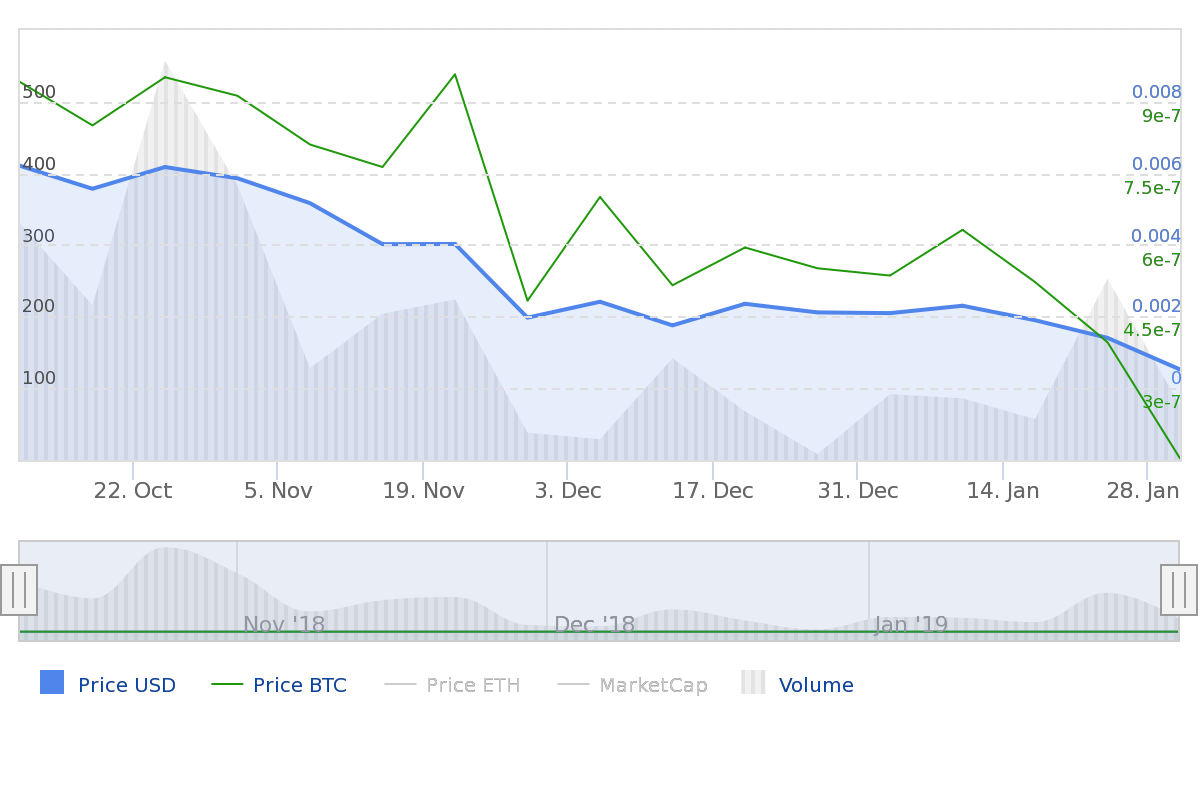

Meanwhile, January was a cruel month for CoinPulseToken (CPEX) token. It lost nearly one-third of its value in a single day on Jan 30 and over 70 percent in the recent 30 days. The token is tradable only at CoinPulse exchange.

Never Heard of CoinPulse?

CoinPulse is a Panama-based trading platform for digital assets founded in March 2017. It offers trading services for CPEX, Bitcoin (BTC), Ethereum (ETH), and Tether (USDT) via its dual offering of an Instant Exchange for quick-trade orders and an Advanced Exchange for sophisticated users.

CPEX is based on ERC-20 standard. Users could use CPEX to pay transaction fees with a 70 percent discount.

The exchange claims that up to 90 percent of user funds are kept in cold storage while multi-signature wallets and two-factor authentication ensure a high level of security.

None of those features saved the company.

January Blues

A protracted bear trend in the cryptocurrency market has hit players in all industry segments — from miners to exchanges. Many platforms for trading digital assets are struggling to survive in The Crypto Winter.

CoinPulse is the third cryptocurrency exchange to shut down in the last seven days. Canadian cryptocurrency exchange QuadrigaCX went to maintenance without a word of notice on Jan 29 and applied for creditor protection to avoid bankruptcy two days later. Additionally, Ukrainian cryptocurrency trading platform Liqui stopped operations due to lack of liquidity.

What do you think of CoinPulse’s indefinite maintenance? Let us know your thoughts in the comments below!