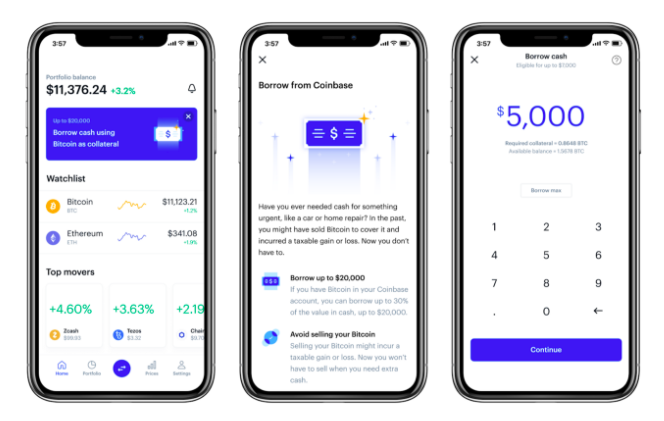

In a Tweet posted yesterday, Cryptocurrency giant Coinbase announced that its U.S. customers (in select states) will soon be able to borrow a percentage of their bitcoin holdings in cash.

On the Coinbase blog, product manager Thorsten Jaeckel elaborated,

with today’s announcement, we want to give our customers even more control over their crypto investments while offering secure access to cash at the same time.He continued,

US customers in eligible states* are now invited to join the waitlist for the option to borrow up to 30% of their Bitcoin holdings.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Colin Adams

Colin is a writer, researcher, and content marketer with a keen interest in the future of money. His writing has been featured in numerous cryptocurrency publications, and his holdings don't amount to more than a handful of BAT.

Colin is a writer, researcher, and content marketer with a keen interest in the future of money. His writing has been featured in numerous cryptocurrency publications, and his holdings don't amount to more than a handful of BAT.

READ FULL BIO

Sponsored

Sponsored