Several Coinbase users have reported that the exchange offers up to a 6% interest rate on any USD Coin (USDC) held on the platform.

Over the past several months, Coinbase has been progressively elevating the interest rates on USDC, starting from 2% and incrementally moving to the newly established 6%.

Coinbase Raises USDC APY to 6%

MV Capital CIO and partner Tom Dunleavy shared a Coinbase email screenshot showing that the elevated 6% rate applies solely to the initial $250,000 USDC. Subsequent holdings would revert to the 5% interest rate.

Several users have noted disparities in the interest rates displayed on their dashboards. While some users observed rates as low as 0.58%, others still maintained up to 5% APY. Dunleavy suggested that the difference might be linked to the amounts held in Coinbase and highlighted the difference between other staking pools.

“As many people have mentioned you can get much higher yields on-chain. All a personal choice if it’s worth the trade-offs. I personally am very happy with these yields vs getting 10-20% LPing a pool with a number of risks not present here,” Dunleavy commented.

Read more: Top 4 Crypto Passive Income Ideas That Really Work in 2023

The US Securities and Exchange Commission (SEC) recently filed charges against Coinbase, alleging various violations related to securities offerings. Notably, despite considering the platform’s staking service as an unregistered securities offering, the SEC’s charges did not explicitly address the specific implications of its USDC reward program.

Therefore, the compliance status of Coinbase’s ongoing USDC rewards program concerning federal securities law remains uncertain.

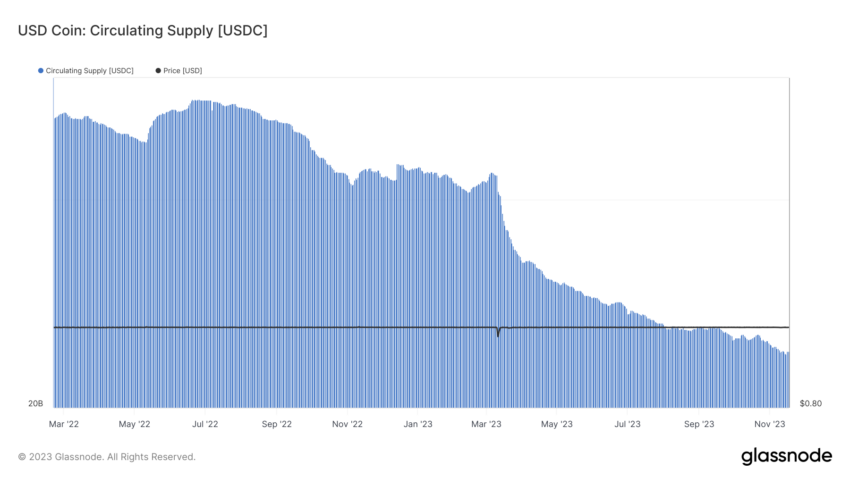

Circulating Supply Is in Free Fall

USDC’s supply has rapidly fallen during the past year to under 25 billion, its lowest level since 2021. Over the past month alone, the supply of USDC has dropped by nearly $1 billion to $24.39 billion as of the latest update.

This trend started earlier in the year when USDC faced challenges due to its exposure to the US banking crisis. Circle, the issuer, revealed that it held some USDC reserves at Silicon Valley Bank, which subsequently failed.

This disclosure led to a temporary depegging of USDC, dropping to as low as $0.87 before recovering. Despite the market conditions improving, USDC’s market share continues on a downward trend.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.