Cryptocurrency exchange Coinbase is set to roll out a crypto spot trading platform, aiming to offer a more streamlined trading experience for global users.

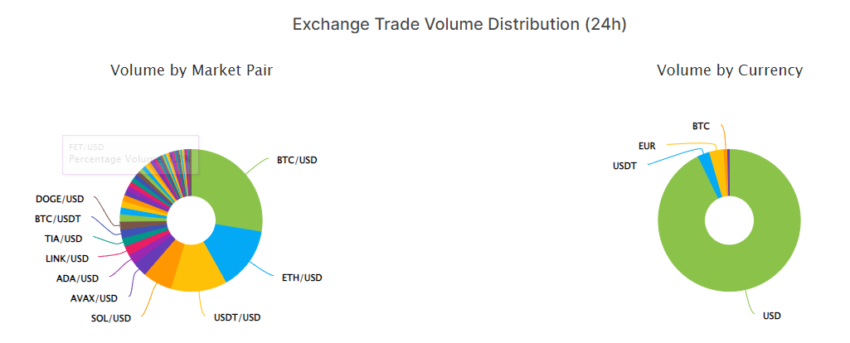

The exchange claims to cater to over 100 institutions and achieved approximately $10 billion in perpetual futures trading volume in Q3.

Coinbase Spot Crypto Trading Will Occur In Phases

According to a statement, recent key developments of the exchange include the introduction of perpetual futures to retail users on Coinbase Advanced.

Additionally, it lists 15 perpetual contracts covering a significant portion of the perpetual futures trading market. Furthermore, an increase in maximum leverage to 10x for all listed contracts.

However, the expansion of spot trading will occur in phases. On December 14, BTC-USDC and ETH-USDC pairs were listed for non-US institutional clients.

The statement explains the initial focus is on building liquidity and establishing a strong foundation. Subsequent phases will involve the inclusion of retail users.

Read more: Coinbase Review 2023: The Best Crypto Exchange for Beginners?

Coinbase Continues Efforts Towards International Expansion

Furthermore, it highlighted features to support new trading strategies and improve capital efficiency.

Coinbase claims to dedicate efforts to international expansion. This aligns with its “Go Broad, Go Deep” strategy. The exchange explains it will be introducing more efficient and accessible products and services in the near future.

It also recognizes concerns about crypto’s uncertain regulatory status in the United States. The exchange seeks to provide a trusted and compliant non-US spot market for asset issuers and crypto community members.

However, Coinbase International Exchange is exclusively available to non-US clients in specific jurisdictions. Additionally, crypto-derivatives are not available to retail clients in the United Kingdom.

Read more: Crypto Portfolio Management: A Beginner’s Guide

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.