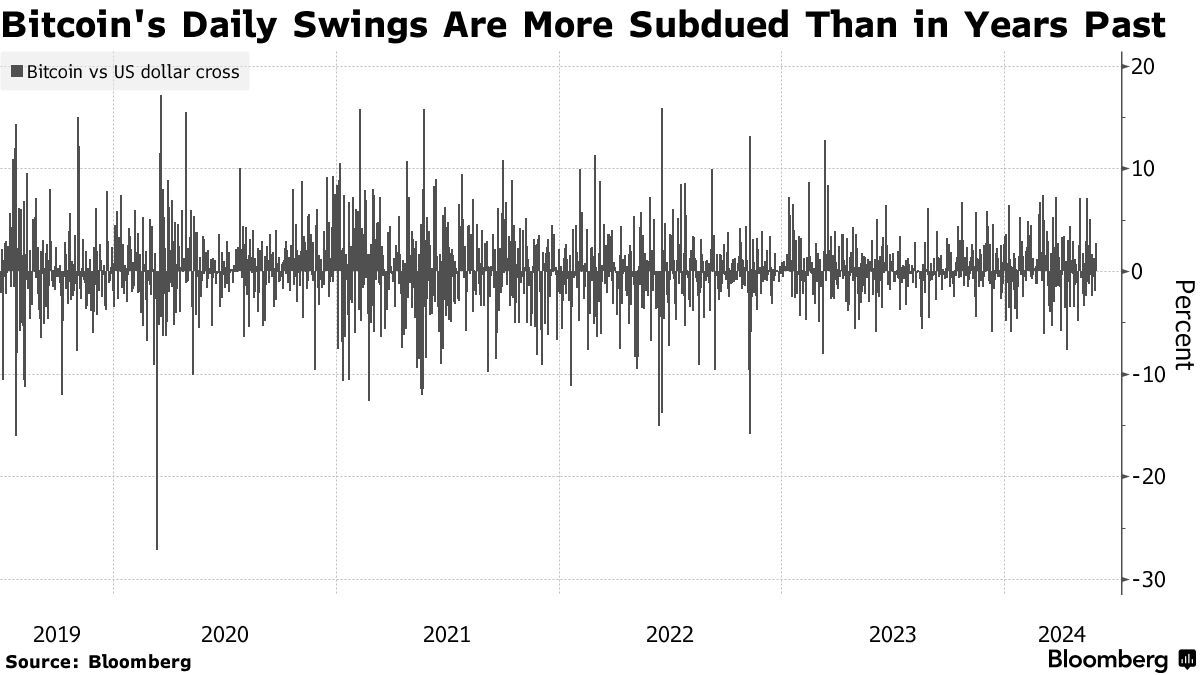

The extreme market volatility that once attracted speculative investors is diminishing in the crypto ecosystem. This change significantly impacts exchanges like Coinbase (COIN), which thrived during periods of high fluctuation.

Despite surpassing financial forecasts for the first quarter of 2024, Coinbase reported a trading volume of $56 billion. This figure starkly contrasts with the $177 billion peak in late 2021.

How Coinbase Navigates Diminishing Trading Volume

According to a Bloomberg report, citing research from CCData, the average volatility for digital currencies has decreased to 57% this year from about 79% in 2021. This reduction indicates a stabilizing market, which, while less appealing to high-risk traders, promises more sustainable growth.

Coinbase’s CFO – Alesia Haas, highlighted this new stability at a JPMorgan conference.

“Volatility looks much more mature in this cycle than it did in 2021. Volatility of Bitcoin, volatility of Ethereum start to come, what I call, on the grid,” Haas said.

Furthermore, spot Bitcoin exchange-traded funds (ETFs) have brought more structured market inflows. As a result, Bitcoin hit a new all-time high of around $73,000 in March 2024.

Consequently, Bobby Zagotta, CEO of Bitstamp USA, suggests that the market retains some volatility. However, he believes the magnitude of price movements will likely be less extreme than in past cycles.

“The market is more mature today and is less likely to have wild swings. It will still be volatile, and there will still be upward momentum on Bitcoin and crypto prices, but I don’t think it’ll be as explosive up and down as prior cycles,” Zagotta said.

Read more: Coinbase Review 2024: The Best Crypto Exchange for Beginners?

Due to this, Coinbase’s financials, while strong, still lag behind the 2021 peak. The company’s future performance is closely tied to the duration of the current bull market and its ability to maintain significant market share, which has slightly decreased since the beginning of 2023.

In addition to these internal challenges, Coinbase has faced technical issues, including several outages this year. These incidents have temporarily barred users from trading during critical times, underscoring the need for improved platform stability to maintain trader confidence.

Financially, Coinbase is diversifying its revenue sources. The company has established itself as a major custodian for US spot Bitcoin ETFs and is poised to hold a similar position for upcoming Ethereum ETFs.

Its involvement in the Base network is expected to become a significant revenue stream. According to Owen Lau, an analyst from Oppenheimer & Co., this diversification should lead to more stable and predictable earnings.

“Coinbase revenue could become even more predictable. It means that they could command a higher earnings multiple,” Lau said.

From a technical analysis standpoint, COIN stock has demonstrated notable activity this year. After reaching a local high of $283 on March 25, 2024, the stock entered a consolidation phase, fluctuating between $236 and $197. On May 24, the COIN stock broke out of this range, converting the $236 level from resistance to support.

Read more: 5 Best Web3 Stocks To Invest in 2024

Currently, the COIN stock is testing this new support level. If it holds, there could be a potential rally of up to 20% as the stock aims to retest the March highs.