Coinbase CEO Brian Armstrong sold company shares the day before the Securities and Exchange Commission (SEC) lawsuit, but Cathie Wood has been buying the dip.

The SEC’s lawsuit against Binance and Coinbase has been the focal point of discussion this week. But the reports of Coinbase CEO Brian Armstrong selling stocks just a day before the lawsuit have sparked controversy throughout the crypto community.

Coinbase CEO Actions Illegal?

A pseudonymous Twitter user, WhaleWire, wrote:

“Coinbase CEO Brian Armstrong dumped 29,730 shares on June 5th, just a day before the SEC lawsuit was made public, and shares tanked 20%.

This should be illegal.”

The tweet got over 469,000 views and initially caused frustration among community members. But later on, some Twitter users, led by journalist Eleanor Terrett, shed light on the fact that those were pre-planned stock sales initiated in August 2022.

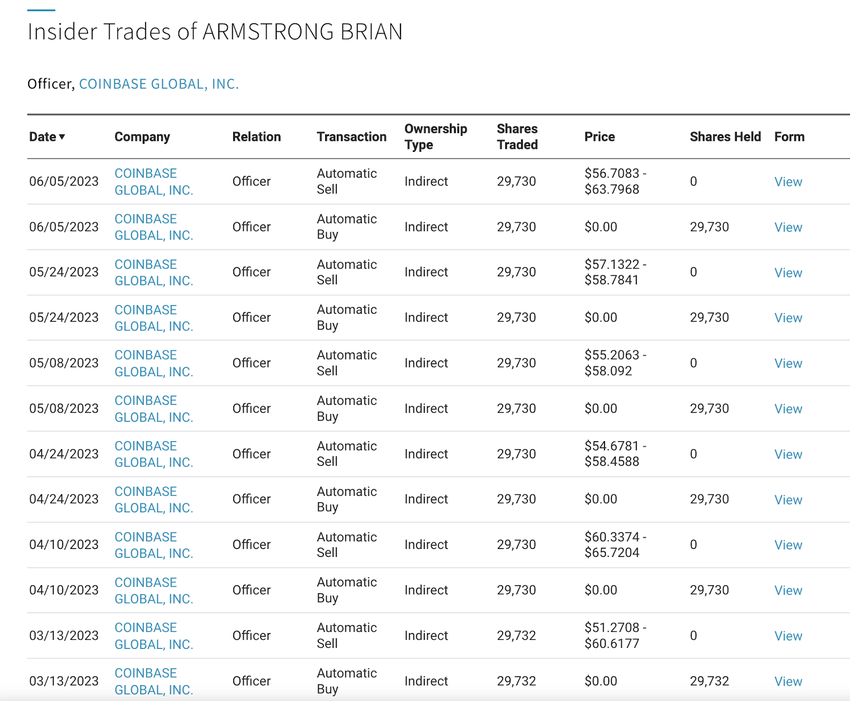

Evidently, the screenshot below from Nasdaq shows that Armstrong has been selling 29,730 COIN stocks every month. Hence, the sale on June 5 was probably a coincidence for the Coinbase CEO.

After the SEC lawsuit, COIN stock tanked by over 20% pre-market.

If you want to get started in crypto trading, here’s our guide to the best crypto exchanges for beginners.

Cathie Wood Buys The Dip

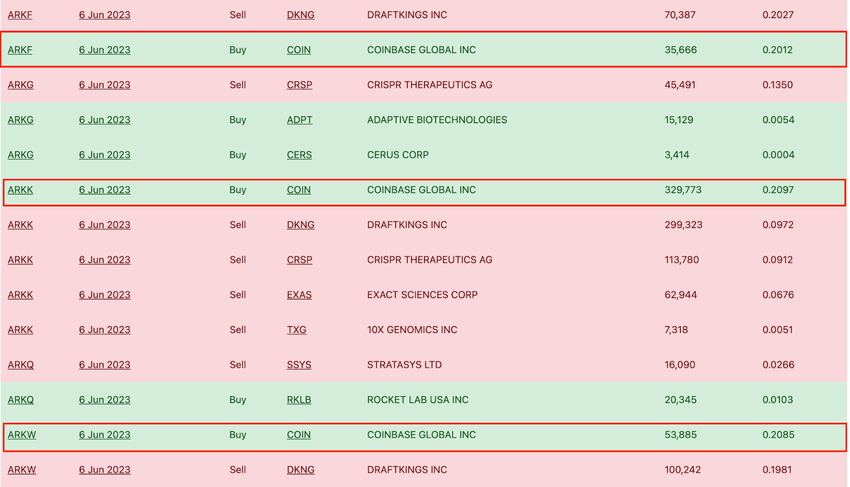

While Brian Armstrong has been selling COIN stock, Cathie Wood continues to buy the dip. On Wednesday, BeInCrypto reported that Cathie Wood’s Ark Invest bought 419,324 shares of Coinbase for more than $20 million.

The screenshot below, from Ark Invest Daily Trades, shows that Wood accumulated COIN stock through three different transactions on Tuesday.

Cathie Wood: Coinbase and Binance Are Not Comparable

Prior to suing Coinbase, the SEC sued Binance on Monday. Hence, Wood feels that the competition for Coinbase has been disappearing, which is good for COIN stocks in the longer term.

She believes Coinbase and Binance are not comparable. She explained that Binance has been under regulatory scrutiny for more criminal activities, including fraud. Wood told a Bloomberg Television interview:

“We now understand that they have been working with regulators and the government to help the government understand how Binance.US was not separate and distinct from Binance International. And how much CZ controlled Binance.US and how much of Binance’s data was in China, and how much commingling of funds there were.

Coinbase is not accused of these. And it is unfortunate that the SEC took action against Coinbase the day after Binance.”

For a detailed comparison between Binance and Binance.US, click here.

In a separate development, SEC chair Gary Gensler compared the crypto market to the 1920s stock market. Speaking at a conference, he said:

With wide-ranging noncompliance, frankly, it’s not surprising that we’ve seen many problems in these markets. We’ve seen this story before. It’s reminiscent of what we had in the 1920s before the federal securities laws were put in place. Hucksters. Fraudsters. Scam artists. Ponzi schemes. The public left in line at the bankruptcy court.

Got something to say about Coinbase or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.