Coinbase’s Wrapped Bitcoin (cbBTC) has soared to a $1 billion market cap in just 57 days since its launch.

This growth trajectory effectively represents almost 10% of the Wrapped Bitcoin (WBTC) market cap, which currently sits at $12.88 billion, according to CoinMarketCap.

Coinbase’s cbBTC At $1 Billion Market Cap

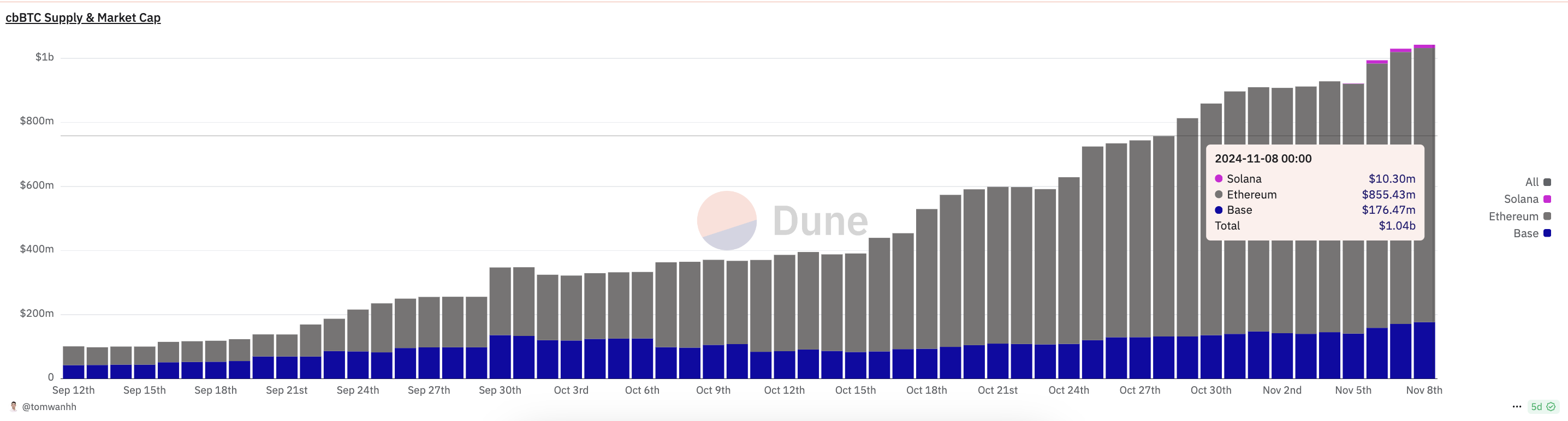

Data on Dune shows the cbBTC Bitcoin wrapper has a market capitalization of $1.04 billion as of this writing. The majority of this value is held on Ethereum at $855.43 million, followed by Base Layer-2 blockchain and finally Solana.

Specifically, out of a total cbBTC supply of 14,678.95, over 12,000 are held on Ethereum. Meanwhile, Base and Solana hold 2,388 and 262 tokens, respectively.

As a Bitcoin wrapper, cbBTC allows BTC to be represented on other blockchain networks. Its rise highlights an important trend: Ethereum-based assets experience faster net supply changes than other leading Bitcoin liquid staking tokens (LSTs). These include eBTC, solvBTC, BBN, and pumpBTC, among others.

“The network effect is unbeatable. They can offer rebate/discount/businesses for MMs/Funds in their diversified line of business to bootstrap liquidity, adoption very easily,” said Tom Wan, an on-chain data researcher.

This swift growth, occurring just over two months after launch, signifies a notable demand for Coinbase’s wrapped Bitcoin product. The pace also reflects an escalating preference for cross-chain compatibility within decentralized finance (DeFi).

It comes as users and protocols look for more accessible and flexible Bitcoin-pegged assets. Coinbase first revealed cbBTC’s planned debut on Base in mid-August.

The product inadvertently presented as a prospective market rival to Wrapped Bitcoin (WBTC). The Bitcoin wrapper has also seen increased support and interest across decentralized finance (DeFi).

The idea of a Bitcoin wrapper is to expand users’ access to BTC. For instance, with cbBTC on Solana, holders can leverage the network’s reduced fees and high transaction speeds.

These metrics are especially relevant for high-frequency DeFi transactions. Aave, a leading DeFi protocol, is already targeting cbBTC for its V3 Protocol.

At inception, cbBTC drew attention from venture capitalists like Dan Elitzer. In August, the VC predicted that cbBTC would be “super strategic” for Coinbase. He also said it could outpace WBTC’s supply within six months.

“Frankly, I’m surprised they didn’t ship this years ago,” Elitzer remarked.

Elitzer also emphasized that cbBTC’s introduction could encourage DeFi users to seek more decentralized Bitcoin-wrapped options, given the “mishandling” of WBTC by Justin Sun-affiliated management.

Controversy Surrounding Coinbase’s PoR for cbBTC

Indeed, Coinbase’s cbBTC’s advent came against the backdrop of the WBTC controversy involving Justin Sun. WBTC, once the go-to solution for wrapped Bitcoin on Ethereum, has faced growing skepticism due to concerns over its management and transparency under Justin Sun’s influence.

The rapid rise of cbBTC has not been without controversy. Coinbase’s approach to transparency and Proof of Reserves (PoR) has invited scrutiny. Critics, in particular, remain a bone of contention.

Duo Nine, a popular user on X, warned that Coinbase’s reliance on users’ trust without providing concrete proof of BTC reserves could lead to a collapse similar to the FTX downfall. This outcome, he articulated, was contingent on Coinbase minting more cbBTC than it could back.

“They will not provide any proof of reserves for the BTC they *claim* they have, nor any proof of backing for their new paper BTC called cbBTC. If they print too much paper BTC they will go the FTX route,” Duo Nine said.

Justin Sun echoed the sentiment, raising questions regarding Coinbase’s decision to forgo standard reserve audits for cbBTC. The Tron executive argued that this lack of transparency introduces significant risk. Against such fears, Coinbase’s custodial practices came into question, prompting BlackRock to revise its custody agreement with the exchange.

This unease may have steered users towards alternatives like cbBTC, which some see as a “safer” wrapped Bitcoin option with Coinbase’s backing. As cbBTC attracts more support, it poses an increasing threat to WBTC’s long-standing dominance. Whether cbBTC will eventually surpass WBTC remains to be seen, but its rapid growth signals a significant shift in user preferences within DeFi.