Bitcoin options contracts on the Chicago Mercantile Exchange (CME) are due for expiry. Meanwhile, BTC is facing heavy resistance at current levels, will it retreat?

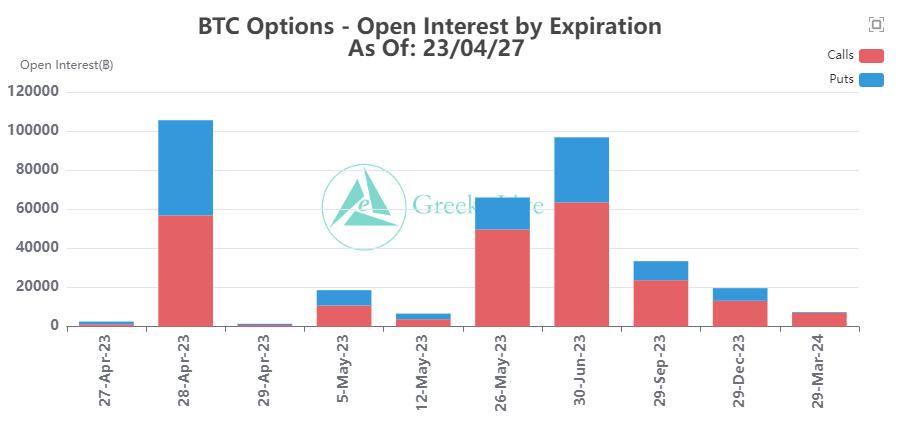

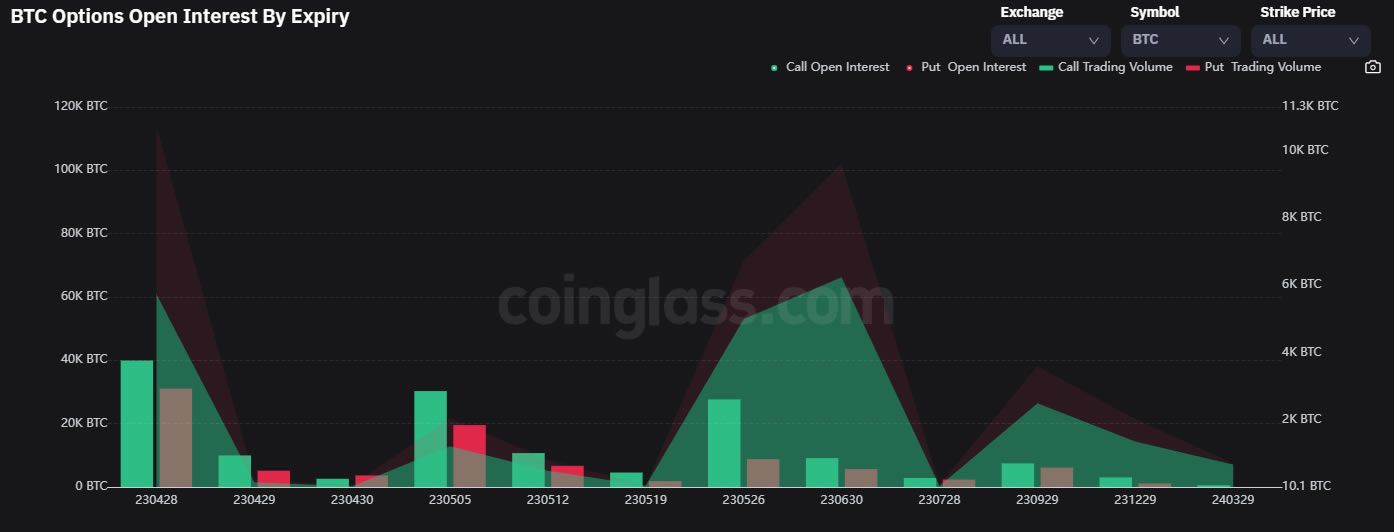

Bitcoin options expiry is approaching again, with 105,000 BTC contracts in the balance on April 28. Additionally, there is a max pain point of $27,000 and a notional value of $3.1 billion.

Bitcoin Options Mixed

The current put/call ratio is 0.85, suggesting a neutral to bearish sentiment.

The max pain price is the strike price with the most open Bitcoin options contracts. It also happens to be the price at which the most losses would be incurred for the highest number of contract holders at expiration.

Open Interest (OI) is 105,000, which refers to the number of outstanding Bitcoin options contracts that have yet to be settled. The next batch of contract expiry with similar OI will be on May 26, according to Deribit.

Furthermore, the put/call ratio is calculated by dividing the number of traded put (short) contracts by the number of call (long) contracts.

A value of 1 means that trading is evenly balanced between sellers and buyers. However, a value lower than 1 is generally bearish as more speculators are shorting the asset than going long.

Additionally, some 807,000 Ethereum options contracts are due to expire on April 28. There is a max pain point of $1,850 and a notional value of $1.54 billion.

The put/call ratio for ETH options is similar to that for BTC contracts at 0.8.

Options allow speculators to buy or sell assets at a specific price with the ‘option’ to sell the contracts at any time. They are more flexible than futures contracts which have fixed expiry dates.

Bitcoin is currently trading at $29,506, following a 1.4% gain over the past 24 hours. However, it is facing major resistance at the $30,000 zone, so it may struggle to overcome this. Moreover, the Bitcoin options expiry is unlikely to influence BTC prices over the weekend.

CME Group to Expand Options Expiries

Earlier this month, the CME announced that it plans to expand its suite of crypto options.

The exchange’s standard and micro-sized Bitcoin and Ethereum contracts will have daily expiry options beginning on May 22.

The new contracts will “provide market participants with greater precision and versatility in managing short-term Bitcoin and Ether price risk,” said Giovanni Vicioso, CME Group Global Head of Cryptocurrency Products.