Trading volume for Bitcoin futures posted a major spike yesterday as the Chicago Mercantile Exchange (CME) saw its highest trading volume in a month.

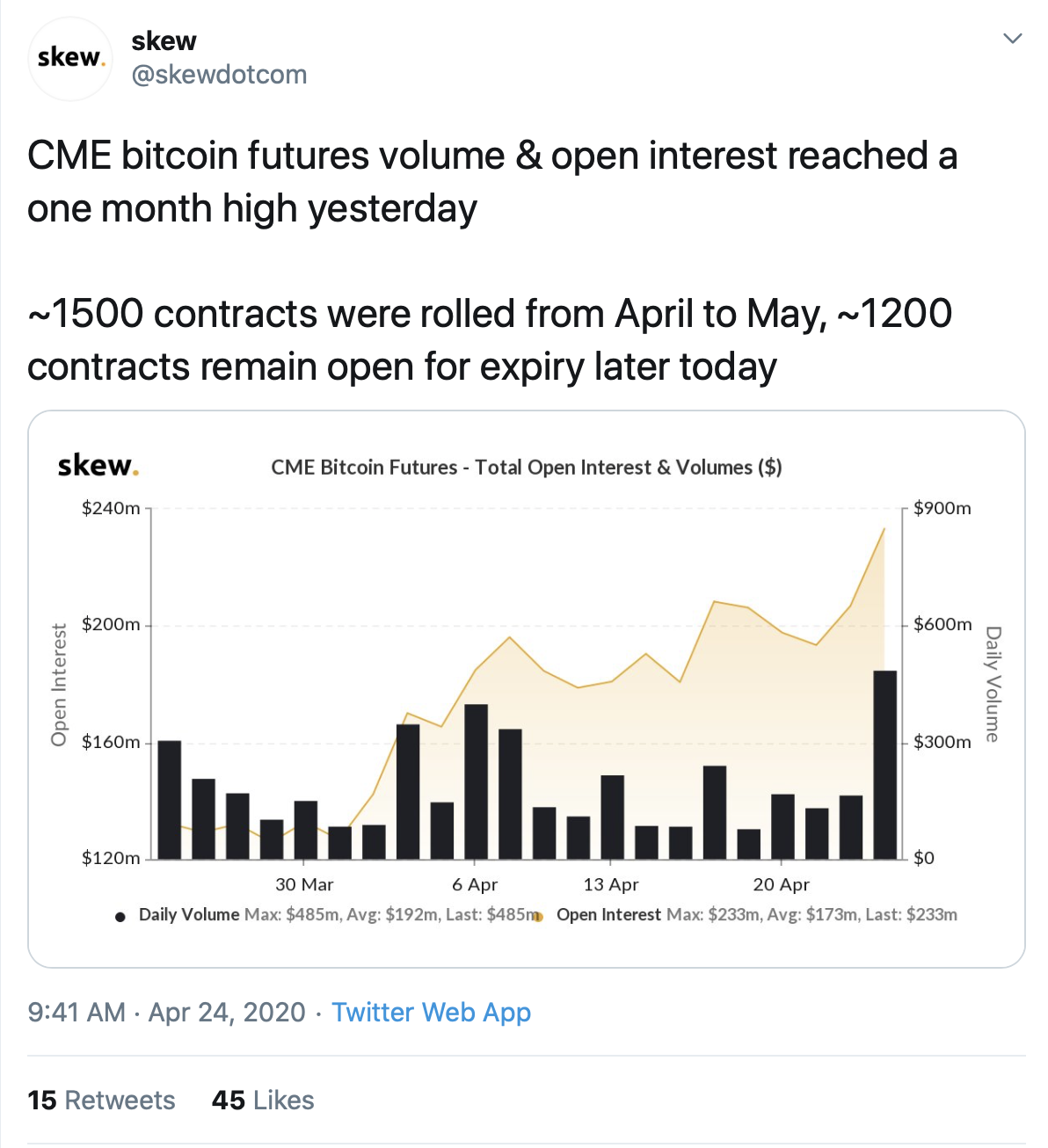

CME Bitcoin futures are booming again after a drastic drop in March, according to skew (@skewdotcom). Yesterday saw a major spike with trading volume and open interest reaching a monthly high.

As tweeted on Twitter, open interest has been ticking upward for some time — but volume was still relatively low for much of April. With yesterday’s spike, we could now see trading volume catch up to the increasing levels of open interest (OI).

The Bitcoin futures market had started to show some signs of life again in early April but has struggled to maintain momentum for much of this month.

As tweeted on Twitter, open interest has been ticking upward for some time — but volume was still relatively low for much of April. With yesterday’s spike, we could now see trading volume catch up to the increasing levels of open interest (OI).

The Bitcoin futures market had started to show some signs of life again in early April but has struggled to maintain momentum for much of this month.

Although CME Bitcoin futures still remains a major marketplace, there have been some new leaders in this sector as of late. As BeInCrypto reported earlier this month, Binance and Huobi are now the top two exchanges for BTC futures trading. BitMEX has fallen to fourth behind OKEx, after initially being in the top spot, having suffered persistent criticism after it was blamed for the drastic -50 percent drop the entire cryptocurrency market saw on March 12.

As Bitcoin futures markets begin to pick up steam again, Binance and Huobi will likely continue to cement their newfound dominance. However, the state of the cryptocurrency market is still dependent on macroeconomic factors. Given the uncertainty, we will have to wait and see whether this futures trading bump lasts.

Although CME Bitcoin futures still remains a major marketplace, there have been some new leaders in this sector as of late. As BeInCrypto reported earlier this month, Binance and Huobi are now the top two exchanges for BTC futures trading. BitMEX has fallen to fourth behind OKEx, after initially being in the top spot, having suffered persistent criticism after it was blamed for the drastic -50 percent drop the entire cryptocurrency market saw on March 12.

As Bitcoin futures markets begin to pick up steam again, Binance and Huobi will likely continue to cement their newfound dominance. However, the state of the cryptocurrency market is still dependent on macroeconomic factors. Given the uncertainty, we will have to wait and see whether this futures trading bump lasts.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Advertorial

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

READ FULL BIO

Sponsored

Sponsored