Crypto data aggregator websites such as CoinMarketCap and CoinGecko have launched a separate category for the tokens classified as securities by the US Securities and Exchange Commission (SEC).

The SEC is in a full-fledged war with the crypto industry, frequently declaring certain tokens as securities. Consequently, it might be challenging for investors to track tokens manually.

A Separate List For SEC Securities Tokens

The data aggregators have categories for crypto assets similar to sectors in the stock markets. Layer 1s, smart contract tokens, and stablecoins are some examples of the categories.

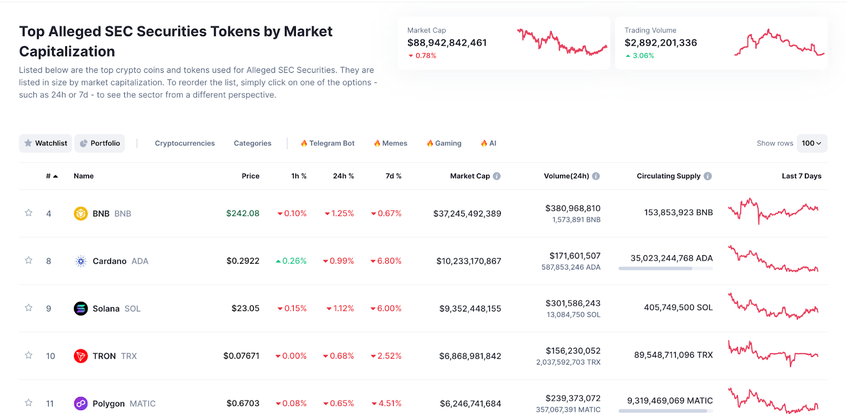

CoinMarketCap listed 65 tokens with a market capitalization of around $88.9 billion. These tokens make up around 7% of the total crypto market capitalization.

Its competitor, CoinGecko listed 48 tokens with a market capitalization of $91.3 billion. BNB coin (BNB), Cardano (ADA), and Solana (SOL) are the three largest tokens based on market capitalization that falls under the “Alleged SEC Securities Tokens” categorization in both the data aggregators.

Learn more about benefits and drawbacks of crypto regulation here.

The data aggregators did not include XRP in the list after the court’s ruling that Ripple’s distribution of XRP on exchanges does not qualify as an investment contract. The categories from the data aggregators are often helpful to investors tracking crypto that fall into specific niches.

The tokens that are deemed as securities might invite extra volatility due to the upcoming court battles and legal developments. This category might serve as a watchlist for traders who want to take advantage of the volatility in either direction.

While the SEC has been in a crackdown against crypto for months, particularly it named 67 crypto tokens as securities in Binance and Coinbase lawsuits. Some tokens have also faced delisting from trading platforms such as Robinhood and Revolut.

Got something to say about this article or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.