Circle CEO Jeremy Allaire pins the decline in the market value of the USDC stablecoin on investors wishing to ‘de-risk out of the U.S.’ due to regulatory and banking sector concerns.

In a recent interview, the executive acknowledged that the stablecoin has steadily declined since March, losing almost $13 billion.

USDC Decline Amid Broader Market Uncertainty

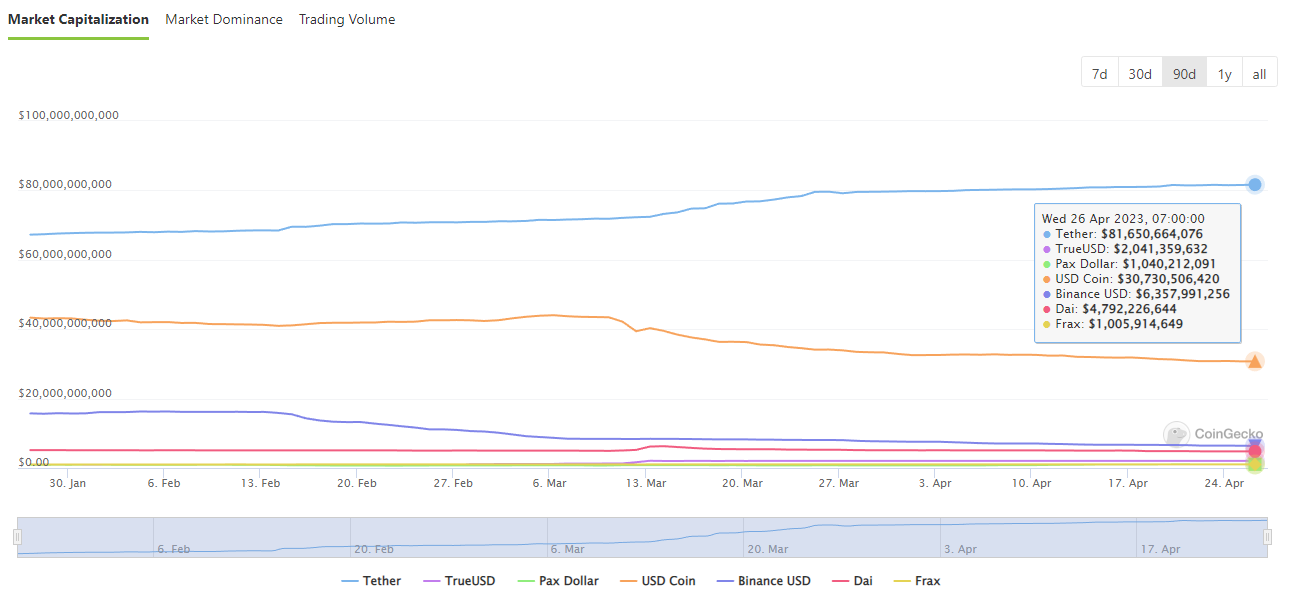

From a peak of almost $56 billion in 2022, USDC’s market value has decreased to just under $30.7 billion.

March caused a further decline in value after it was revealed that $3.3 billion in reserves used to underpin the stablecoin were lost in the defunct Silicon Valley Bank. USDC was temporarily de-pegged when the news surfaced, losing almost $13 billion.

Allaire noted, “We are seeing concern about the regulatory environment in the U.S.”

After the collapse, regulators vowed to make the depositors whole in the SVB collapse. Meanwhile, Circle also offered to cover any reserves shortfall.

But, stablecoins can become depegged from their base currency (normally USD) due to a volatile market environment and need real assets to ensure investor safety.

However, stablecoin regulations are still absent from the regulatory landscape.

How Other Stablecoins Are Faring

Allaire pointed out that the U.S. is trailing behind in crypto legislation compared to the Middle East, Hong Kong, Singapore, and the European Union. In the interview, he made the point that it is imperative for Congress to take action and address worries about the U.S. dollar’s survival in light of the development of internet-based currencies and blockchain technology.

On April 15, the U.S. House Financial Services Committee released the first draft of its stablecoin legislation. The Bill includes broad suggestions, such as prohibiting algorithmic stablecoins and designating the Federal Reserve as the regulator for stablecoins issued by non-bank companies.

Despite anticipated rules, Binance’s switch to TrueUSD (TUSD) amid its growth has garnered attention. TUSD, which trails BUSD and Tether in volumes, recently became the largest BTC trading pair on Binance.

TRON founder Justin Sun recently told Bloomberg that there aren’t many stablecoins on the market, contributing to the growth of TUSD.

According to Kaiko’s update from last week, Tether pairs represent 80% of all trading volumes on centralized cryptocurrency exchanges. TrueUSD is on 9% and could likely overtake the competition shortly, it said.

The stablecoin market has a capitalization of around $131.6 billion. Data from CoinGecko shows that Tether leads the list with $81.1 billion, followed by USDC and BUSD. TrueUSD ranks fifth with a capitalization of $2.04 billion after a spurt of exponential growth in the last two months. MakerDao‘s decentralized stablecoin DAI ranks fourth at $4.7 billion.

Tether recently surpassed the $80 billion barrier after its previous supply peak in May 2022. The largest stablecoin is now near supply levels that were seen the year before Terra’s collapse knocked the market back.