Circle CEO Jeremy Allaire has refuted that the firm focuses solely on the American market. In a tweet on Monday, Allaire asserted that a substantial portion of their business comes from abroad.

The executive noted, “Despite the hype that we’re all about the US, we estimate that 70% of USDC stablecoin adoption is non-US,”

Emerging Markets Fastest Growing Sector for Circle

Allaire noted that emerging and developing markets have seen the quickest growth. He said, “Strong progress happening across Asia, LATAM and Africa. Demand for safe, transparent digital dollars is strong.”

Allaire’s statement comes weeks after the US House Financial Services Committee advanced a framework bill for stablecoins. The bill circles requirements for issuing stablecoins, but it witnessed significant delay.

Earlier this year, Tether also revealed a similar trajectory. It noted in a January blog post,

“While market pundits obsess over market cap and how large the lead is between Tether and its competitors, the story being written in emerging markets is different.”

According to the biggest stablecoin, it is not concentrating on being “Wall Street buddies like other competitors.”

Please take a look at our explainer for a better understanding of stablecoins: What Is a Stablecoin? A Beginner’s Guide

In the meantime, USDT continues to command the highest market capitalization. Contrarily concerns over its reserves after Silicon Valley Bank (SVB) debacle have decreased USDC’s market presence.

As the stablecoin market is primarily a duopoly, Tether CTO Paolo Ardoino recently expressed astonishment that a slight depeg of USDT did not benefit the market for USDC.

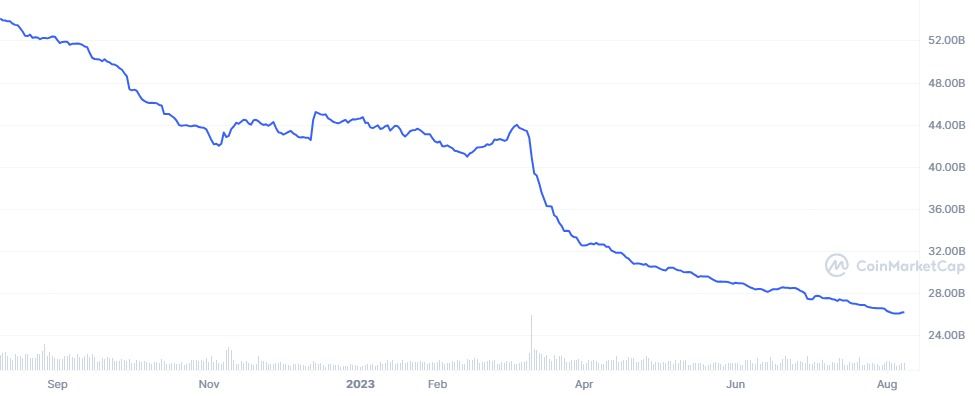

The market valuation of the USD Coin is estimated to be $26 billion. This is a considerable decline from a market valuation of almost $42 billion at the beginning of the year. The market of USDC was worth more than $55 billion around this time last year.

Circle Boasts of Liquidity Network

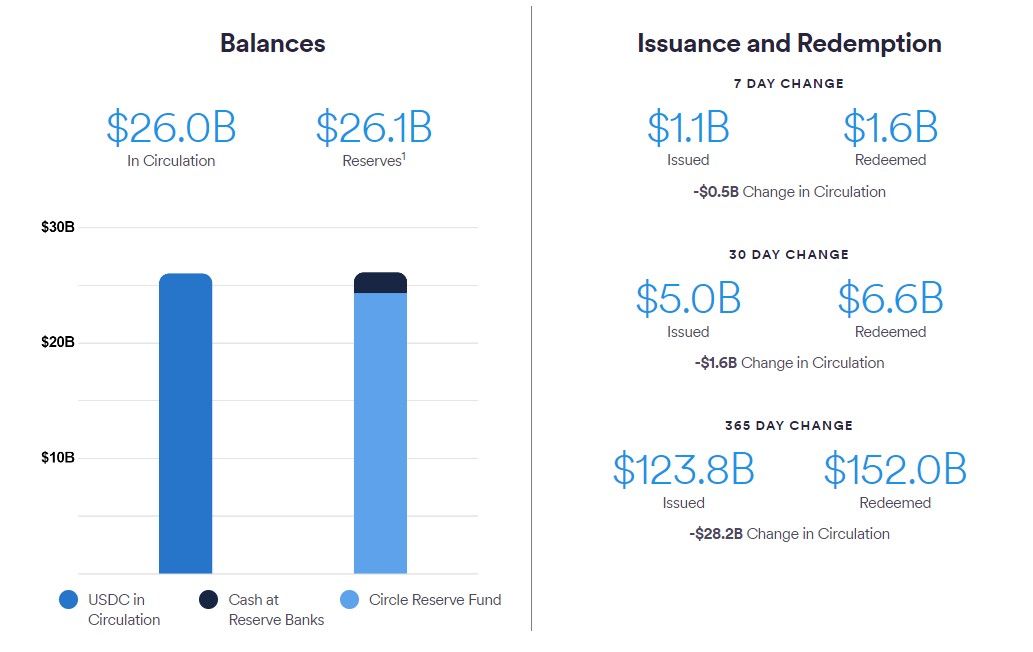

Despite the falling figures, Allaire’s tweet assures that their “global banking and liquidity network is expanding.” The chief recently revealed that USDC issued $5 billion coins and has redeemed $6.6 billion USDC in the past month.

The Circle Reserve Fund, which owns a portfolio of short-term US Treasuries, overnight US Treasury repurchase agreements, and cash, claims to be a government money market fund registered with the SEC.

At publication, it boasted of $26.1 billion in total reserves, consisting of $24.3 billion in the fund and $1.8 billion in cash.

Coinbase’s founder Brian Armstrong also disclosed that the company’s market valuation had increased when Binance liquidated all of its USDC assets. Armstrong said during the company’s Q2 results, “USDC market cap is up after Binance pulled out.”

On-chain researchers and fund managers claim that Binance has recently been exchanging USDC for dollars and transferring resources to First Digital USD (FDUSD) after gaining control of most TrueUSD (TUSD).

And with the recent launch of PayPal’s PYUSD, the competition for USDC has certainly intensified.